Major stock market indices made significant gains in the first half of the year due to improving inflation, slowing Fed rate hikes, the absence of a recession, a more stable banking sector, and a strong rally in tech stocks. Many investors may be wondering whether this is truly the beginning of a new bull market or is instead a “bear market rally.” This is a shift from the concerns investors and economists faced at the start of the year when bear markets and recessions were top-of-mind.

Experienced investors with a broad perspective on markets know that there are always risks that must be balanced against long-term returns. These risks often feel insurmountable as they are occurring. Once they are in the rear-view mirror, investor concerns often shift to whether the recoveries are sustainable. These back-and-forth swings in investor sentiment are a normal and natural part of markets, and are why long-term investors can increase their odds of success by focusing instead on underlying trends. To that end, below are seven important insights from the first half of the year that will likely be just as relevant in the second half.

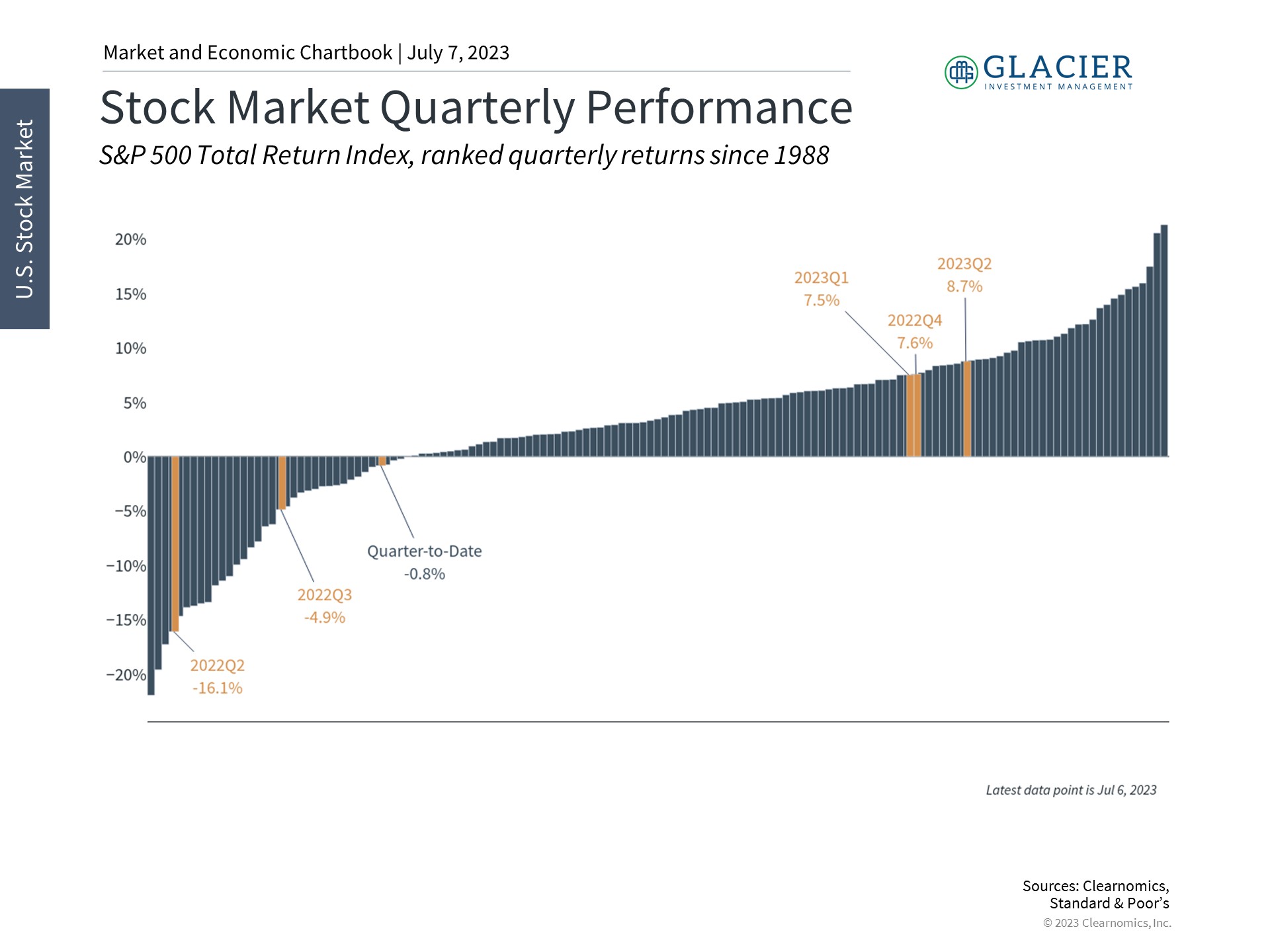

1. Strong returns over the past three quarters have surprised many investors

The S&P 500 has now notched three consecutive quarters of strong returns, beginning with the fourth quarter of 2022. This is a 180-degree shift from the bear market returns experienced during the first three quarters of last year, and is happening at a time when sentiment is still negative. While there is no guarantee that markets will continue on this strong trajectory, it underscores the idea that markets can change direction without notice.

