Things have gotten a little wobbly here at the start of 2022. Volatility and interest rates have shot up as measured by the VIX and the 10-year US Treasury. Earnings season for the S&P 500 companies was uninspiring. There are currently six to seven interest rate hikes priced in with an anticipated recession to occur on the heels of the rate hikes. And to boot, geopolitical tensions are high with the Russia/Ukraine situation and China.

Given all the distractions, I feel it’s a good time to check in on our economy as it is a big factor in the direction of medium to long-term asset price movements. As I have shared before, I monitor several variables to provide me with insight into the broader health of the economy. I am not an economist and am not making forecasts. I’m simply trying to keep a finger on the pulse of the economy so that I can be properly informed in my decision- making process.

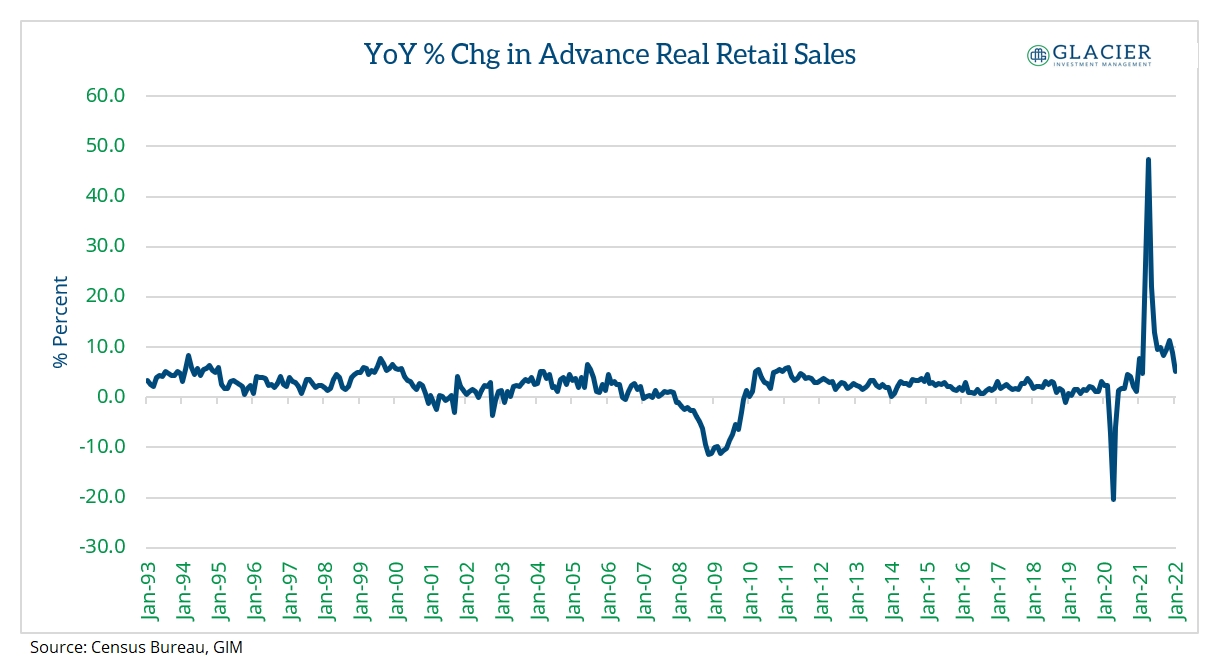

Retail Sales

Since two-thirds of the US economy is still driven by the consumer, retail sales are always a good place to start. If consumer spending is healthy, then chances are the economy is doing okay. An important note on consumer spending for 2022 is the withdrawal of fiscal stimulus. It doesn’t appear the federal government will be mailing out checks to taxpayers this year. That could put a crimp on consumer spending which in turn could lead to a slowdown in overall economic activity. Higher wages, savings and even credit could offset any drop off in spending. Time will tell.

