The first half of the year is in the books. Contrary to popular belief coming in to 2023, stocks have performed quite well, especially technology stocks. Of course, performance in the second half of the year is on everybody’s mind now.

Needless to say, all the reasons the bears have cited for an imminent decline in stock prices have yet to come to pass. We may still get the much anticipated decline in stock prices, but it will likely not happen the way the bears have been outlining.

The thing about markets is they’re discounting machines, meaning they anticipate future events, rightly or wrongly, and adjust prices accordingly. If a plausible negative catalyst is in the mainstream then it is likely reflected in stock prices already. Of course if an outcome is worse than the mainstream narrative then you might get an unexpected sharp decline in stock prices. Think of the rapid increase in interest rates in 2022. That caught a lot of us off guard and resulted in a pretty nasty decline in stock prices.

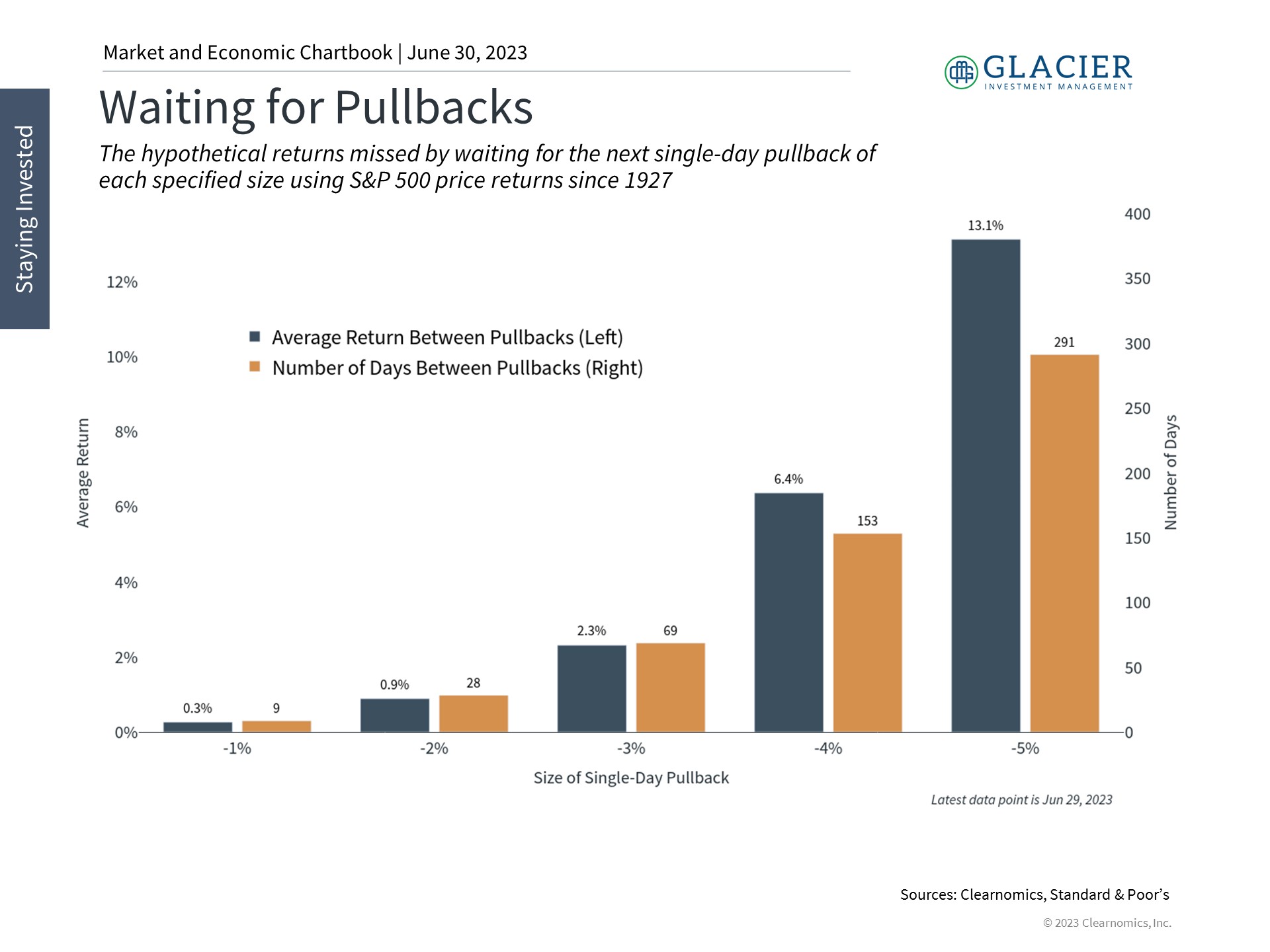

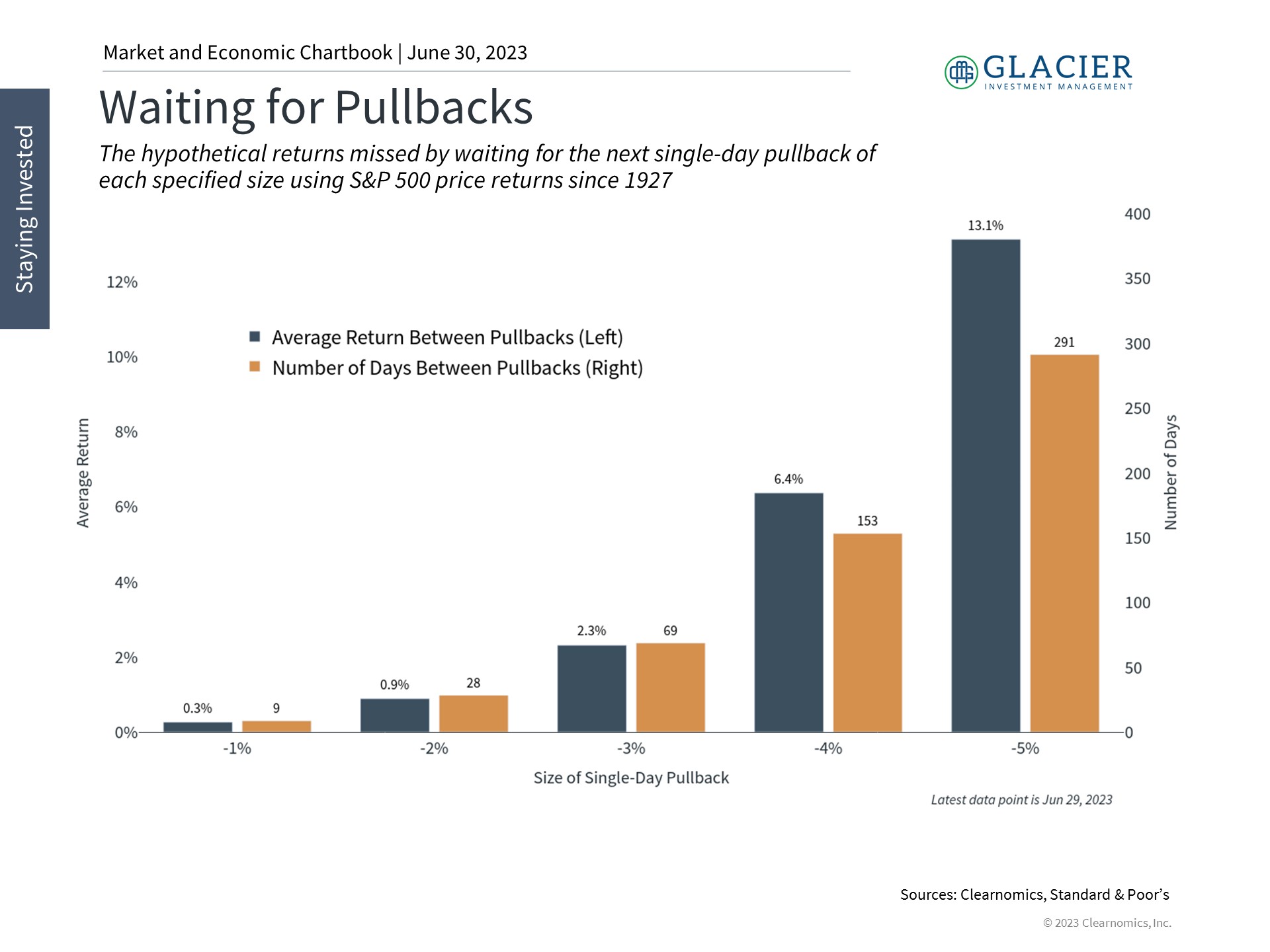

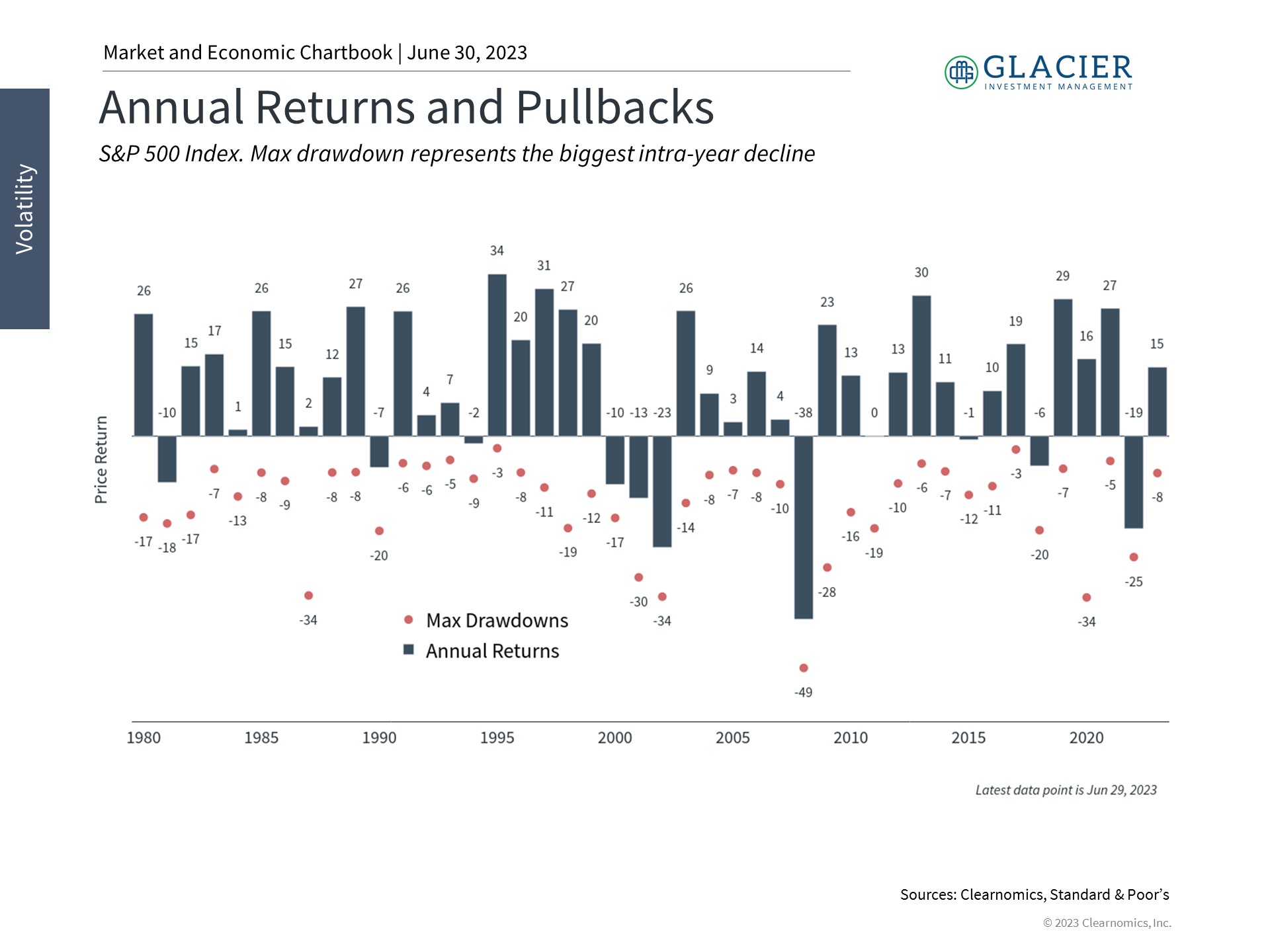

There’s a lot of handwringing about declines in markets, but that’s part of the process. If it were a straight line up, then it would be easy and everyone would participate and returns would likely be less attractive.