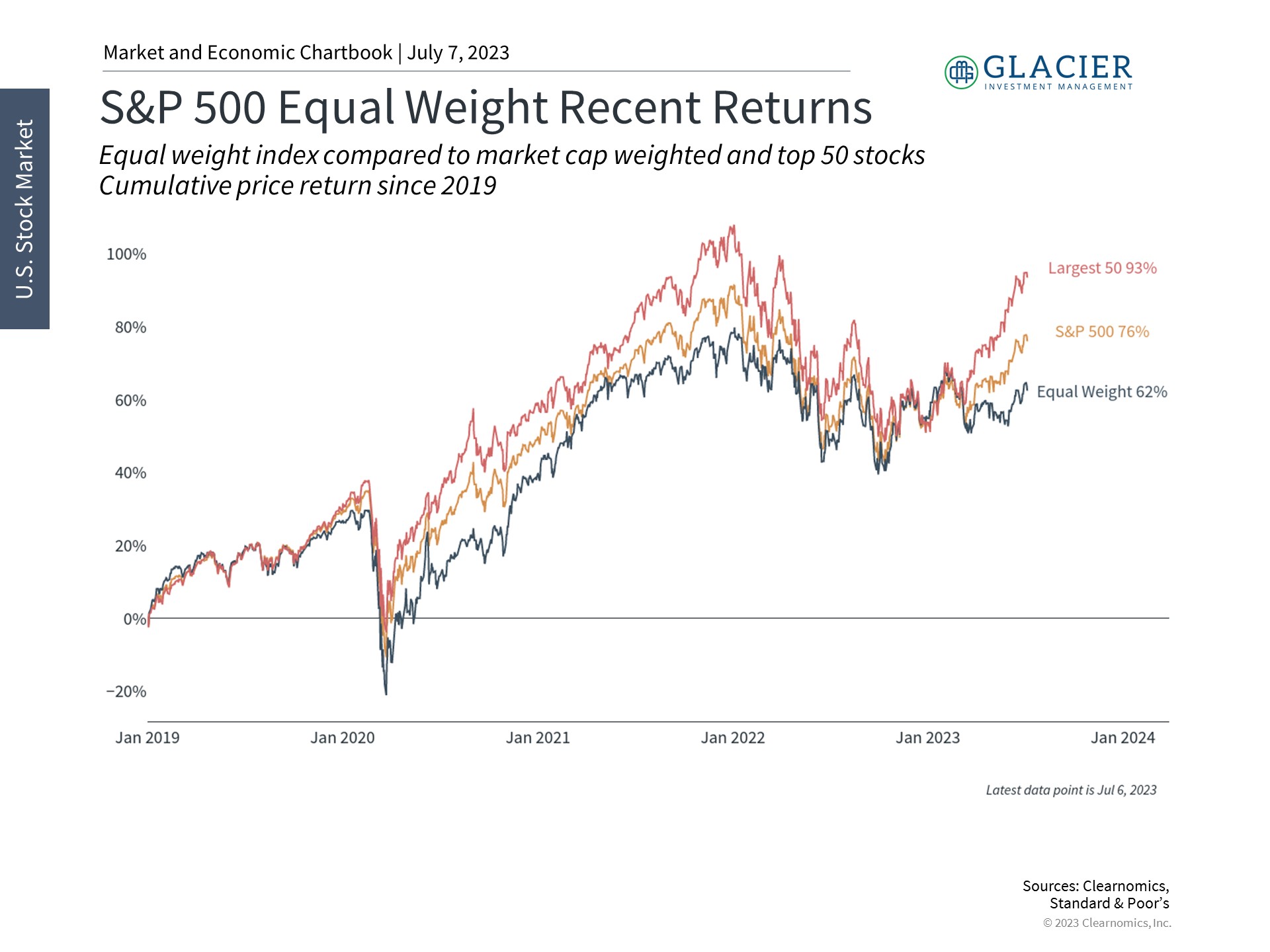

2. Market breadth has been low as mega-caps have led the rally

While the market rally has benefited most investors, not all stocks have participated equally. Under the surface, mega-cap stocks have led the way. The accompanying chart shows that the largest stocks in the S&P 500 have outpaced the broader index this year. What’s more, an equal-weighted index (i.e., an index that gives more weight to smaller stocks than the market-weighted index), has lagged even more.