While still strongly in positive territory, year-over-year growth decelerated in January. We’re still well above pre-pandemic growth levels but the path of least resistance is likely back to the pre-pandemic trend. The concern here is the withdrawal of fiscal stimulus and higher interest rates. What impact will those have on consumer spending. Anecdotally speaking, I have read in more than one place that government checks were going straight to savings and not back into the economy. If that’s true, then the impact of no government money may be de minimis. The bigger impact may come from consumers not having the same spending needs as before, especially as it relates to durable goods. While the pandemic is hopefully ending very soon, we may see an uptick in spending on services which would be a nice boost for that part of the economy and could offset and decline in durable goods spending that has been so strong over the past couple of years.

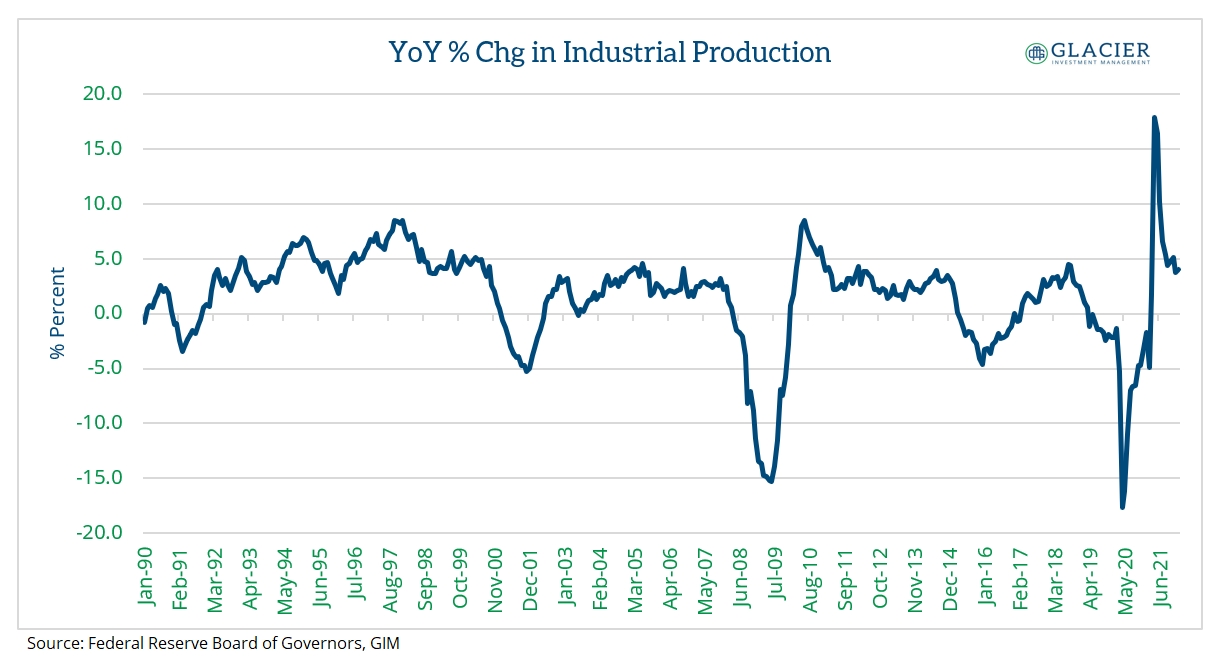

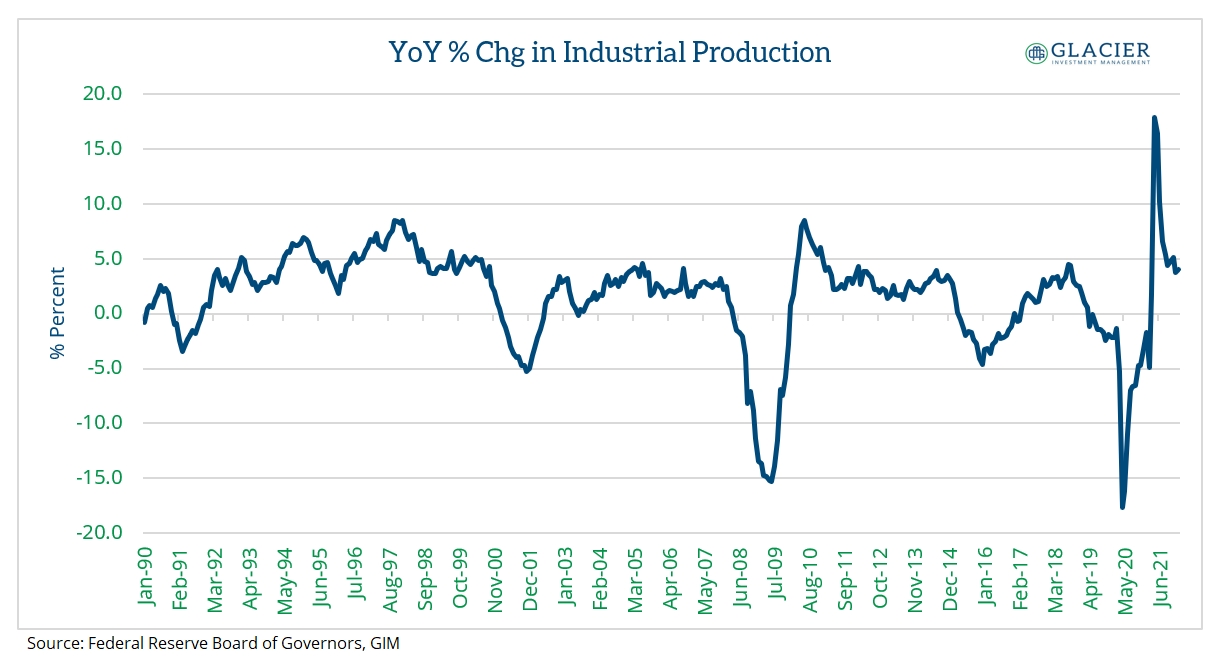

Industrial Production

The next indicator I monitor is growth in Industrial Production, which captures the manufacturing component of our economy. Yes, the US economy has become less and less of a manufacturing economy, but this indicator still provides valuable context regarding the broader health of the economy.

Industrial production is hanging in there for the time being, which is good news. If companies are bringing production jobs back home that could help buoy this number for a good time. We aren’t observing the same level of deceleration in industrial production growth as we are observing in retail sales. Yes, we are well off the peak from mid-2021 but growth is still solid.

Employment Growth

Employment growth is often considered a lagging indicator, but it can still provide valuable information. If jobs are being lost, then people presumably have less money to spend. If jobs are growing, people presumably have more money to spend.

Job growth continues to slow but is positive and above pre-pandemic trend levels. Depending on the composition of those not in the labor force or who are still looking for jobs, we could continue to see consistent job growth if the services sector picks up some steam with the end of the pandemic. Job growth is always a good thing for the economy as it means there is actual economic activity and people are earning money to spend.

