Recent US economic data have been a bit confusing, especially employment data. Recession has been on most people’s minds as leading indicators appear to be pointing to an inevitable recession. Recessions are inevitable but the timing is always uncertain. We have written about this previously here.

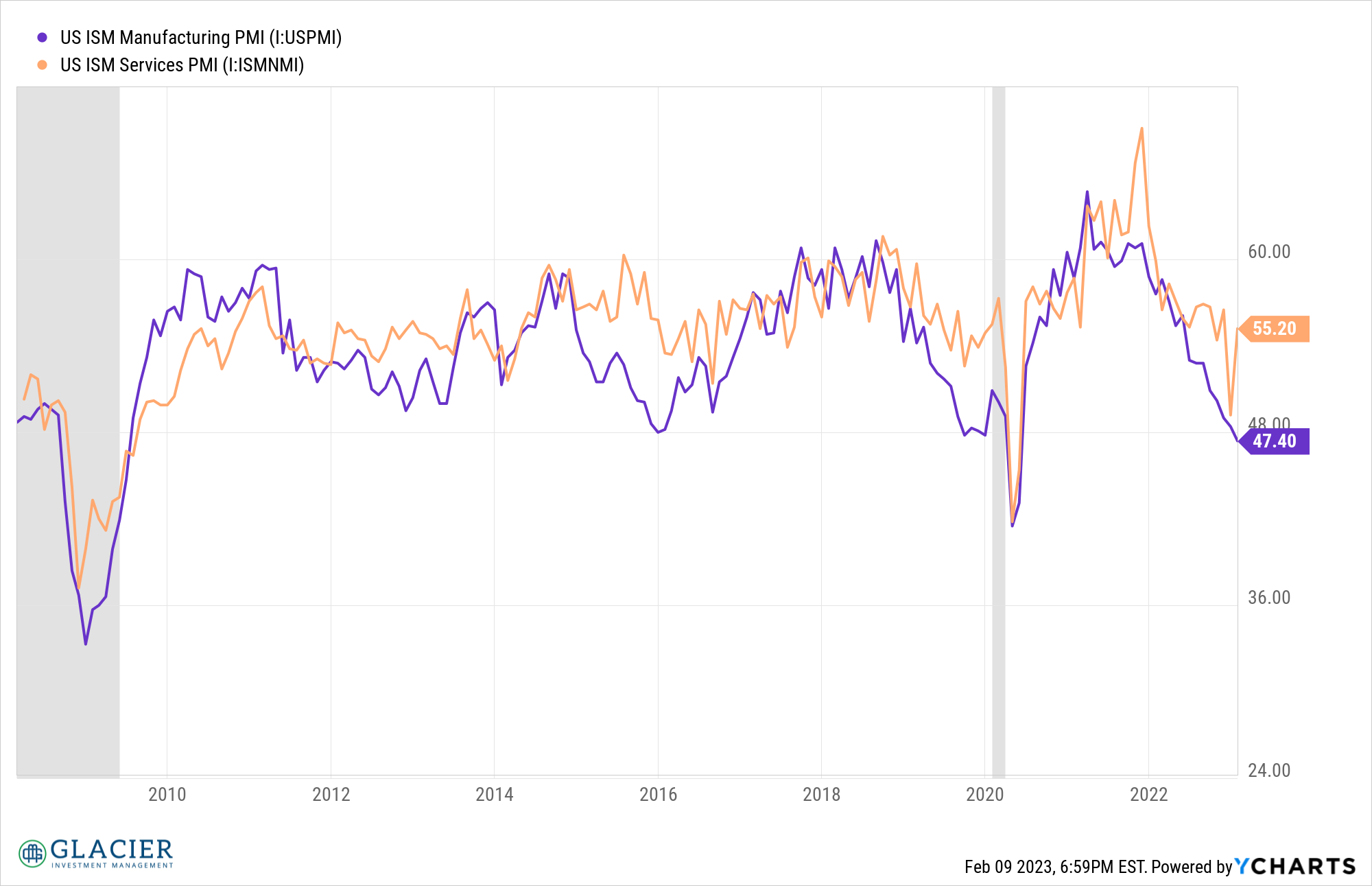

Economic performance appears to be bifurcated between goods and services. While economic figures for goods have been weakening for some time, economic data points for services have been quite robust. The January ISM Services index rose the most ever in a single month outside the global pandemic, according to a Bloomberg piece.