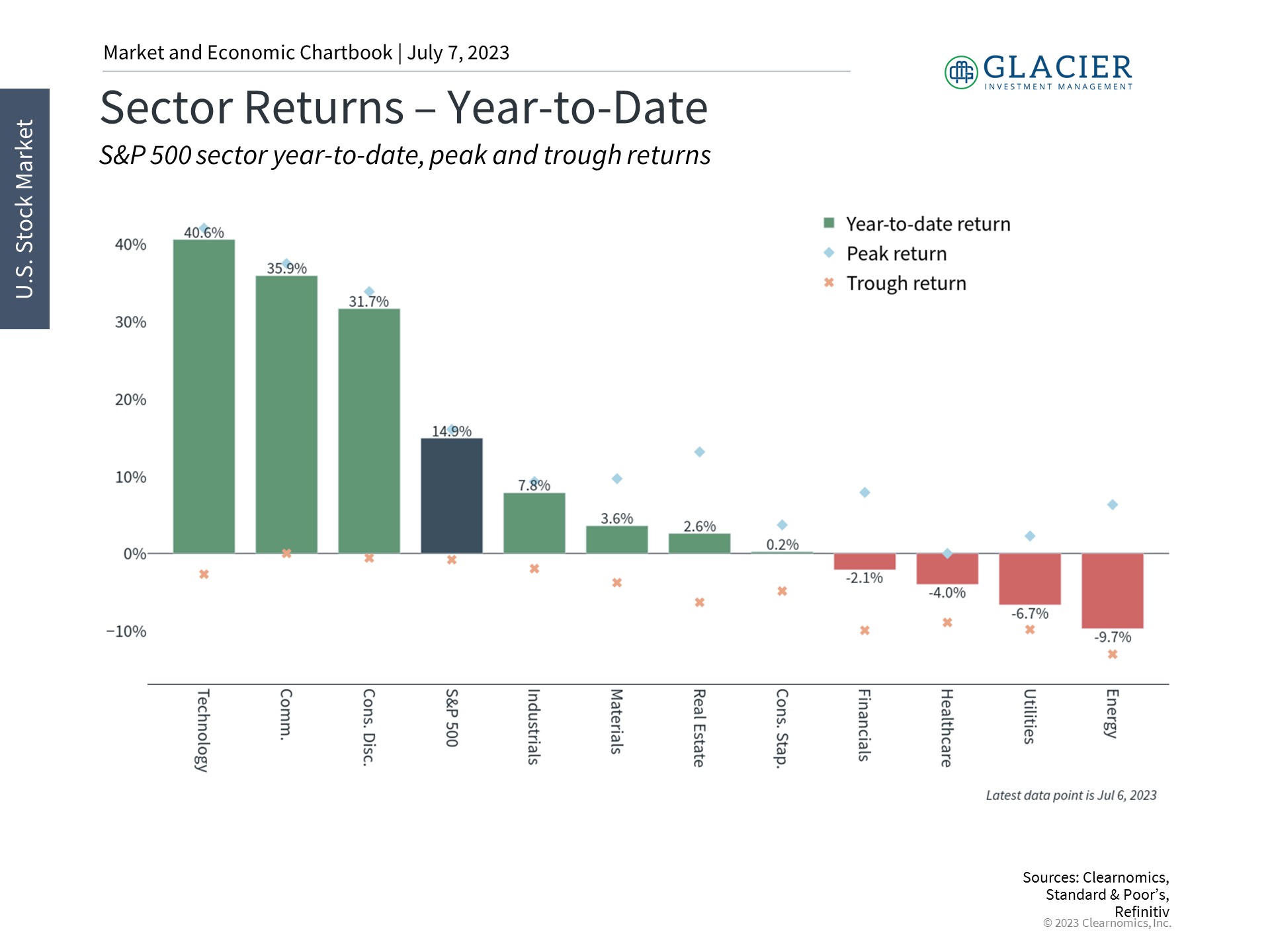

3. Sector returns have differed across the market and compared to last year

Thus, one investor concern is whether this year’s returns have been “distorted” by tech returns. Unfortunately, it is a fact that the largest stocks have only grown in importance over the past decade. This is due to the increasing economies of scale due to technology across the economy. More recently, enthusiasm for artificial intelligence has driven greater gains in these sectors.

However, this year’s gains in these areas are not only due to these trends. The returns among these companies also represent a rebound from last year when these were the hardest-hit stocks as rates were rising and the future looked increasingly bleak. Taking the last two years together, returns are still outsized but look much more reasonable.