Price declines, or drawdowns, are part of the ebb and flow of the stock market

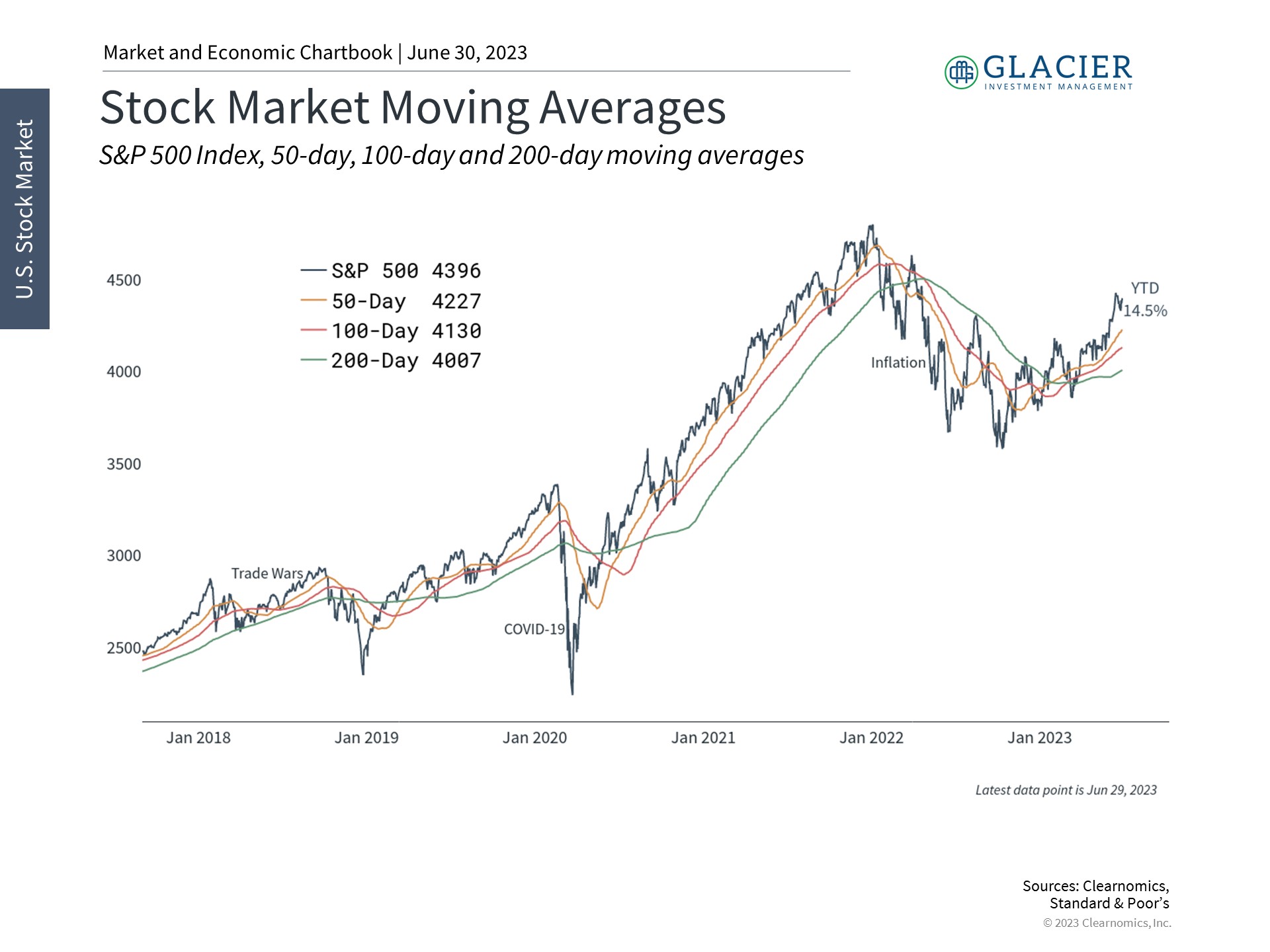

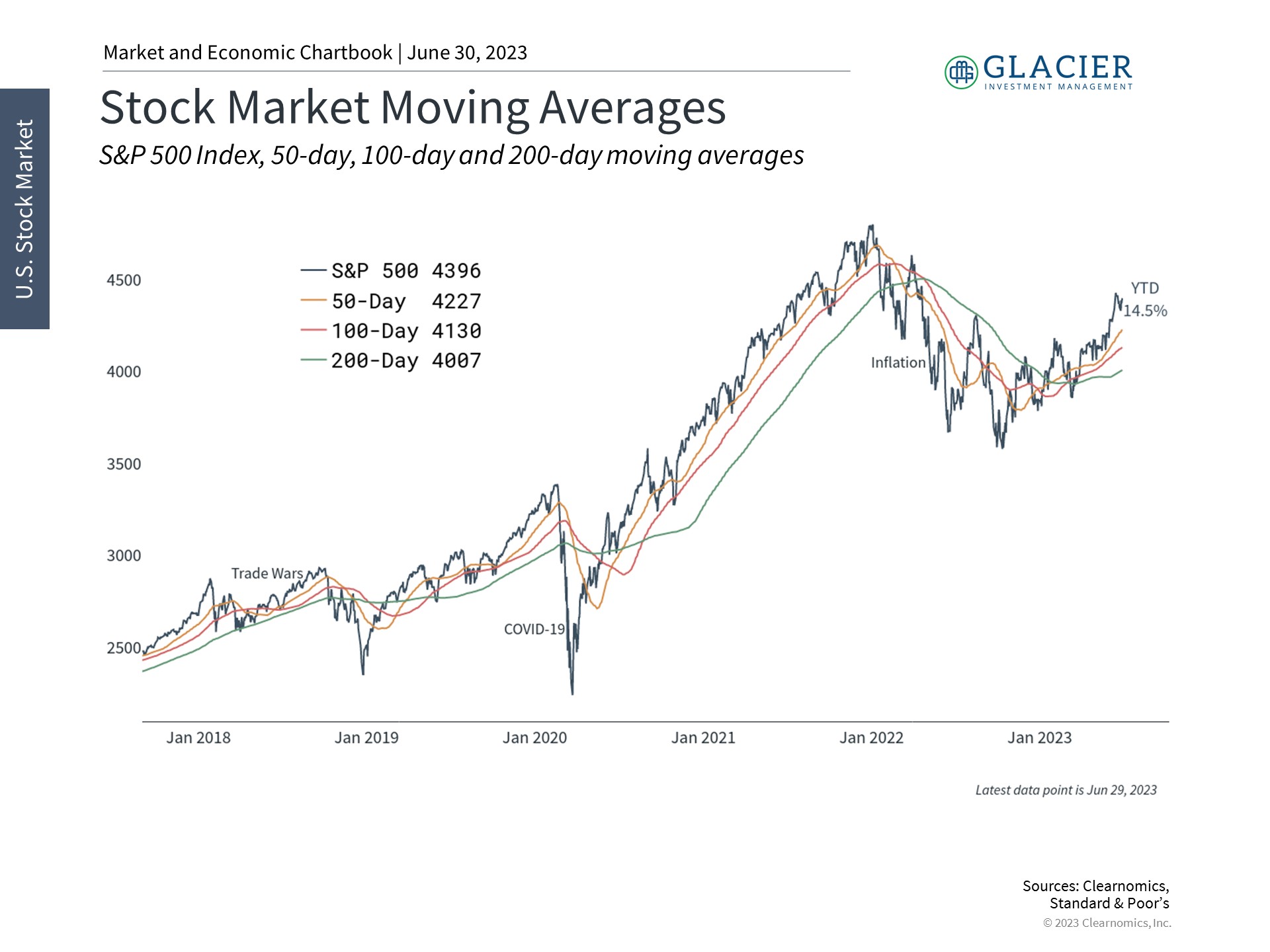

The S&P 500 has already experienced an 8% decline from a recent peak in 2023. Will that be the extent of pullbacks for this year? I don’t know. For now, stocks are moving higher at a gradual pace. The overall trend of the stock market is favorable and should be monitored and used as a reference point for perspective. Trend is often the forest that is missed for the trees of daily price movements.

The trend in the S&P 500 this year is decisively up although we’re still below the 2022 peak

Whether we experience a meaningful pullback in the second half the year remains to be seen. There are plenty of things to worry about, but being invested in stocks isn’t the biggest risk you face as an investor. Not being invested in stocks is by far the bigger long-term risk.