I looked at current NBER recession indicators in last week’s post. I concluded there still wasn’t a measurable significant decline in activity across the economy. In spite of my observation, it is becoming increasingly apparent to me the consensus view is a recession is coming, if not already here. I find this somewhat humorous as a recession is always coming. It’s a matter of how far away we are from the next one. I realize leading economic indicators are flashing recession warnings. I also realize the yield curve is the most inverted it has been in over 40 years. Allow me to state the obvious, I’m neither an economist nor a forecaster, which actually may be a good thing. After all, somebody once quipped economists have predicted nine of the last five recessions.

All joking aside, there appears to be a disconnect. The yield curve is really inverted but stocks continue to hover around 4,000 in the S&P 500 and appear to have broken the downtrend, at least for a few days. I know most professionals in the investment business will give deference to the bond market since it has been observed that the bond market is always ahead of the stock market. That may be the case, but could interest rates be falling because inflation and rate hike expectations are falling? Look, a recession may occur this year or next but if you’re making the call now and the recession doesn’t start until the end of this year or next are you really right in your call? I mean technically yes from an event perspective, but timing is also important, especially in the stock market.

As a follow up to last week’s look at NBER recession indicators, I wanted to dive into a few macroeconomic indicators here in the US that are important to broader economic health.

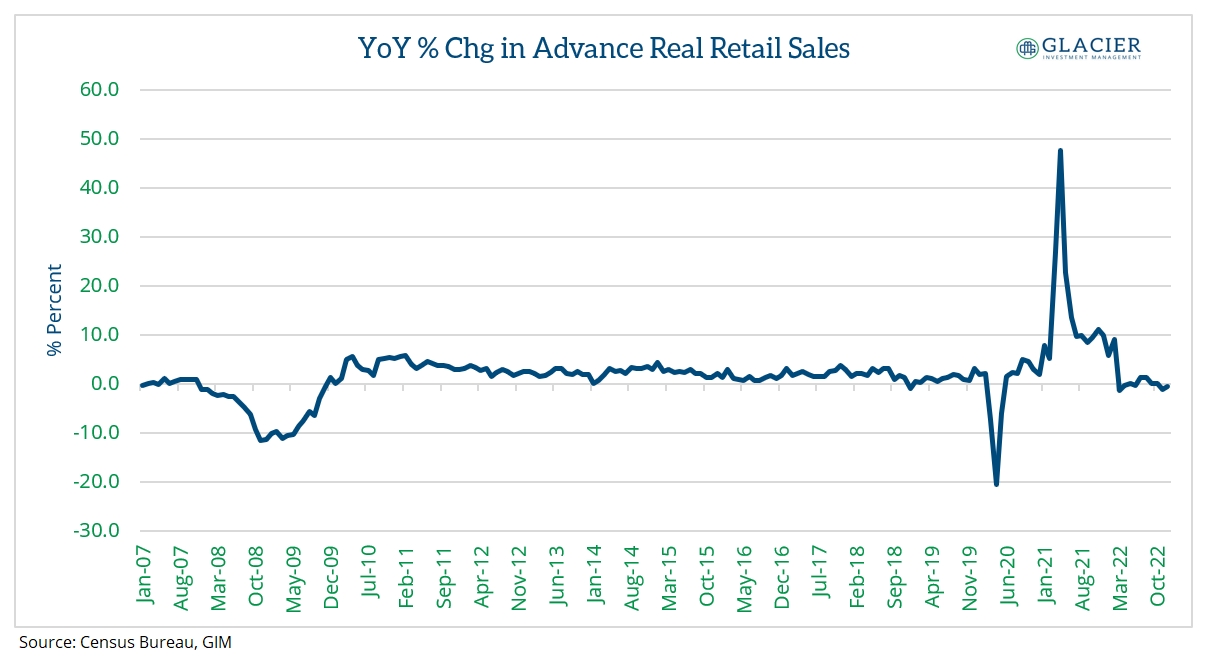

Real Retail Sales

Year-over-year growth in real retail sales has been bouncing above and below zero for most of the past 12 months. Obviously, the increase in inflation has contributed to the softness as real retail sales are adjusted for inflation. The last two months’ readings were negative. As the rate of inflation continues to slow, will we see any rebound in this metric back into positive territory? It’s difficult to say but broad income growth has not kept up with inflation over the past 10 to 12 months, which is just the continuation of a 50-year trend.