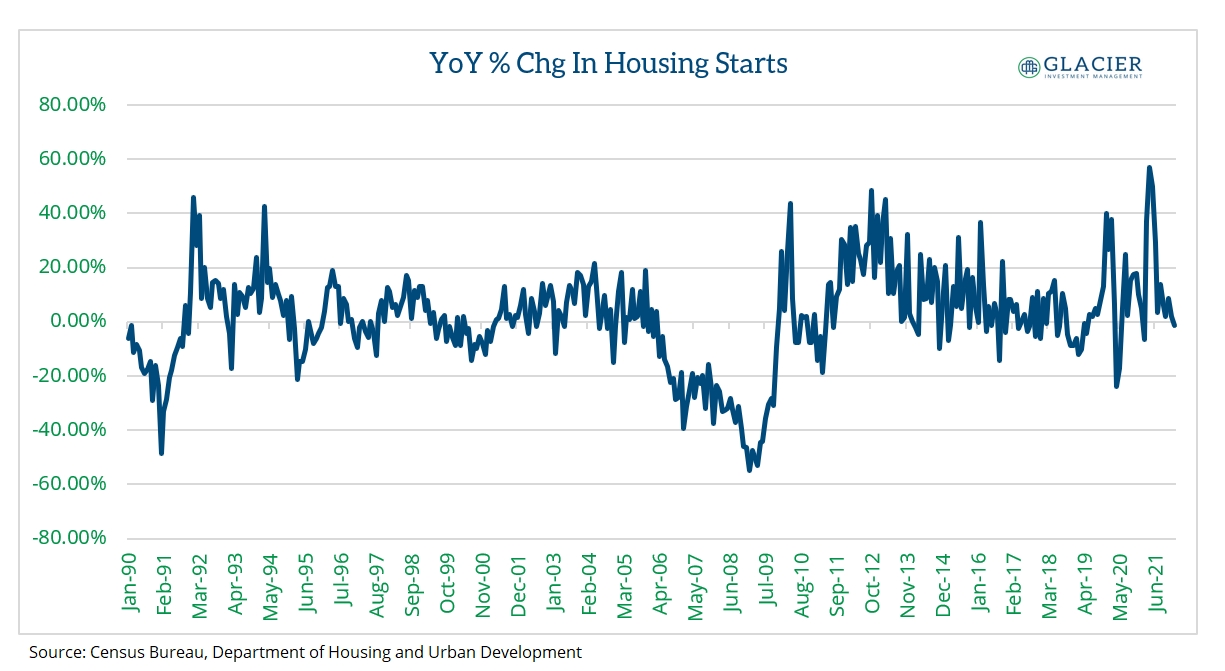

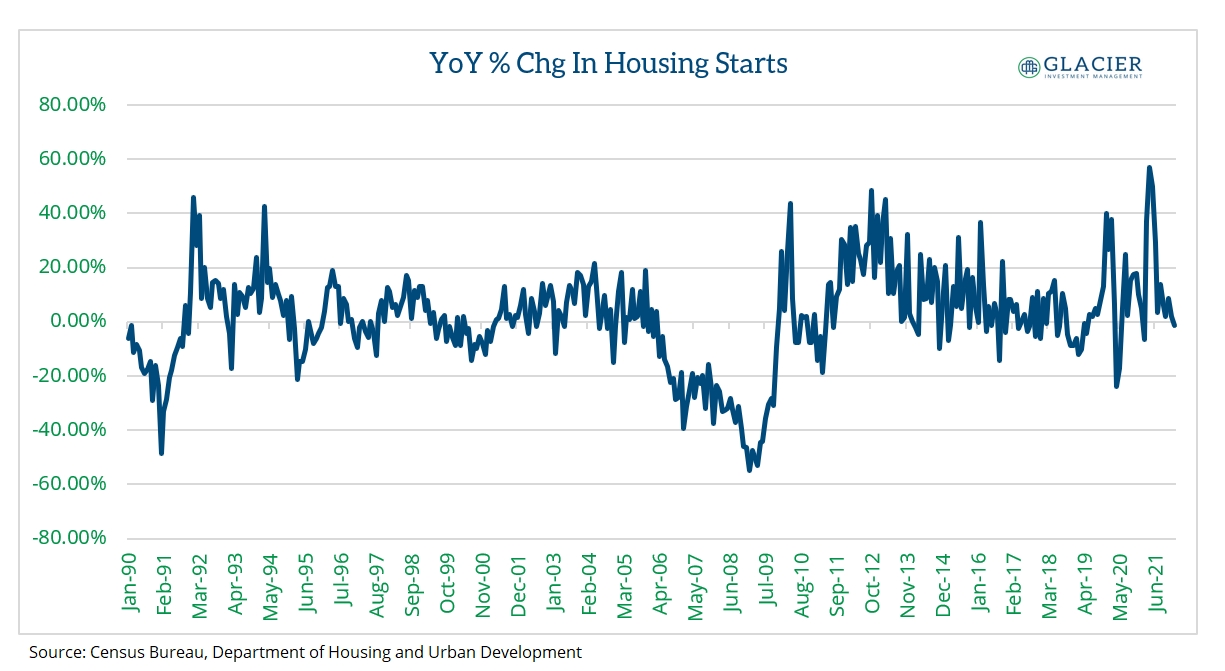

Housing Starts

Housing is an important part of the US economy. People need places to live, and construction of new housing contributes to economic growth and reflects improving individual economic situations for Americans.

