A lot of ink has been spilt and breath wasted on recession talk and concerns. I’m not going to regurgitate most of it, but I think it’s worth pointing out a couple of things.

First, there is an official definition for a recession and it’s not the technical two consecutive quarters of negative GDP growth. Per the National Bureau of Economic Research (NBER), a recession is “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators.”

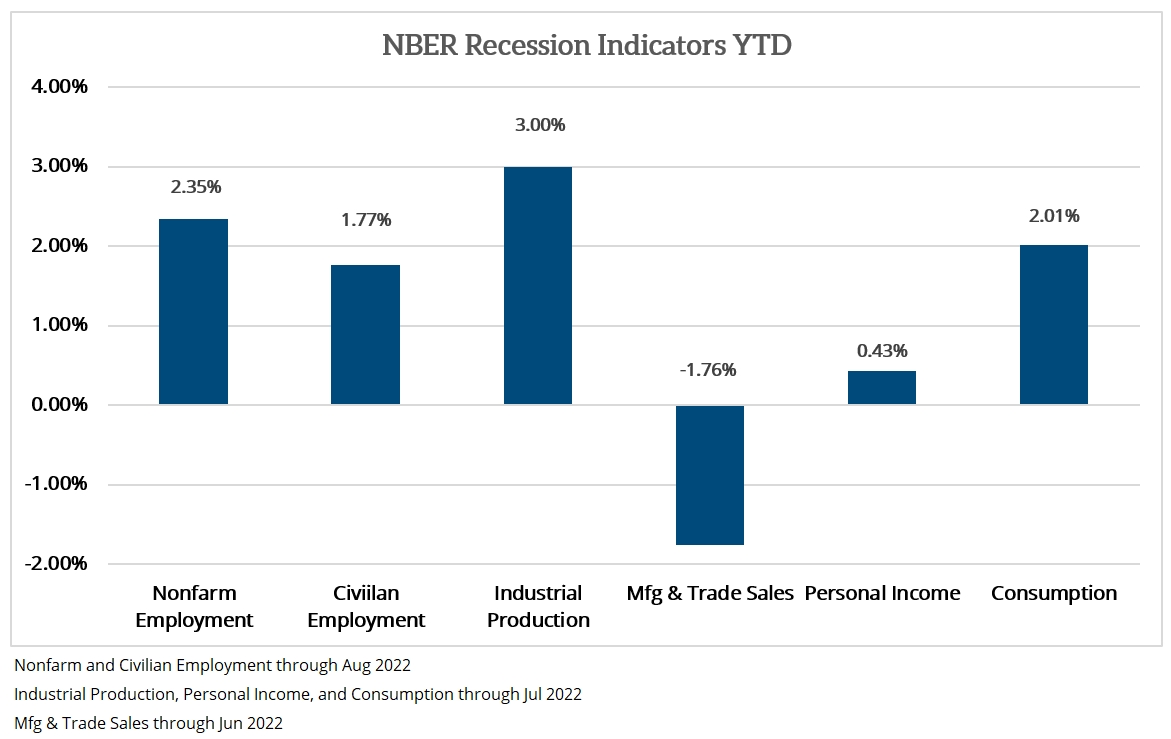

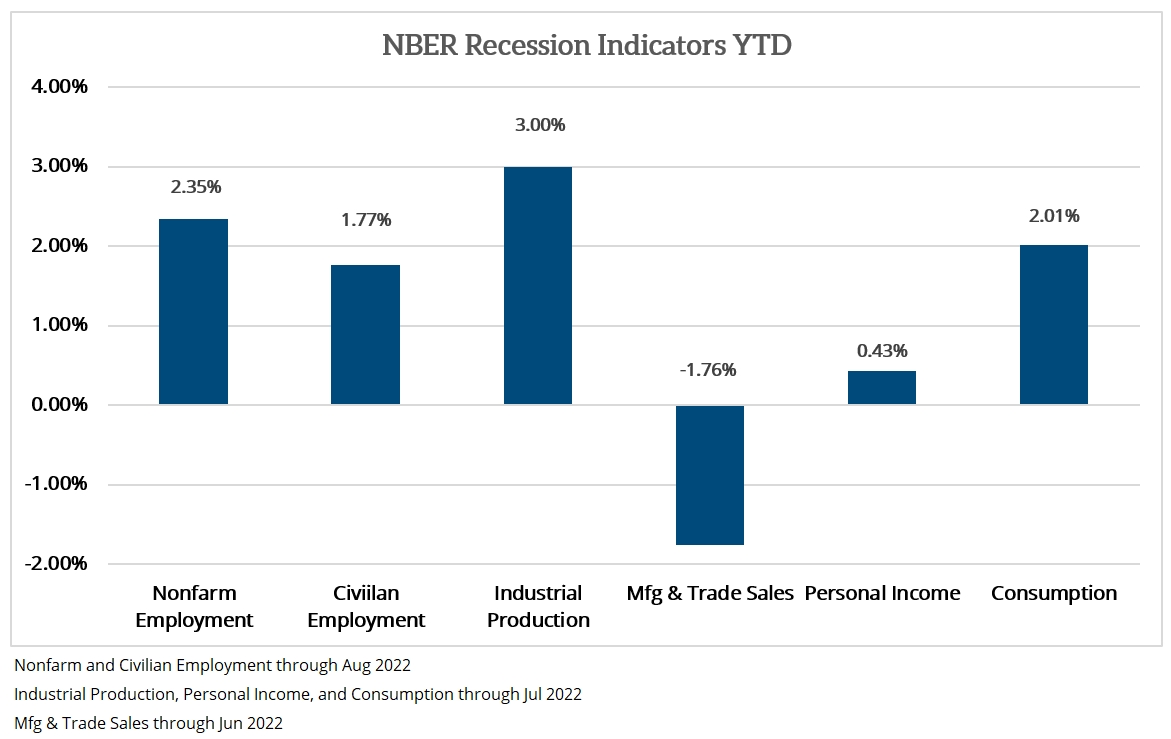

The NBER relies upon six measures of economic activity: 1) Nonfarm employment; 2) Civilian employment; 3) Industrial Production; 4) Real Manufacturing and Trade Sales; 5) Real Personal Income; and 6) Real Personal Consumption Expenditures. As you can see by the chart below, with the exception of manufacturing and trade sales, all the indicators have increased year-to-date. So, according to the official measures used for determining recessions, we are not in a recession right now. You can track all of these indicators here.

All six data points are backward looking so it is always possible in any given month, say August or September, economic activity takes a turn for the worse and in hindsight the NBER would declare a recession. It’s probably not worth splitting hairs over that though.

Leading economic indicators have been softening as economic activity has slowed in response to tighter monetary policy among other variables. However, asset prices rebounded sharply over the summer as it appears the market may have been anticipating the Federal Reserve to pivot in its tightening efforts in response to the softening economic data. Chairman Powell blew that thesis up last Friday in his remarks at the gathering in Jackson Hole. Prior to the gathering, I wrote about how investors didn’t seem to believe the Fed would tighten as much as it was claiming. Well, the markets got the message and have adjusted their expectations. Higher rates for longer, quantitative tightening, and explicit statements of “pain to households and businesses” seem to point to further economic slowing and probably a recession. Buckle up, September and October tend to be adventurous months in the stock market.