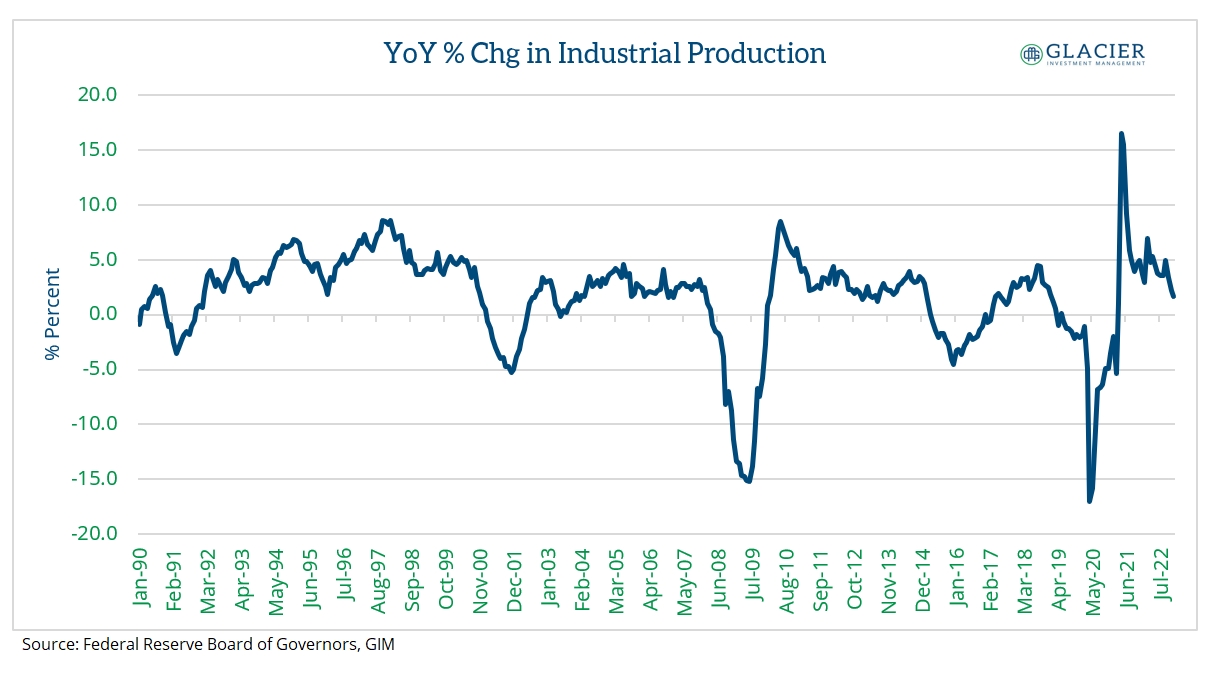

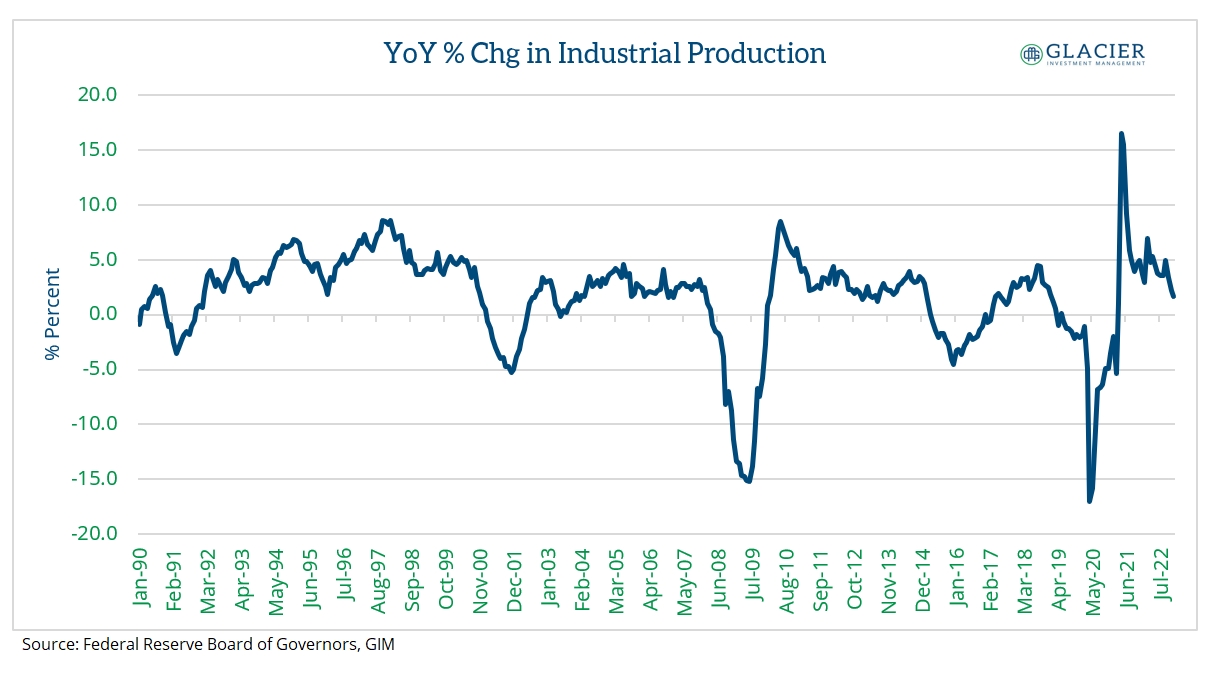

Industrial Production

While year-over-year growth remained positive in the most recent reading of industrial production, the one-month annualized showed the greatest deterioration in the variables NBER uses to determine recessions in the US. The momentum has been to the downside as growth has been decelerating. Weakness in this metric is apparent but probably still not significant. It may be a matter of time, but we still aren’t there yet.