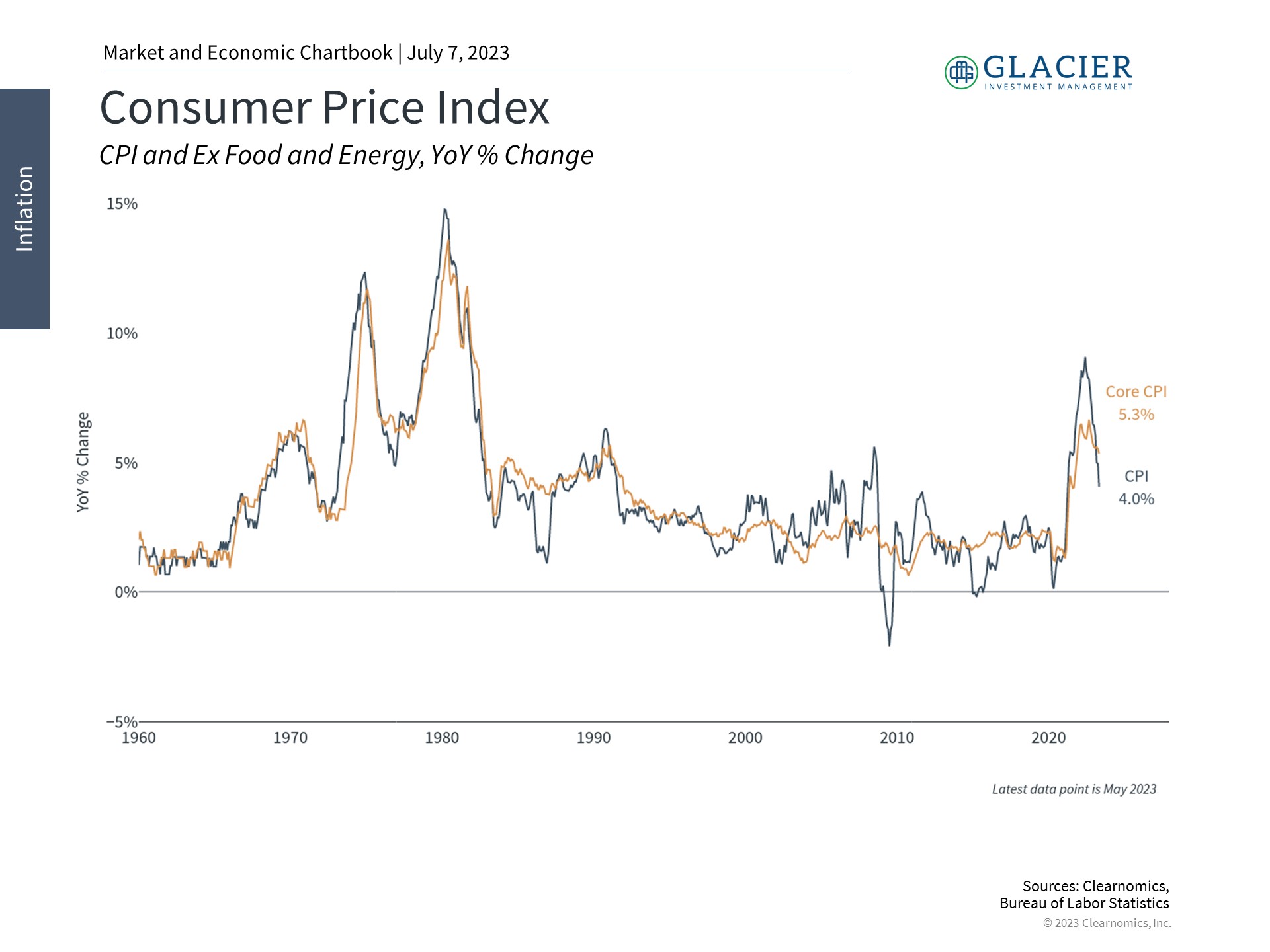

4. Inflation is improving even as core measures remain sticky

One reason for the reversal from last year is that inflation has shown signs of improvement. The headline Consumer Price Index has decelerated from a peak of 9.1% a year ago to 4% today. This is primarily due to deflation in energy prices and other categories such as used cars. However, core inflation remains sticky due to shelter prices.

The Fed and other economists believe that these prices will improve as rent prices stabilize and new leases are signed. Investors should also maintain perspective on further inflation improvements. At best, both headline and core inflation will likely remain high through much of 2024. In the meantime, it’s possible that year-over-year inflation figures will worsen due to comparisons to last year’s levels.

5. The Fed has slowed its pace of rate hikes

Improving inflation alongside a strong economy allows the Fed to slow its pace of rate hikes. The Fed has raised rates 10 consecutive times from zero to 5%. The size of each increase has decelerated over the past year from a peak of 75 basis points (0.75%) every meeting to perhaps 25 basis points every other meeting.

The Fed has made it clear that they are committed to returning inflation to their 2% target by keeping rates higher for longer. Market-based expectations have shifted this year from believing the Fed will cut rates later this year to agreeing that rates could rise further.

