With so much going on in the markets over the past several weeks, I’ve been getting this question a lot. The funny thing is I hardly ever get this question when prices are moving higher. Everybody loves the high of growth in their investment portfolios while prolonged declines are painful. We want to do whatever we can to stop the pain. Enduring investment pain well (or at least without taking drastic action) is a key characteristic of successful investors.

The answer to the “what to do now” question is always the ambiguous and oft times annoying “it depends”. Time horizon and liquidity needs are key variables to consider. However, most people asking me this question are longer-term investors (> 5 years) that are experiencing discomfort. So, my answer to the question to them is “do nothing” (assuming you have an investment plan in place that you’re following).

For long-term investors, it’s hard to be patient in an environment like this. Having a well- diversified portfolio hasn’t produced the expected results this year unless you had a decent allocation to commodities and USD. Of course, what’s happened year-to-date could reverse with stocks and bonds rallying later in the year causing the pain of today to be a faint memory. I’m not sure that’s really in the cards after three years of above average returns. Regardless, the level of pain may decrease as the year progresses.

The important thing to keep in mind is this too shall pass. Maintaining discipline and sticking to your plan in environments like this is the best test of your conviction in your plan. If you’re doubting your plan and want to make changes, then your conviction may not be what it needs to be. It’s always good to reevaluate investment plans, but reviews should be programmed into your calendar at set times each year, not when you’re unhappy or uncomfortable with your investment portfolio’s performance.

My $0.02

A lot of comparisons are being made between today and 2011 when similar concerns about the liquidity cycle were percolating. There was a 13% drawdown midyear then, but the uptrend found itself again later in the year and never looked back. The difference between 2011 and today is the starting point. Stock market valuations are substantially higher. Inflation is substantially higher. Rates were moving down then, not higher like today.