Housing starts turned negative in January for the first time since last February which could be due to seasonality. However, with the recent rise in rates and an expectation of continued increases in interest rates, is it possible some plans to build homes were scratched? I’m not sure that would show up this quickly, but it is something to consider. Higher rates will likely lead to a slowing in the housing market, which is evident in the homebuilder stocks which are down over 20% so far in 2022.

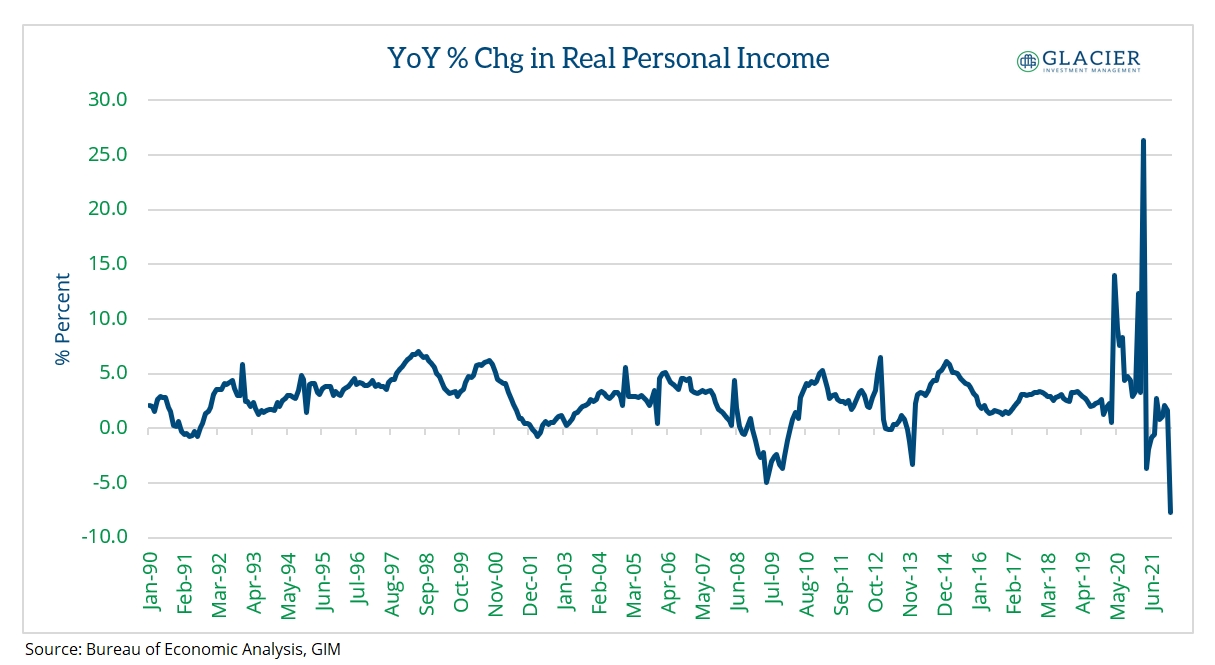

Real Personal Income

In conjunction with having a job, having money is another requisite for people to be able to spend. If that money source is growing that’s even better, especially on an inflation adjusted basis. Note: “Real” in economic terms implies adjusted for inflation.

Growth in this metric fell off a cliff in January after a couple of months of stabilizing. The sharp uptick in inflation is likely largely to blame for the large negative print. It goes without saying, but this isn’t good. Consumers are losing purchasing power which means they will be purchasing less for their dollar than they were before. I don’t want to be an alarmist on a single data point so we should wait for another month or two of confirming data points. Regardless, this was a big negative swing.