The job market, at least as reported by the BLS and JOLTS, appears to be remaining resilient in the face of slowdowns elsewhere in the economy. I’m not sure that makes sense but maybe it’s the services sector of the economy that’s helping to keep the job market afloat.

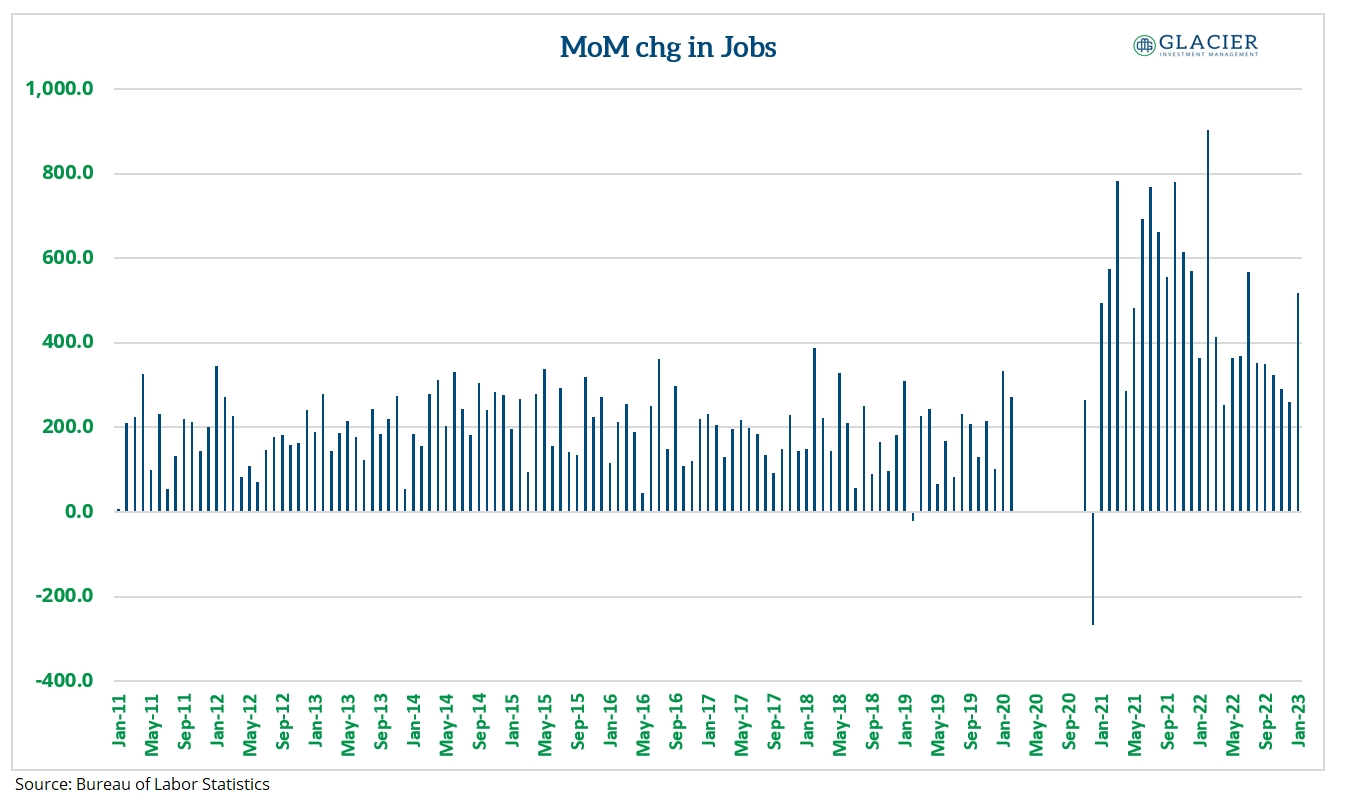

Employment Growth

Job growth in January was an astounding 517,000 jobs (seasonally adjusted), one of the highest prints for a January on record. The average seasonally adjusted job growth for Januarys going back 80 years is about 133,000. With job prints like this, should we really be concerned about a recession? Of course, job growth is a lagging indicator and other “soft” job indicators imply a weakening job market. Additionally, with all the layoffs announced recently there may be some softer job prints in the coming months.