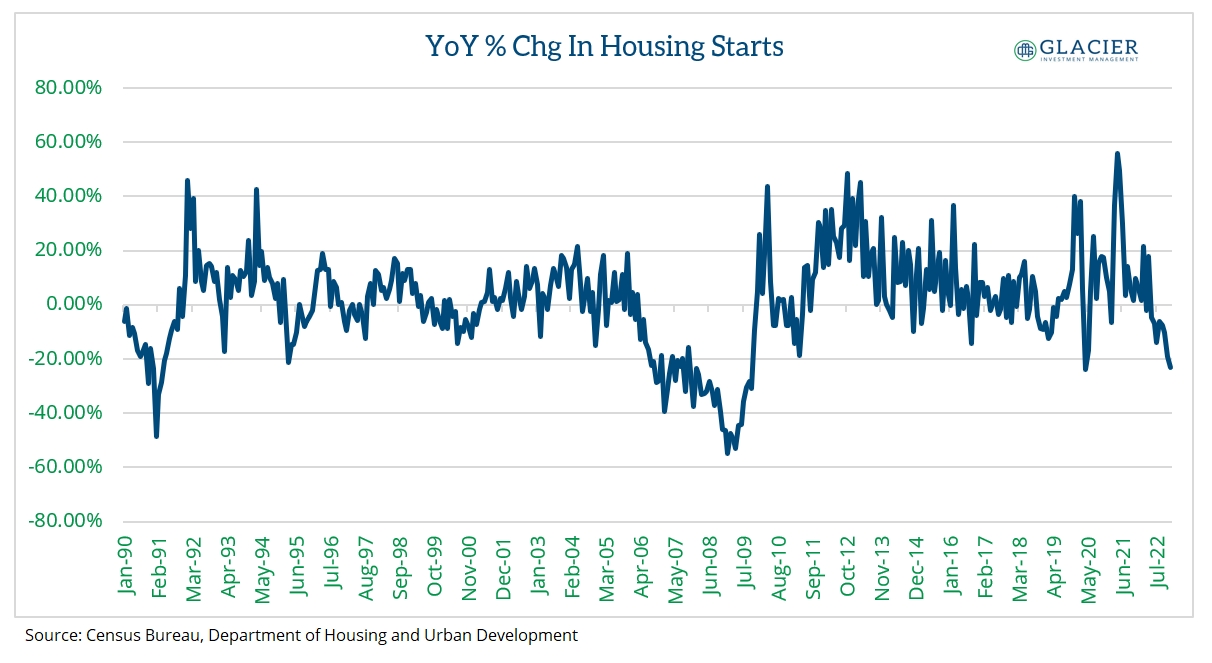

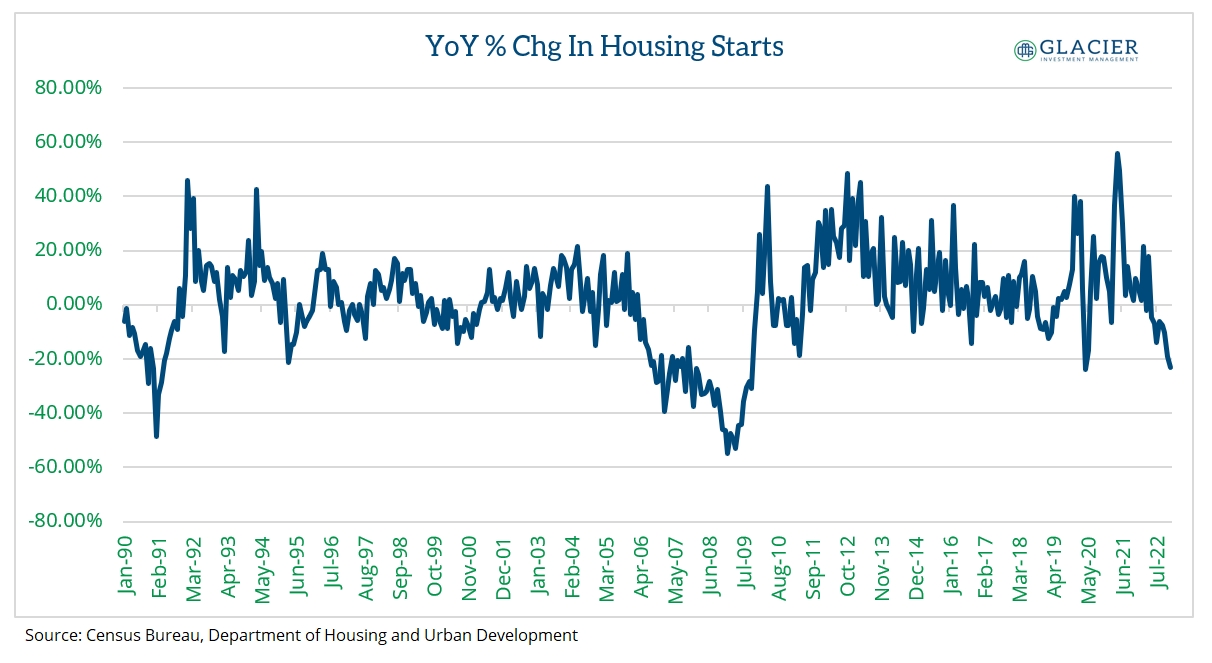

Housing Starts

If a recession has been anywhere, it has been in the housing market. With the rapid rise in mortgage rates, the housing market ground to a halt. Housing start data have reflected this as year-over-year growth in starts is very close to levels last seen during the depths of the global pandemic. While some thawing appears to be occurring, there’s a lot of ground to make up.