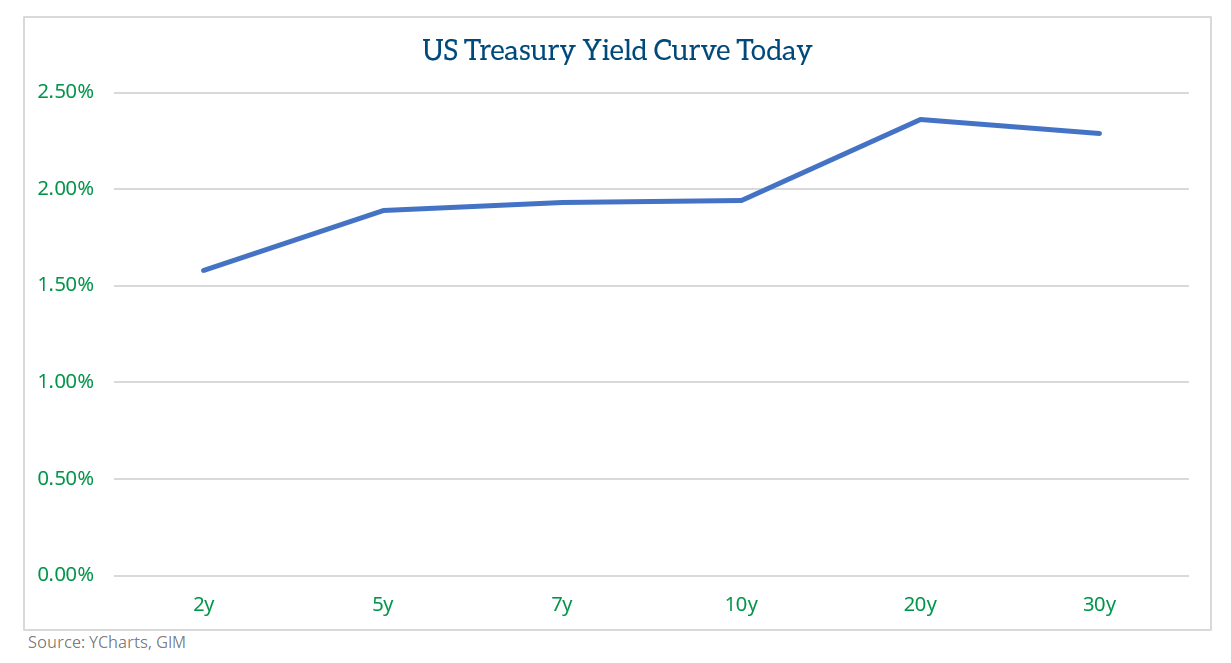

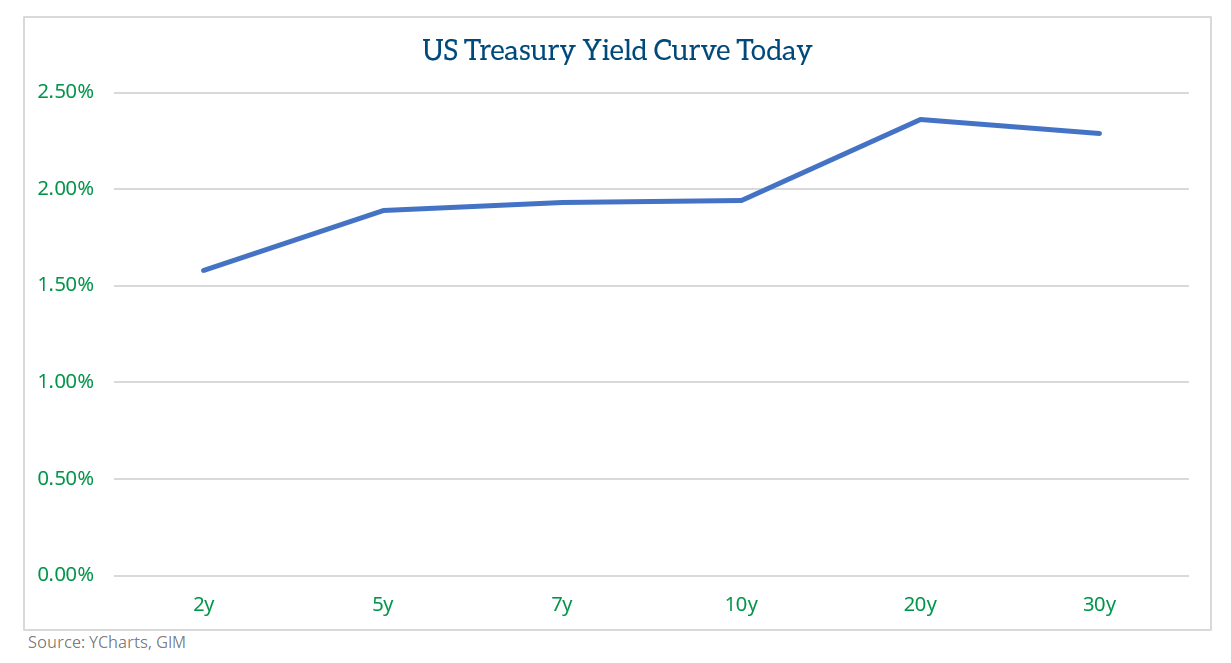

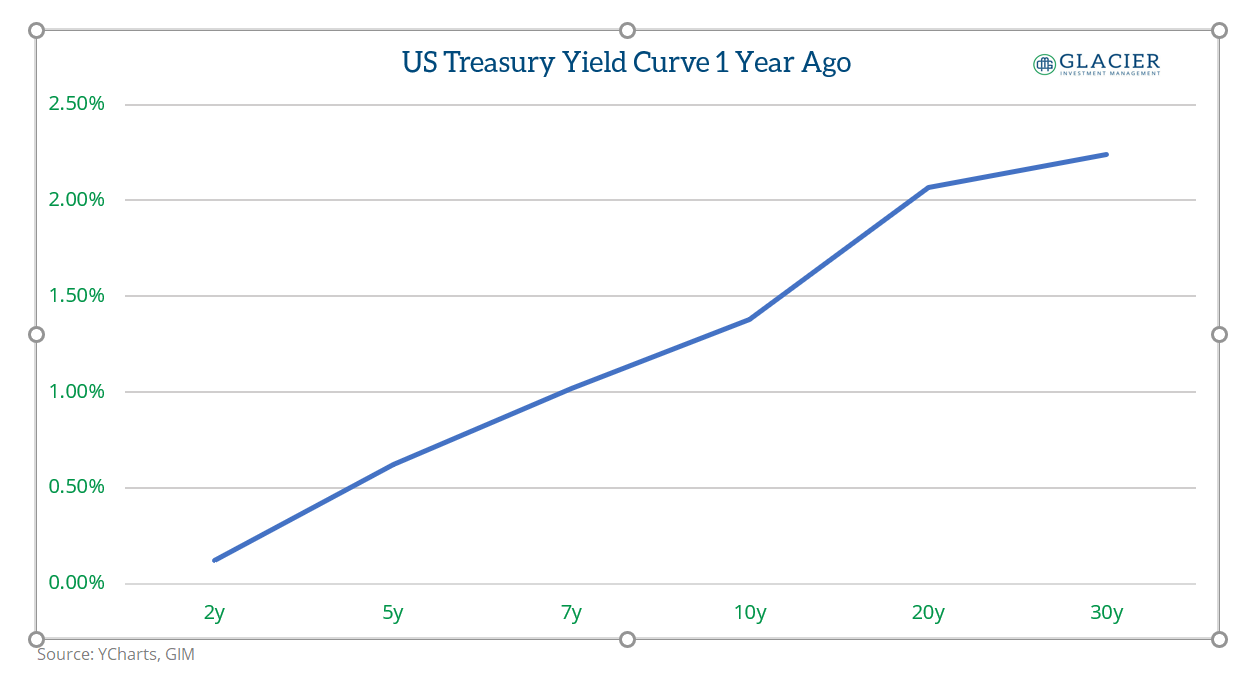

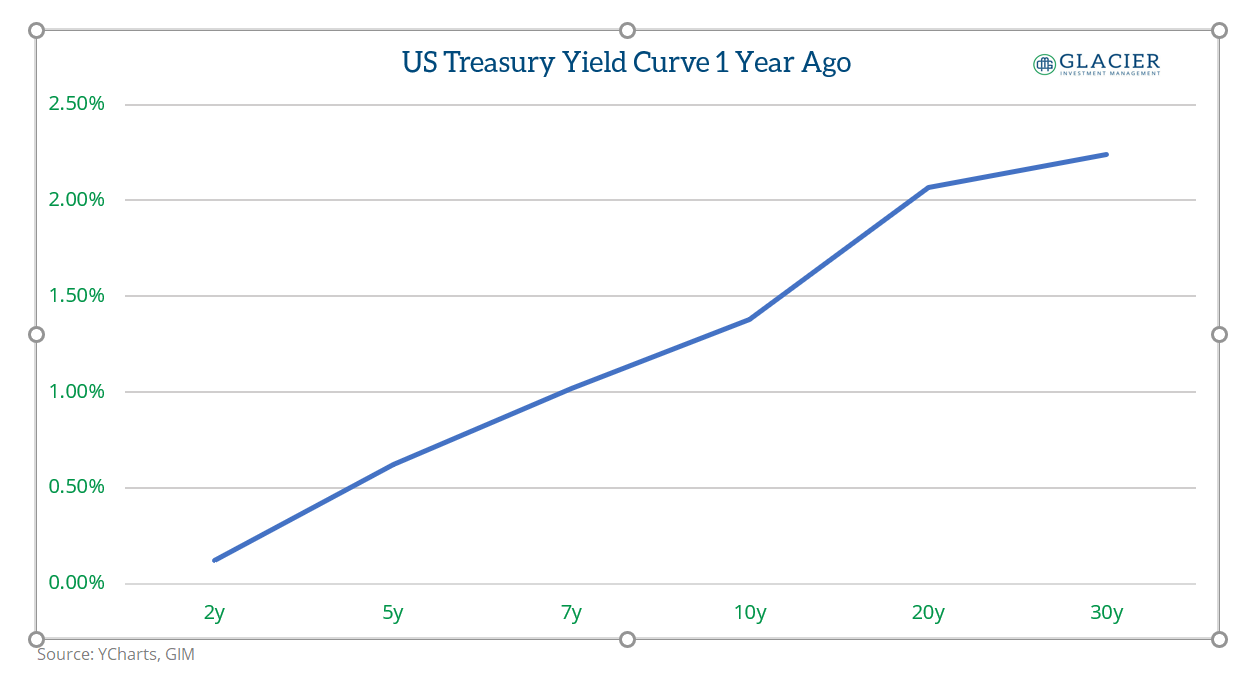

The Yield Curve

One important growth indicator that I haven’t always included in my previous blog posts is the yield curve. The yield curve is a series of interest rates at different maturities. Its shape can provide insight into future growth expectations. An upward sloping curve (long-term yields are higher than short-term yields) generally implies expectations for positive future growth and/or higher inflation. This is the most common shape of the yield curve.

A flat curve (short-term yields roughly equal long-term yields) tends to imply a more cautious outlook for future growth while an inverted yield curve (short-term rates are higher than long-term rates) generally implies a more pessimistic outlook for future growth and has been a harbinger of recession in the past.

Interestingly, with all the talk about inflation so far this year the yield curve has been flattening (short-term rates have been rising faster than long-term rates in this case), implying a more cautious growth outlook. This is likely due to anticipated interest rate hikes by the Federal Reserve. As mentioned above, there are six to seven rate hikes priced into the market right now with expectations that those hikes will push the economy into a recession and lead to easing (cutting rates) afterwards. The yield curve could be flattening for other reasons such as geopolitical tensions although I’m not sure how much that might be impacting the shape of yield curve right now.

Regardless, the key economic metrics we track have been slowing which when coupled with a flattening yield curve imply a more cautious growth outlook. Whether that leads to a recession or not remains to be seen. For now, investors are more cautious and have been getting more defensive.