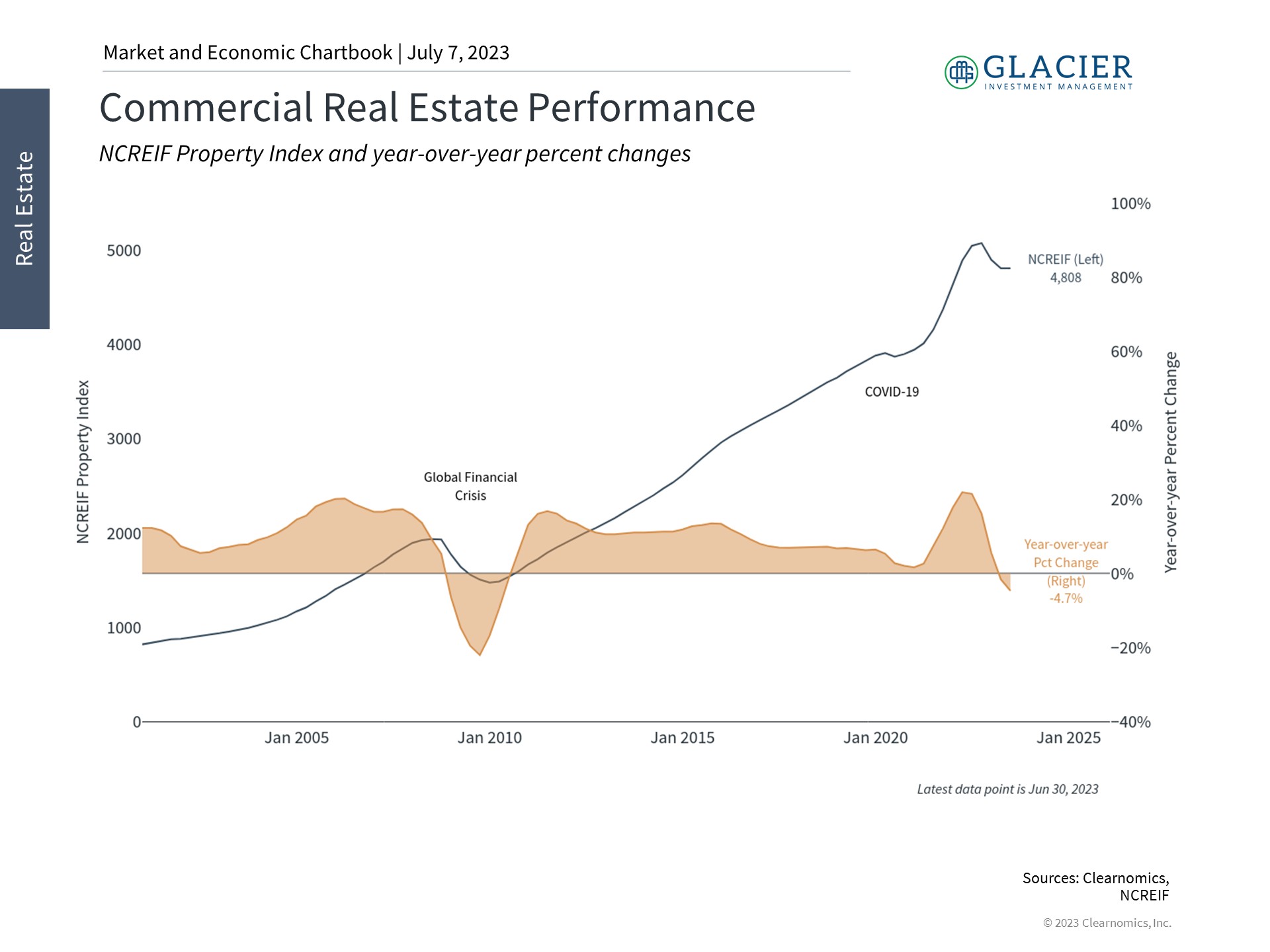

6. Rate-sensitive areas such as commercial real estate face challenges

Of all of the areas impacted by rising rates and financial instability, commercial real estate is seen as the biggest source of risk among investors. This is not only because CRE has struggled with post-pandemic shifts in office usage and occupancy, but because trillions of dollars in loans will need to be refinanced in the coming years. Higher interest rates and tighter lending standards may make this more difficult, creating both liquidity and solvency issues among CRE companies.

So far, greater stability in the banking system over the past few months, along with Fed and government support have helped to reduce some of these risks. Market participants will continue to watch this sector closely in the months to come.