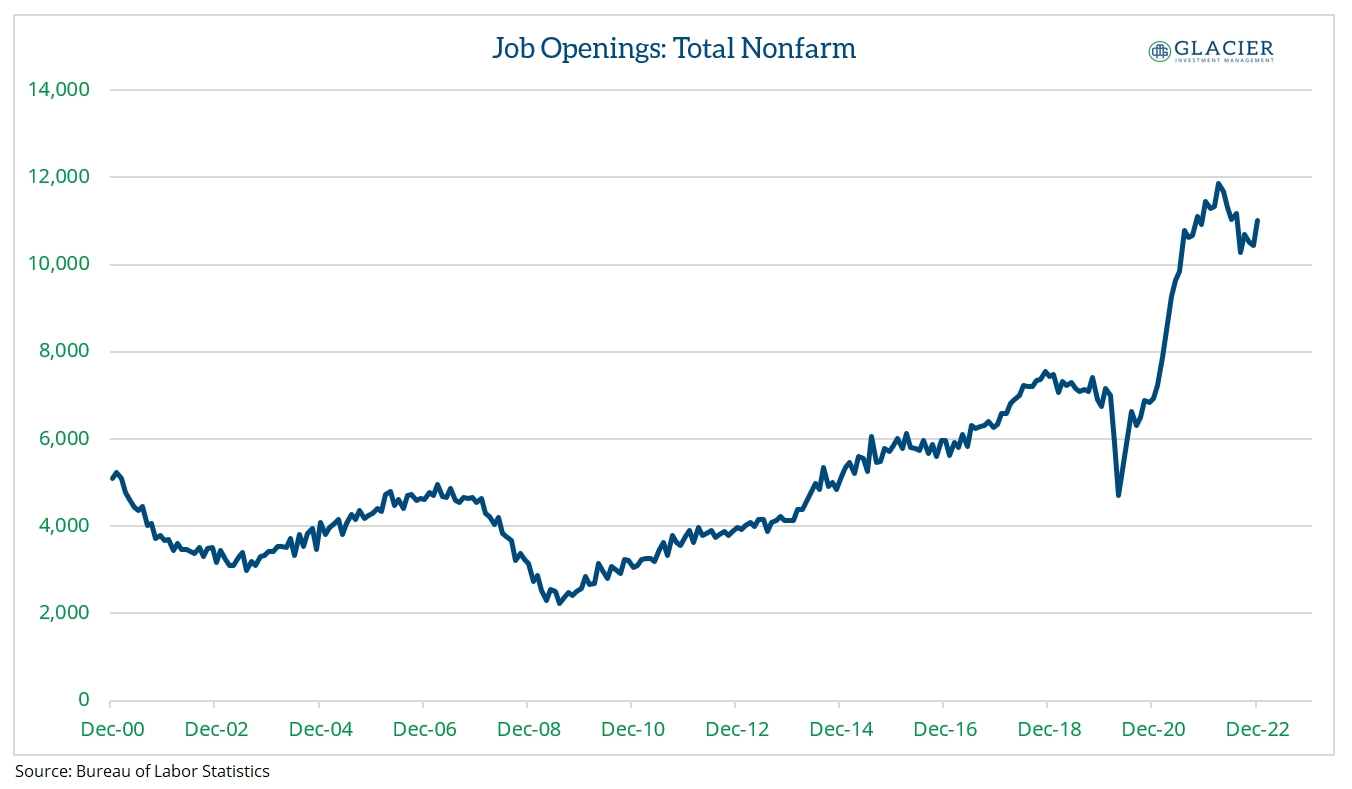

Job Openings

In another sign of a healthy labor market, job openings remain high. In other words, there’s greater demand for workers than there is supply of workers, leading to upward pressure on wages, all else equal. As the economy slows and works its way toward a recession, we should see the number of job openings decline, which has been reflected in the brief history of this data set. There was a sharp tick up in January, so we probably need another few months of data to get a sense of the overall trend.