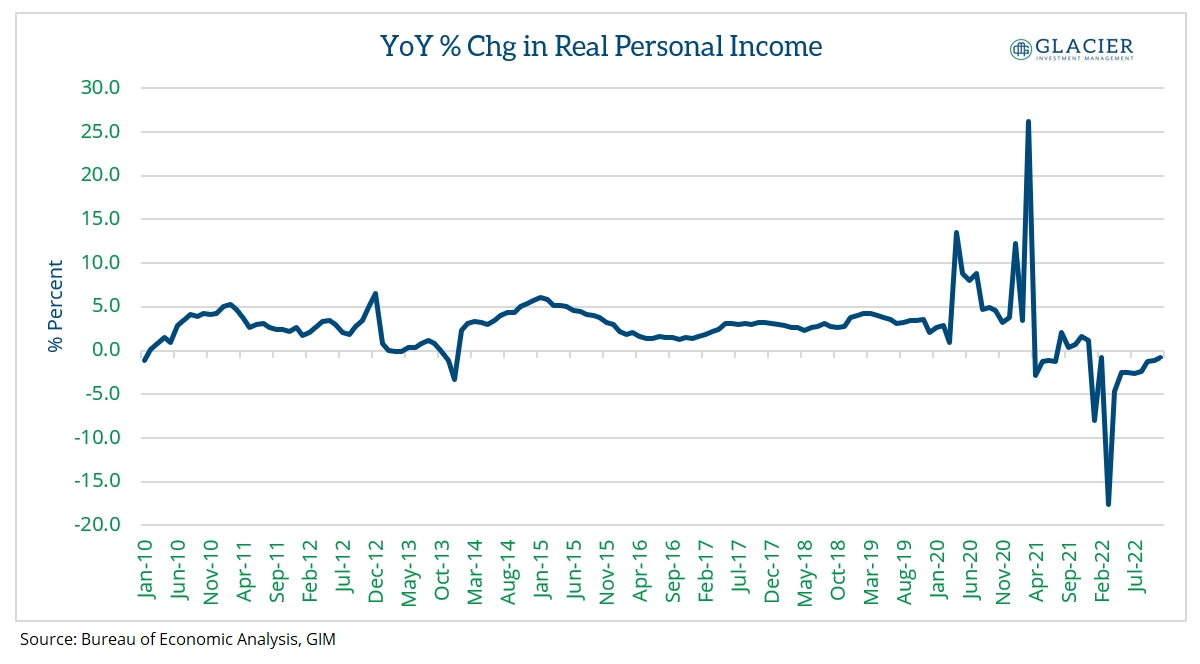

Real Personal Income

Growth in inflation-adjusted income has been negative since inflation started spiking last year. To state what we’re all experiencing, it takes more dollars to buy the same amount of certain goods and services than it did one to two years ago. This is clearly a negative as consumers trade down or purchase less of the same goods and services. Wages have been growing but not at the same rate as consumer inflation. As inflation slows, it will be interesting to see if wage growth can catch up.