Shiller CAPE Ratio

Source: Barclays-Shiller

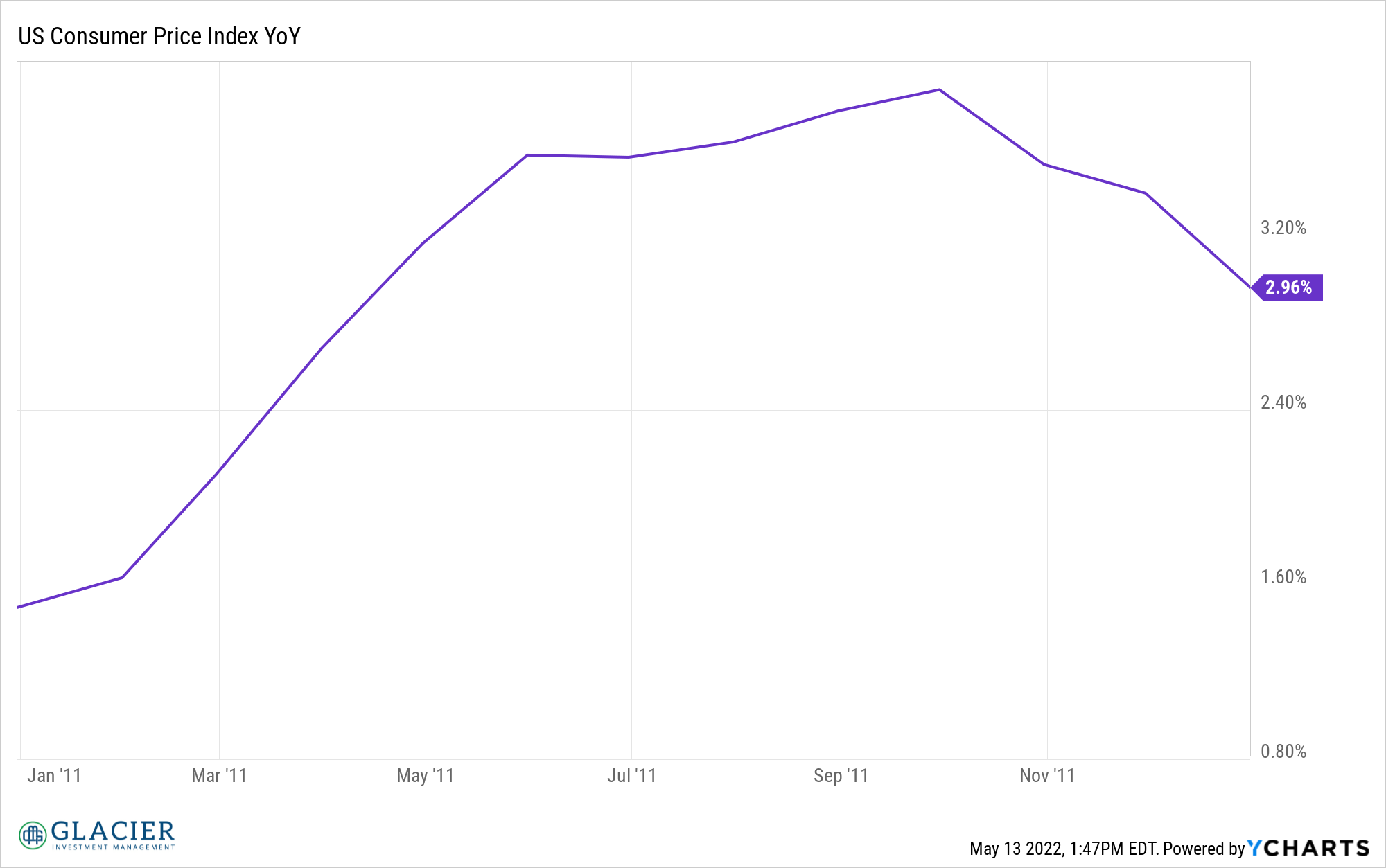

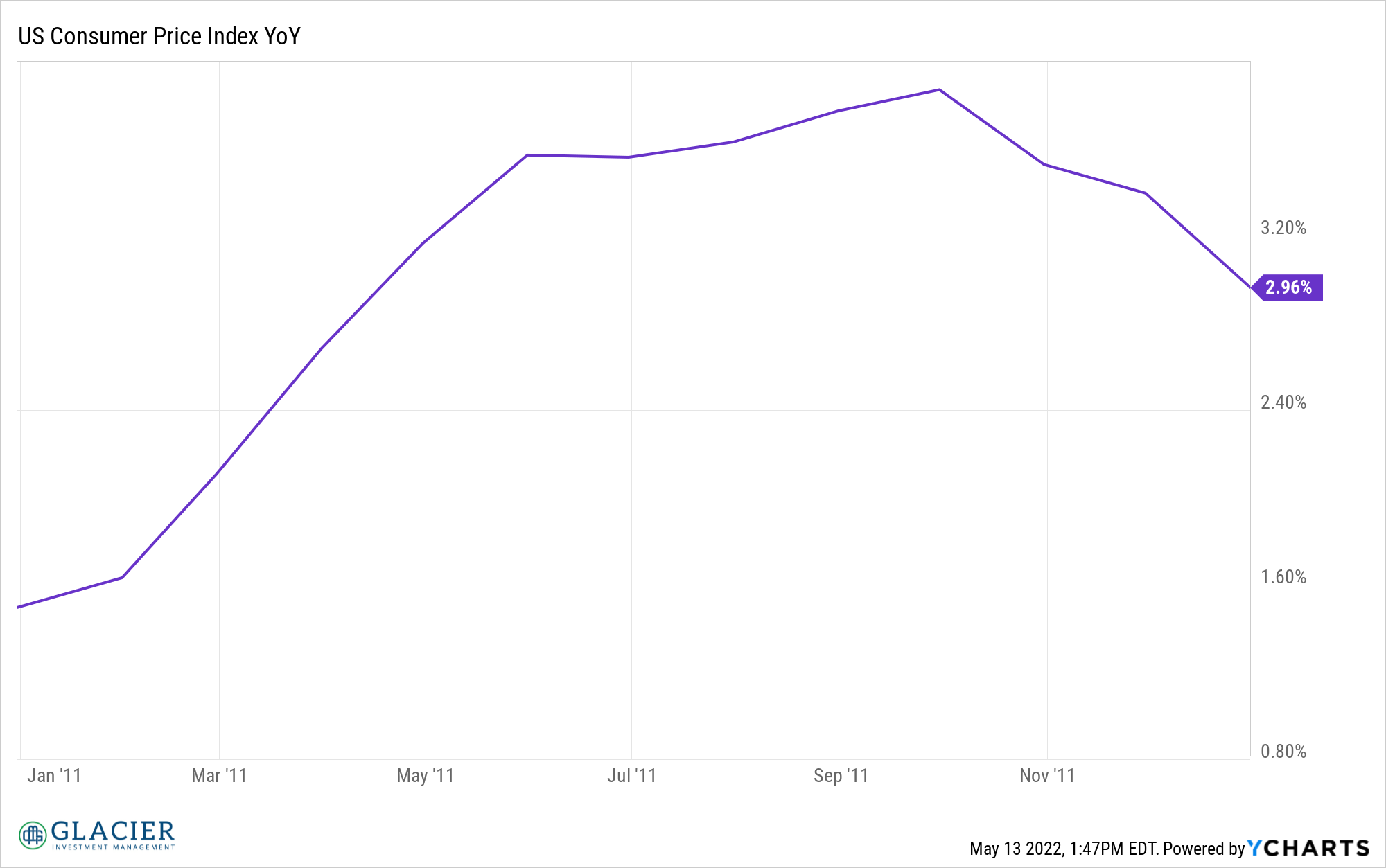

Inflation 2011

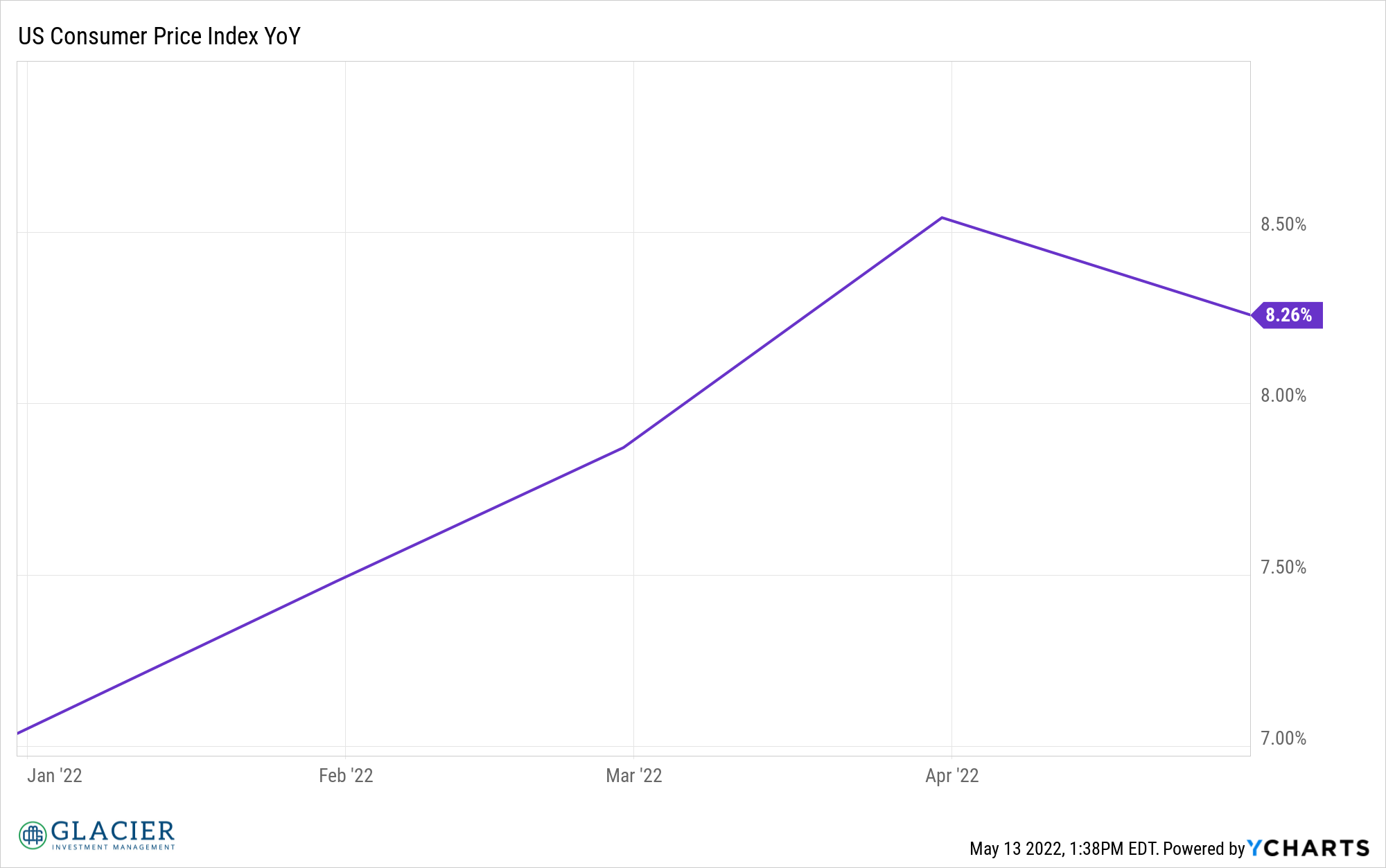

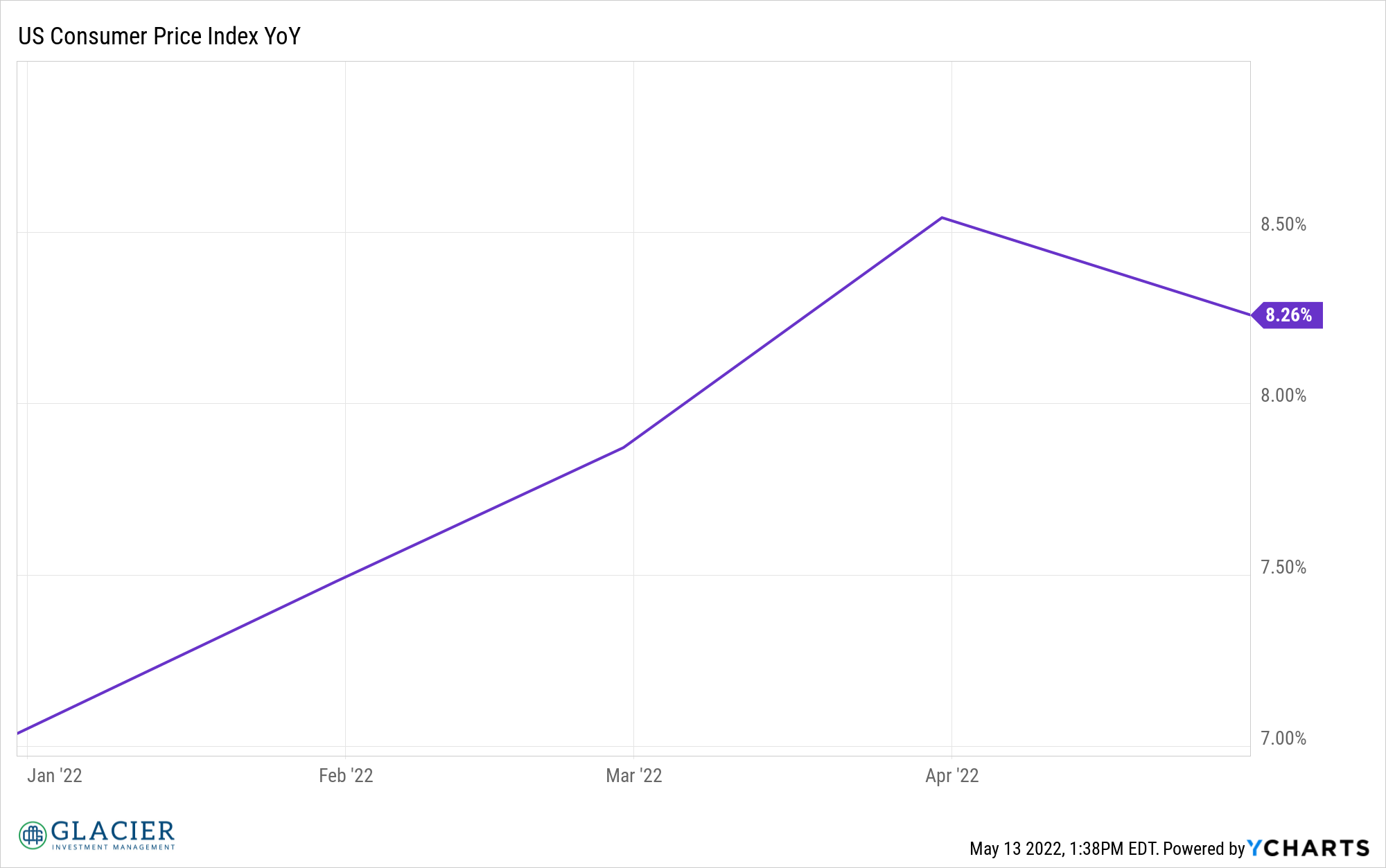

Inflation 2022

10-year UST % Change 2011

10-year UST % Change 2022 YTD

I think today is more akin to a mix between 2000 and 2011. Elevated valuation levels and a potential liquidity squeeze. Unless the Fed reverses course on its tightening path, I think we could be in for more downside. The chairman has insisted he is going to break inflation which probably results in a recession. Is that palatable to the powers that be in an election year? It kind of feels like we’re at a tipping point. Either we opt for lower inflation and a recession or higher inflation to avoid a recession. Perhaps the Fed will be able to engineer the proverbial soft landing, which would be a welcome relief to all of us. I’m not sure how likely that is today.

There’s a battle between the crowd that has been waiting for a market crash and those that have been converted to that camp so far this year and the crowd that is confident the Federal Reserve will ride to the rescue (the buy the dip crowd?). Which one will blink first? From a sentiment perspective, I feel this is a very important dynamic.

Right now, markets are oversold and are rallying hard as I write this post. Investor sentiment is terrible. Whether today’s rally is sustainable or not is TBD. I’m leaning towards not being sustainable in the short-term, at least, given the outsized move up in prices today in what has otherwise been sloppy downward trending market in the short term.

Economic growth data is slowing. It’s not negative (in most cases) but the rate of change is decelerating.

All in, we’re facing well-known headwinds. Right now, liquidity is moving in the direction of less versus more, growth is slowing, and inflation is high and may or may not have peaked. Markets aren’t crashing but 2022 seems like it’s going to be a bumpy and uncomfortable year, especially compared to the past three years.