Stock prices are impacted by any number of drivers. We like to think we can zero in on one or two drivers to explain why stocks may have been up or down on a given day, but in reality it’s impossible to identify all the moving pieces that impact daily stock price fluctuations. The good news is we don’t have to know what drives stock prices on any given day to be successful investors.

When investing, the long term is what matters, not the daily ups and downs. I came across a great post this week diving into the impact of interest rates on stock prices. The main takeaway was over the past 25 years, company earnings have been the primary driver of stock prices, not declining interest rates. Granted different factors can drive stock price movements during different regimes, but fundamental factors like earnings are always going to be part of the stock price growth equation.

To that end, that’s why the stock market cares so much about the economy. It’s hard to have broad earnings growth without economic growth. A potential recession has been discussed for several months now as the Fed has continued to relentlessly raise rates. We did have two consecutive quarters negative GDP growth last year, which some use as a guide to declaring a recession. However, the National Bureau of Economic Research (NBER) is the official arbiter of recessions in the US and evaluates six economic variables in declaring recessions. We previously discussed the NBER and recession declarations here. We revisit the NBER recession indicator below.

Not Quite Yet

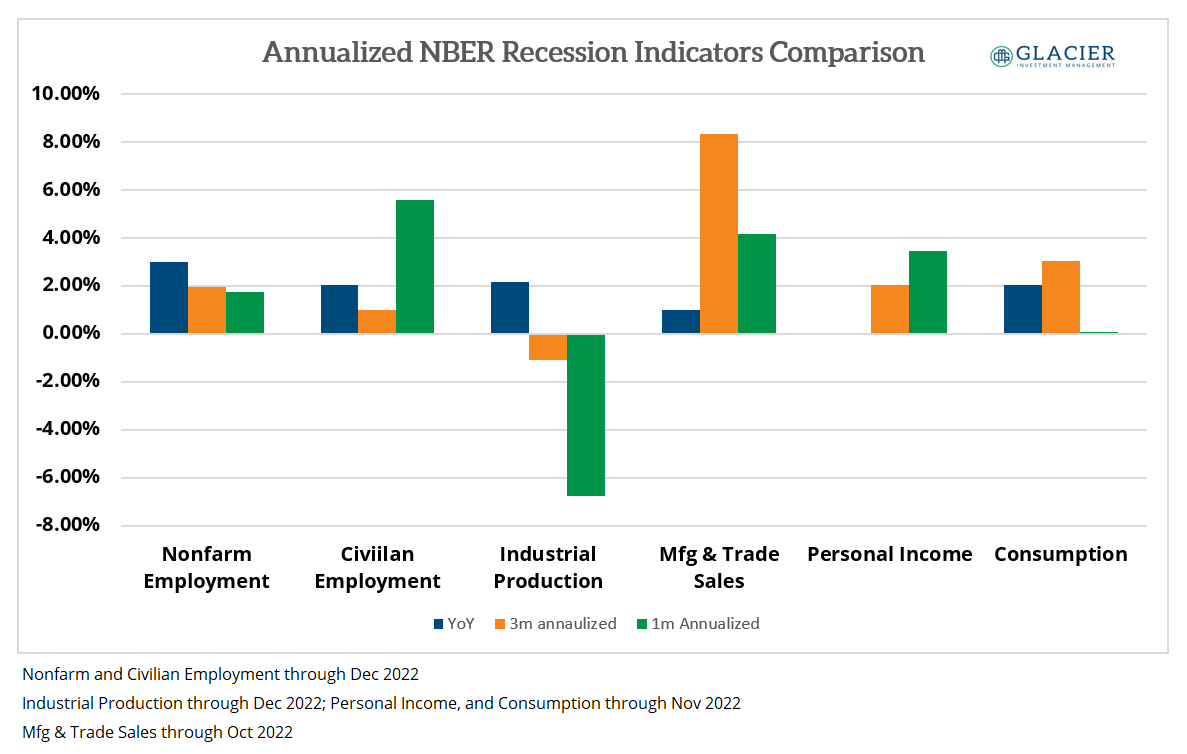

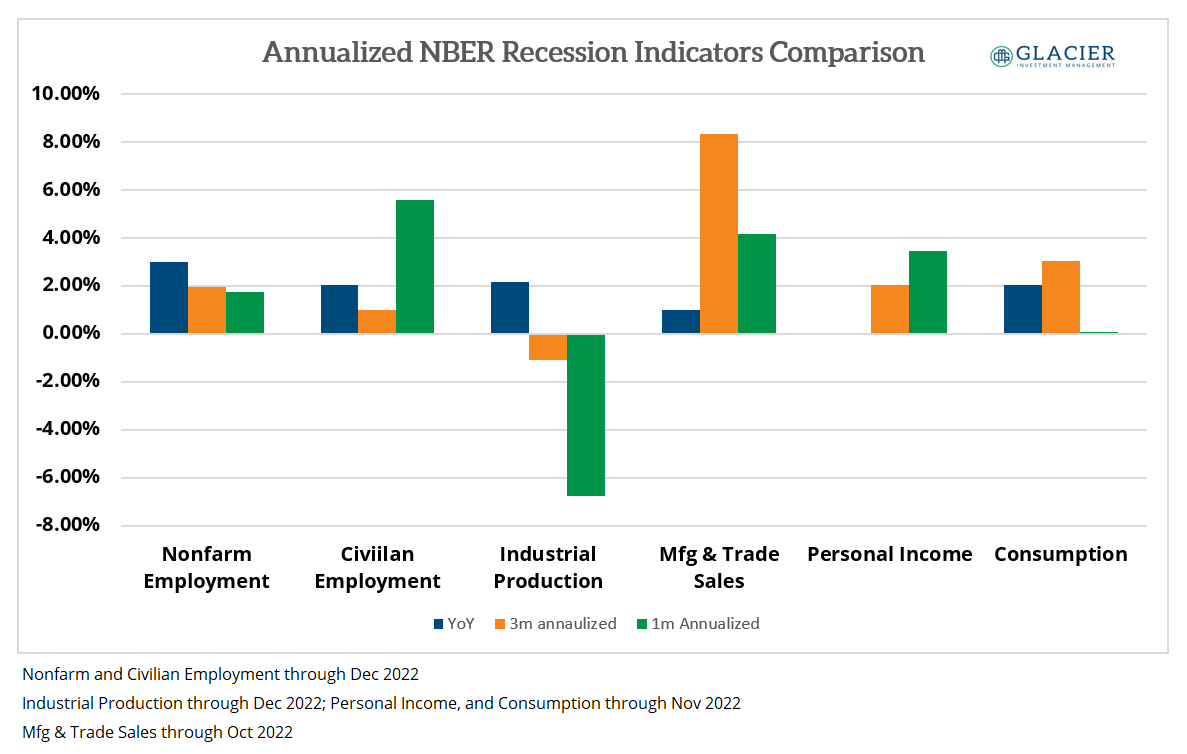

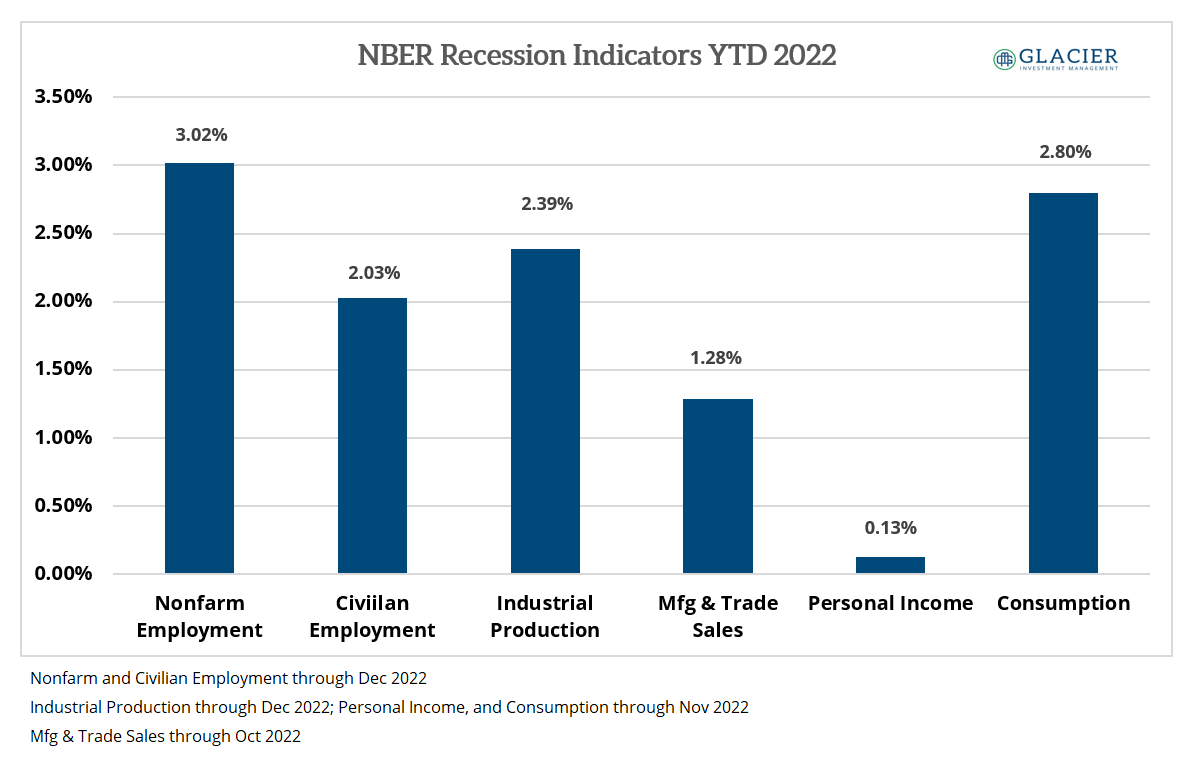

Looking at the year-to-date figures, everything appears to be in good shape (nothing is negative) through the most recently reported data points. However, if we look at shorter term data points and annualize them for comparability purposes, we are seeing a softening in the data points, especially Industrial Production. I’m not one of the NBER’s recession experts but the current trend in data still doesn’t look like “a significant decline in economic activity across the economy.” Of course, this may be the early innings of the “significant decline”, but I don’t think we’re at the recessionary breakpoint yet.