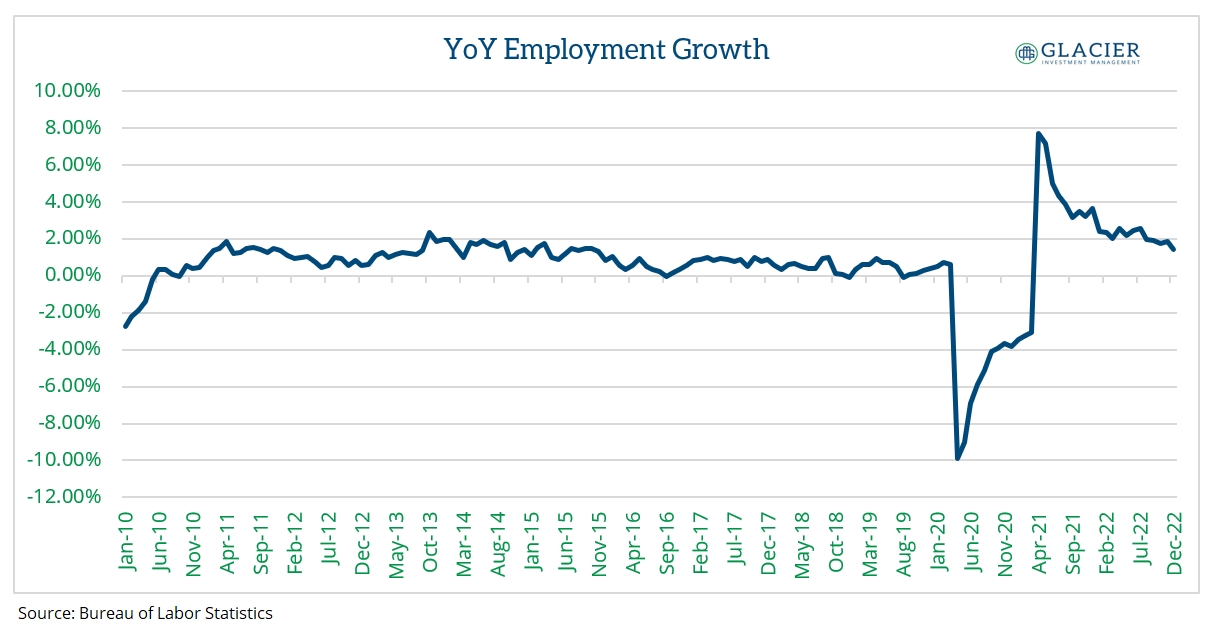

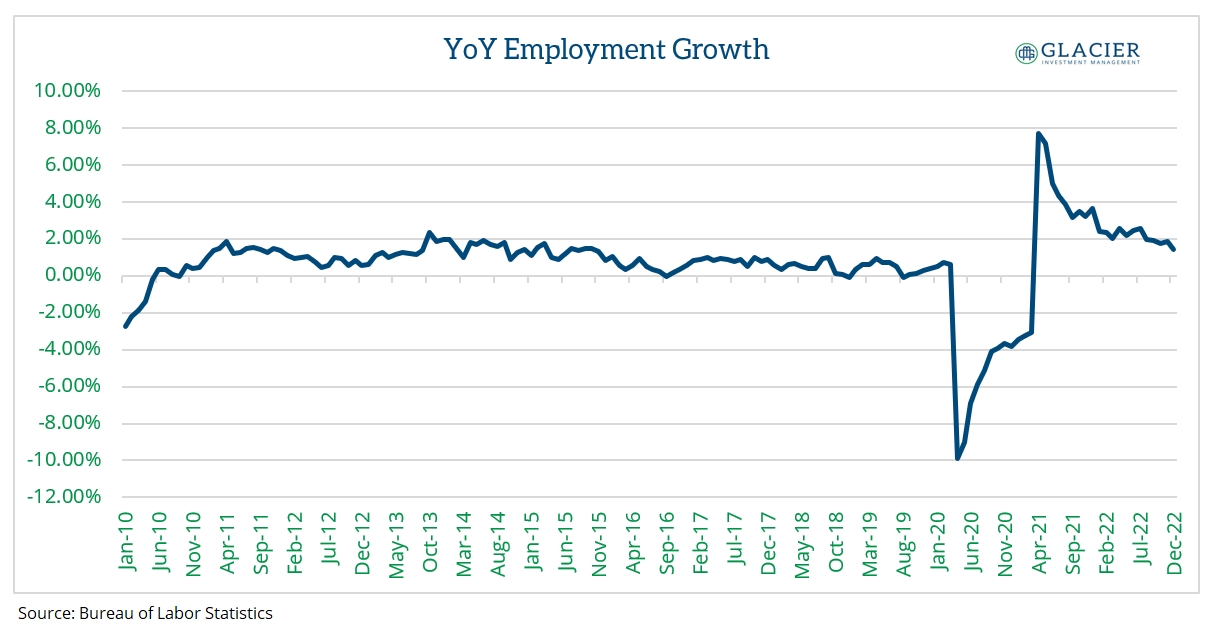

Employment

Job growth remains fairly robust although the rate of growth has been trending downward. With all the recently announced layoffs, we may see a sharper deceleration in the coming months. If we get a break in the job market, that could seal the deal for the recession. I realize employment is a coincident indicator at best, but the job market has been consistent, and the labor shortage doesn’t appear to be going away any time soon.

As I said before, a recession is always on the way. What investors really want to know is when it’s going to happen. While it’s difficult to predict the timing of recession, there are markers along the way that indicate a weakening in economic activity. We have been observing weakening activity in various segments of the economy for several months now. However, activity isn’t weakening everywhere. A recession will eventually come. It just may not be now. Furthermore, with all the extraordinary monetary policy measures taken over the past several years distortions in data may be sending mixed signals.