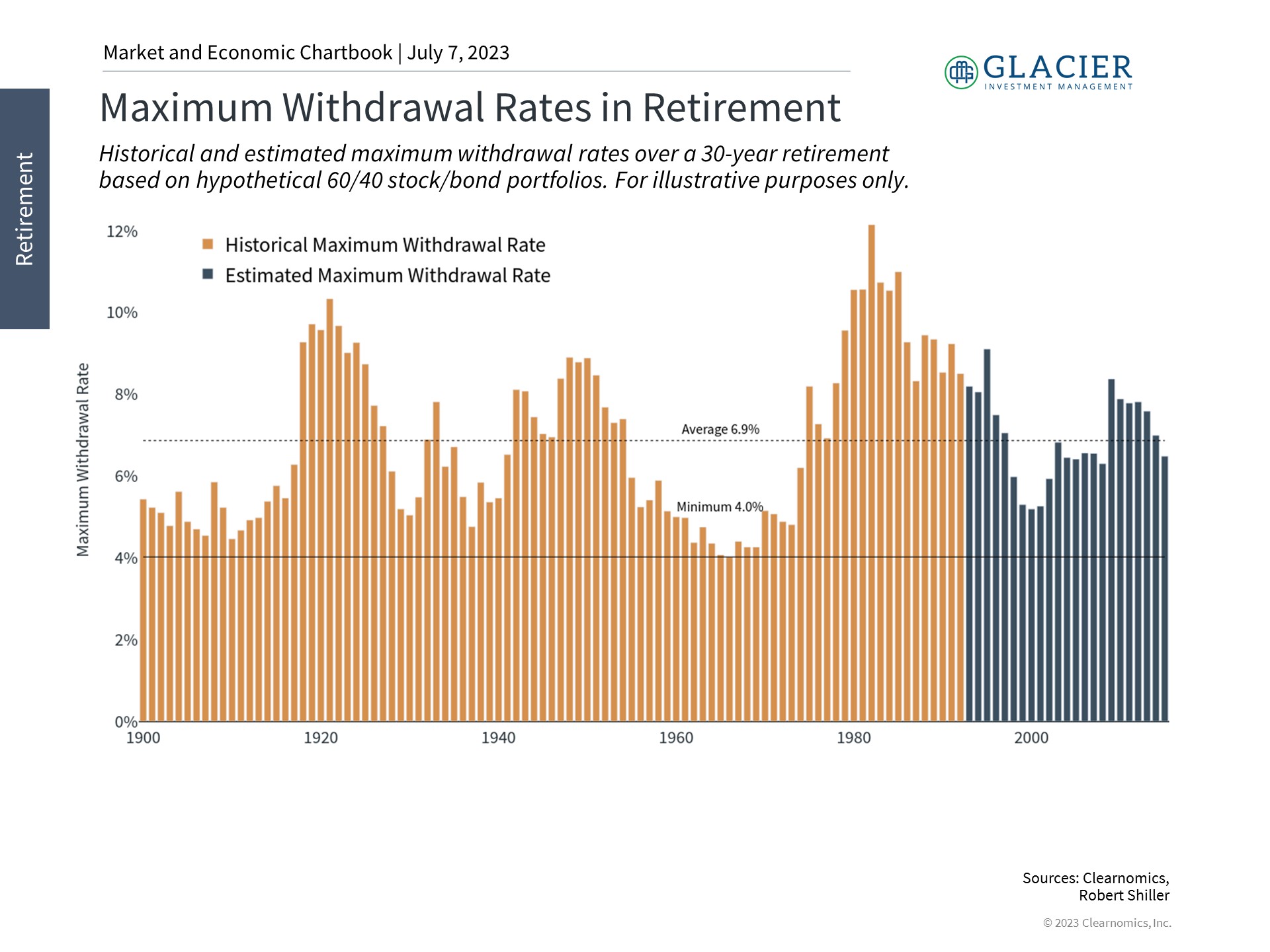

7. Financial planning is especially important in times of uncertainty

Many investors may wonder what market uncertainty means for their portfolios, especially for those approaching retirement. The classic 4% rule specifies a “safe” withdrawal rate in retirement based on the historical performance of a hypothetical 60/40 stock/bond portfolio, as shown in the accompanying chart. This includes both good and bad market periods since 1900.

However, this chart also shows that safe withdrawal rates can fluctuate significantly, with the average being closer to 7%. So, while investors need to minimize the risk of running out of funds, they also need to make the most of their retirements, especially as life expectancies increase. Rather than just following a rule of thumb, it’s important for investors to understand their unique circumstances to better project their safe withdrawal rates. Doing so can help long-term investors to better achieve their financial goals, especially during uncertain market periods like the present.

The bottom line? Markets rebounded in the first half of the year, catching many investors off guard. While markets never move up in a straight line, investors who focus on long run fundamentals and avoid trying to time the markets will likely be in a better position to take advantage of market opportunities in the second half of the year.