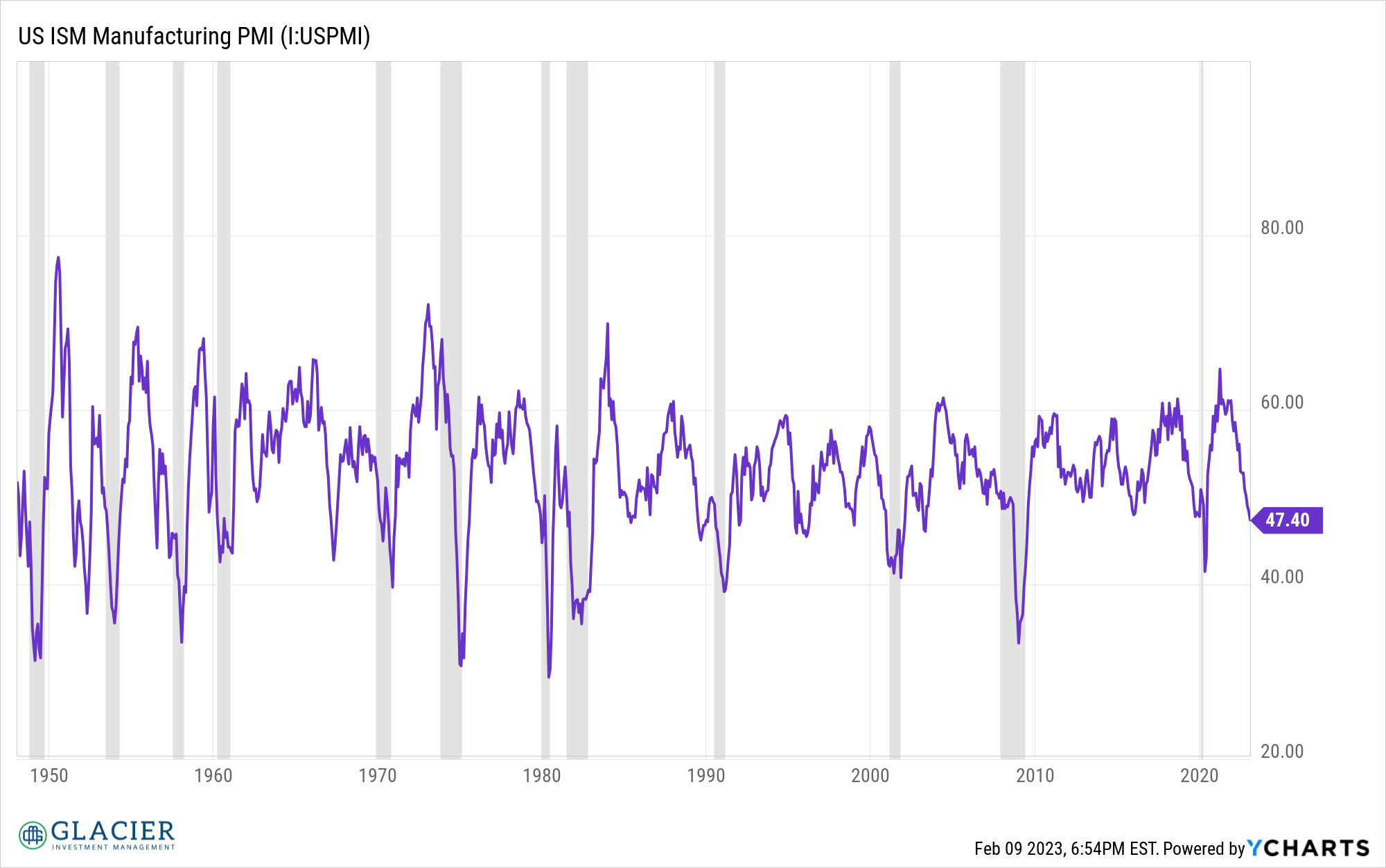

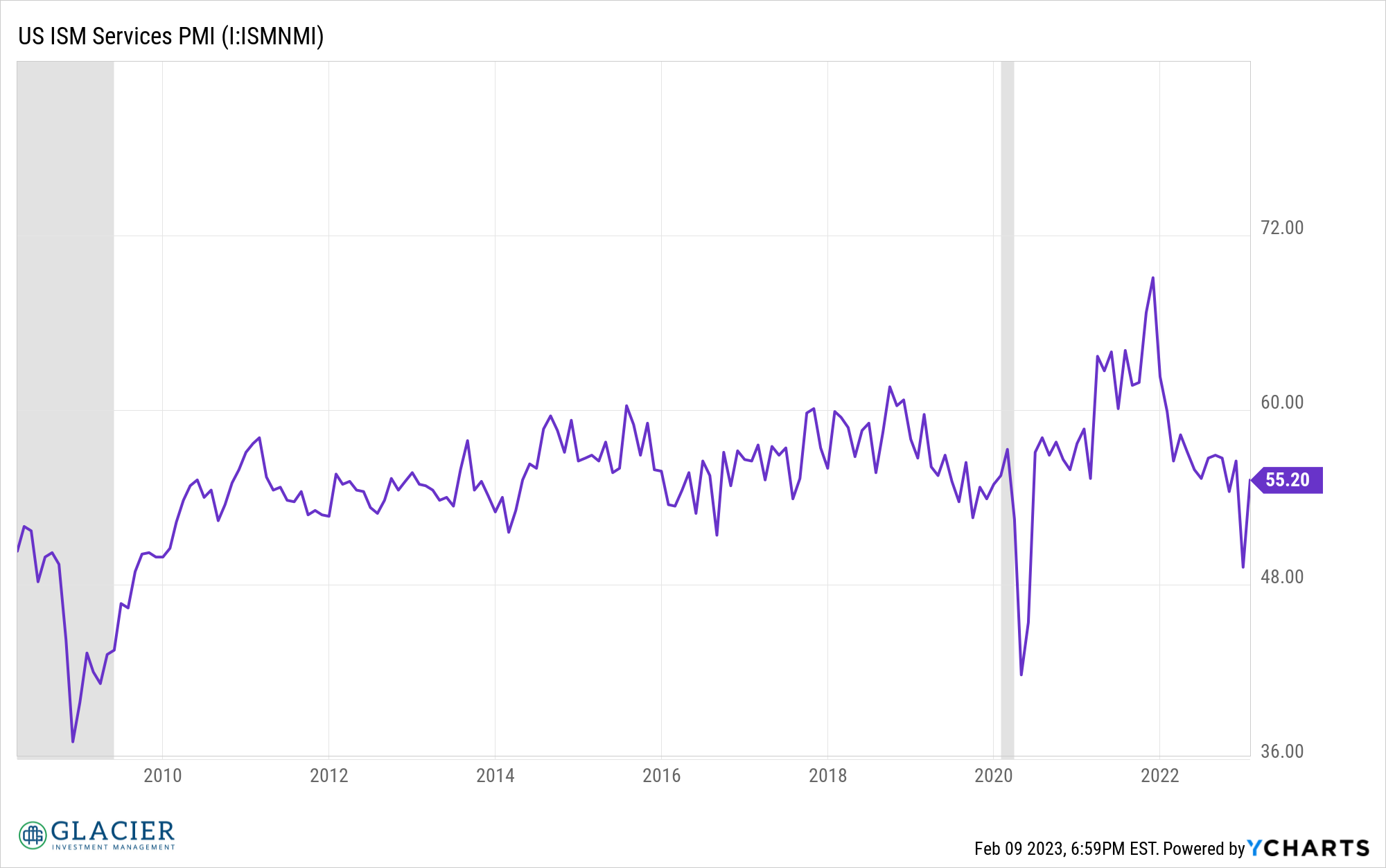

ISM Services

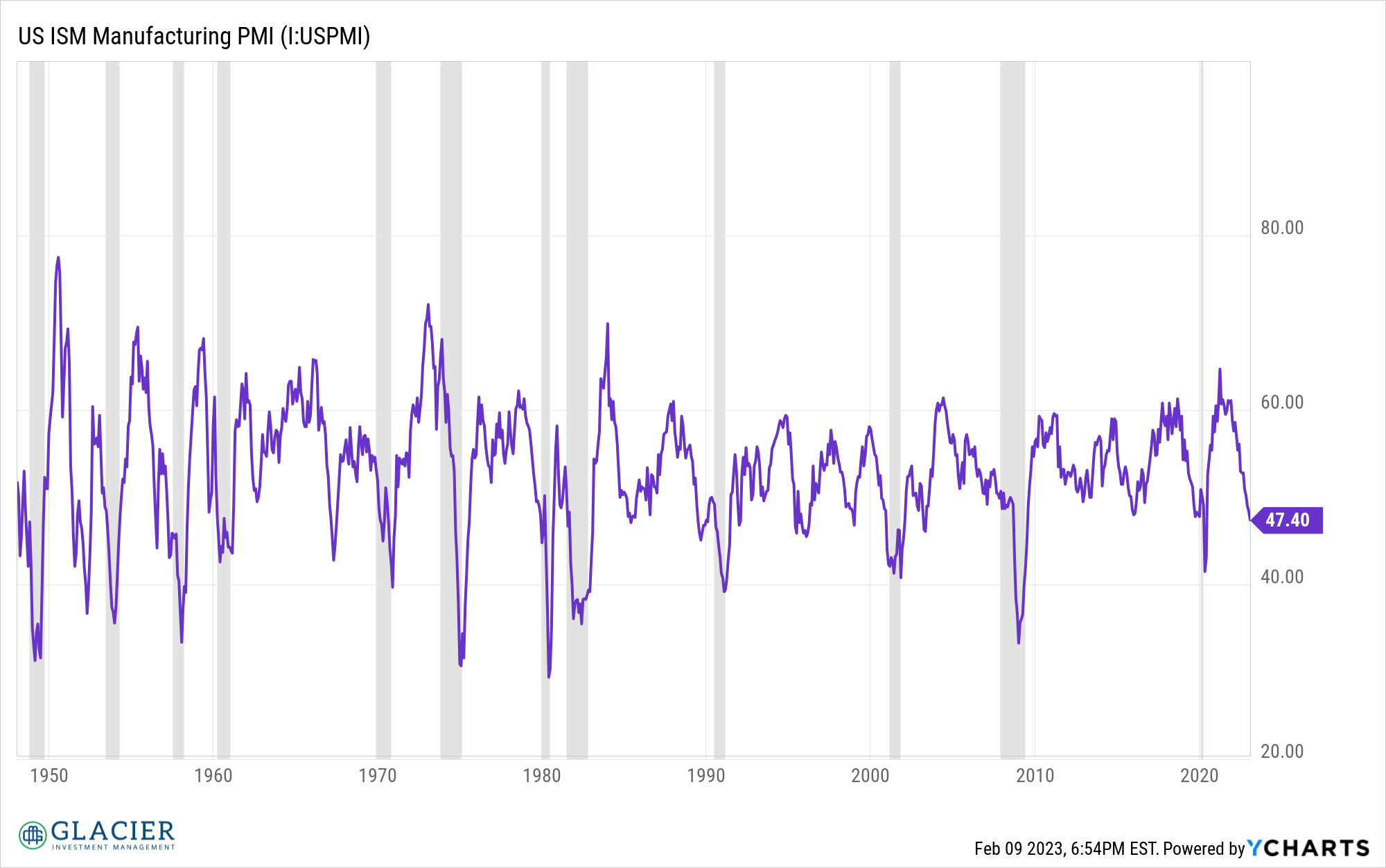

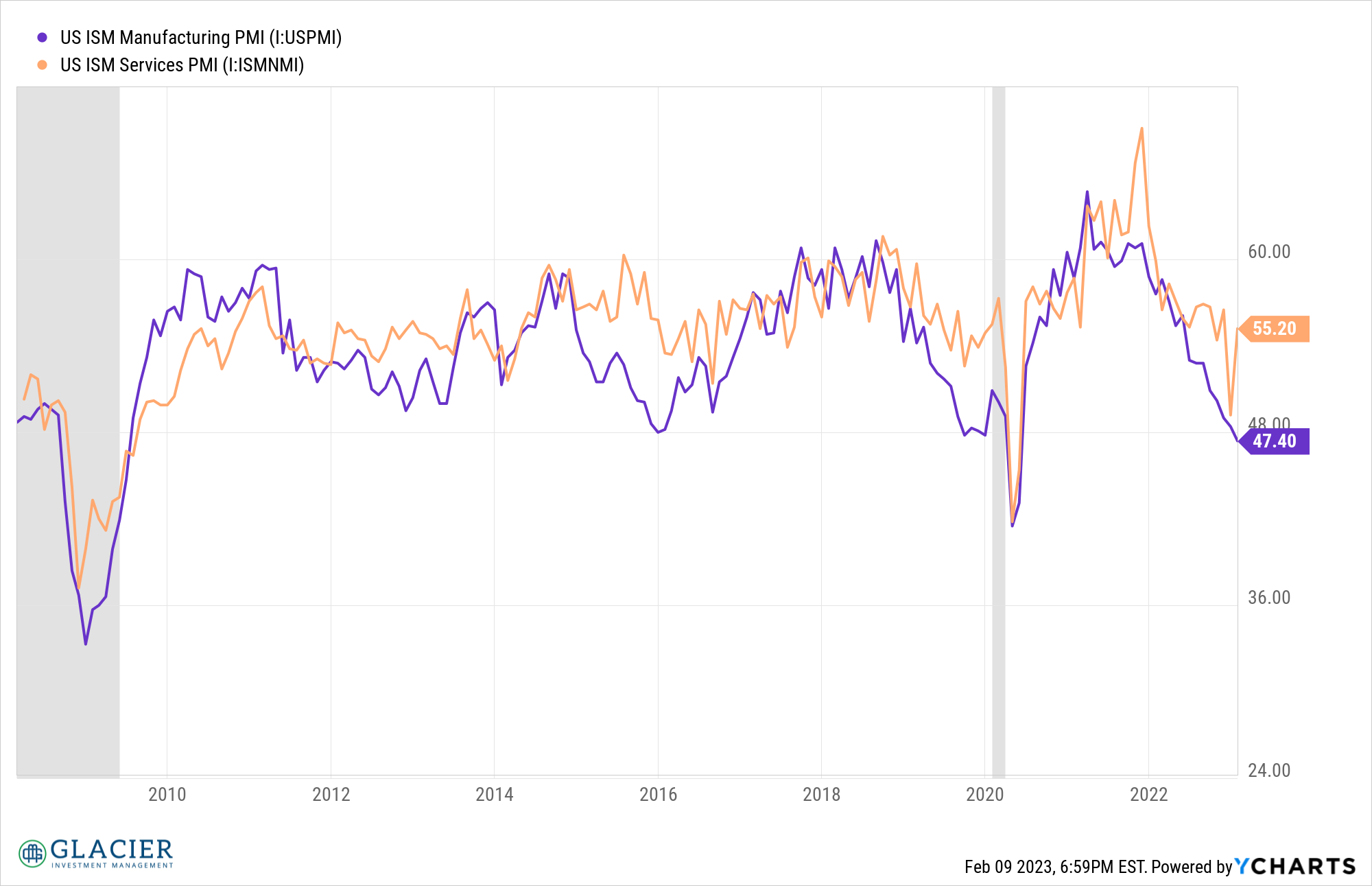

The trend in manufacturing has been deteriorating for more than a year, leading many to predict a recession is on the way. Historical data trends would seem to corroborate this although the timing of the recession again comes into question.

The sharp bounce in January Services PMI is reminiscent of a rebound coming out of a recession. Services sharply diverged from the downward trend it had been following in parallel with Manufacturing. Is this a one-month anomaly or will there be recession in Manufacturing while Services keep the broader economy afloat?

A recession is always on the way. It’s a question of when. While the consensus is calling for a recession in 2023, I’m still not sure it’s a foregone conclusion. Even if the US and/or the globe experiences a recession this year, how severe will it be and how should you position your portfolio? Bonds are still all over the place, making it difficult to follow the playbook that has worked over the past several decades when bracing for a recession. Predicting recessions is useful if you can nail the timing. Otherwise, it can be a waste of time and detrimental to your portfolio’s returns.