For patient investors with time horizons of years and decades, the primary drivers of portfolio returns are not day-to-day market fluctuations but the business cycle and other longer-term trends. One reason that questions around inflation, the Fed, and geopolitics have resulted in market swings is that they shed light on where we might be in the cycle. Additionally, the business cycle impacts not only the broader stock market and interest rates, but individual sectors as well. What can long-term investors do to maintain perspective and stay on track to achieving their investment objectives?

Where are we now?

At the moment, there seems to be little agreement among investors and economists as to where we are in the business cycle, just as there is little agreement about whether there might be a recession in the near future. Are we experiencing late-cycle dynamics in which the economy overheats, policy rates are too restrictive, and growth begins to slow, signaling an impending recession? Or are there early-cycle dynamics in which inflation stabilizes, financial conditions improve, and demand accelerates, all of which set the stage for future growth?

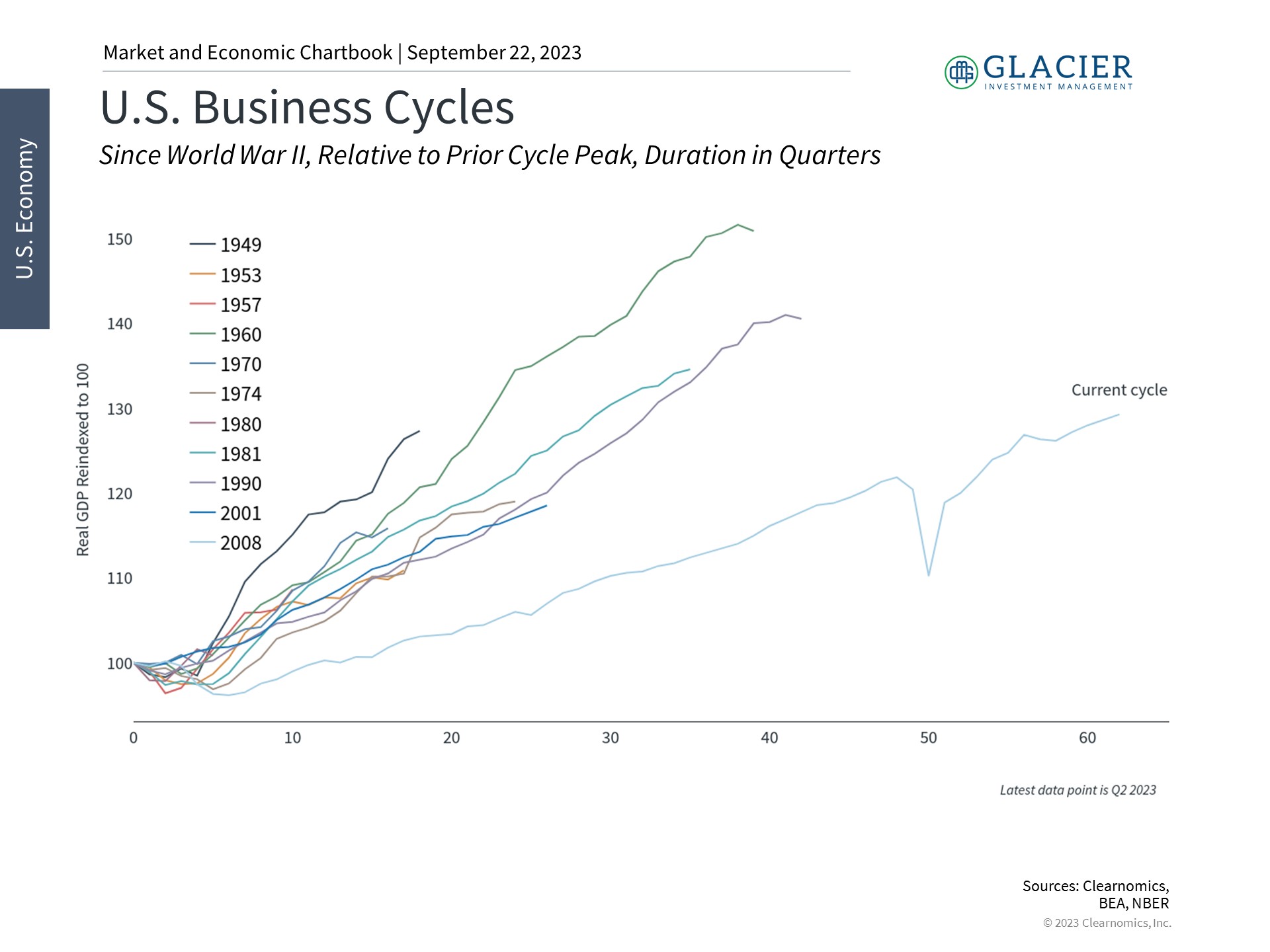

The business cycle is near its pre-pandemic trend

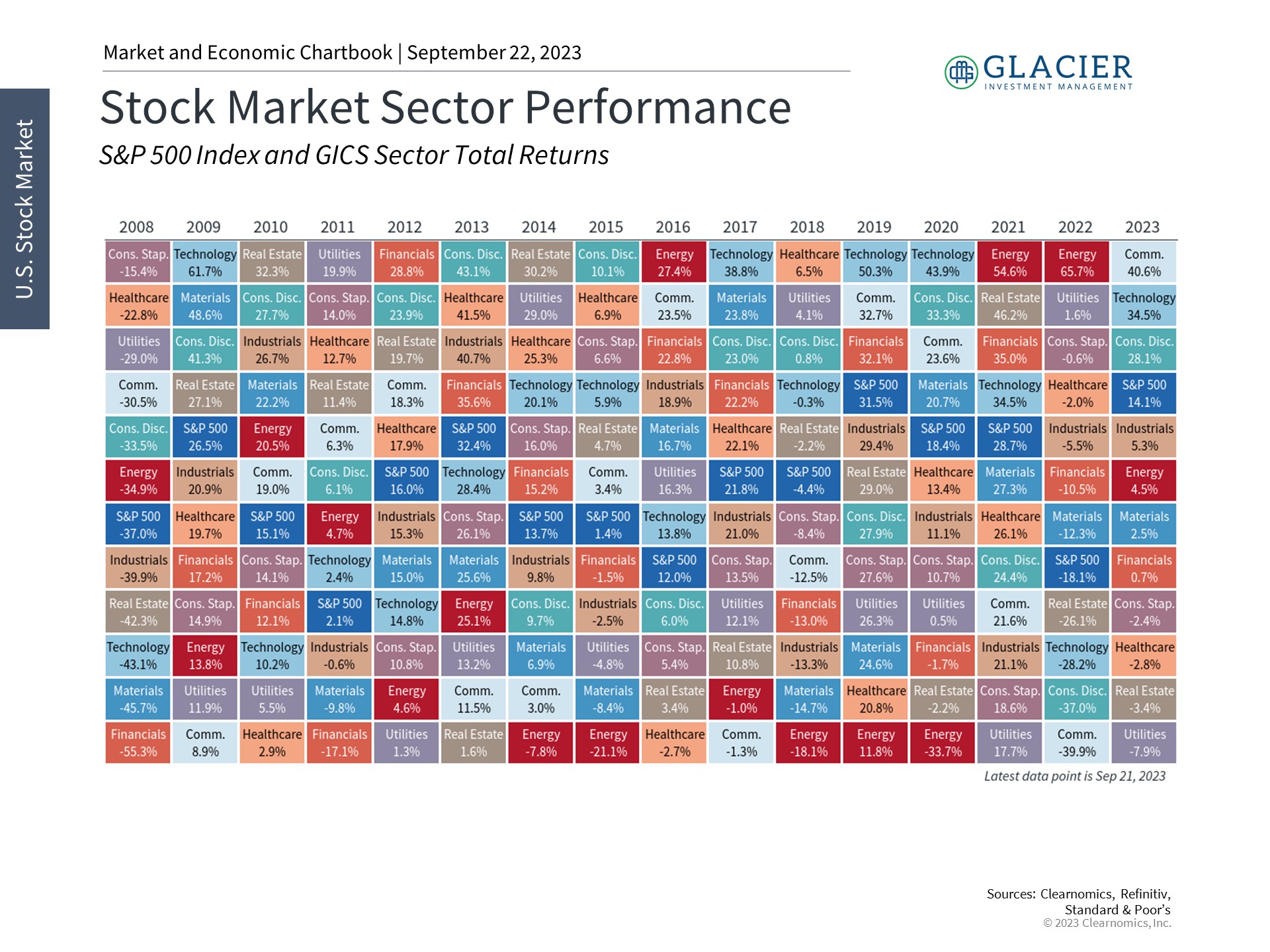

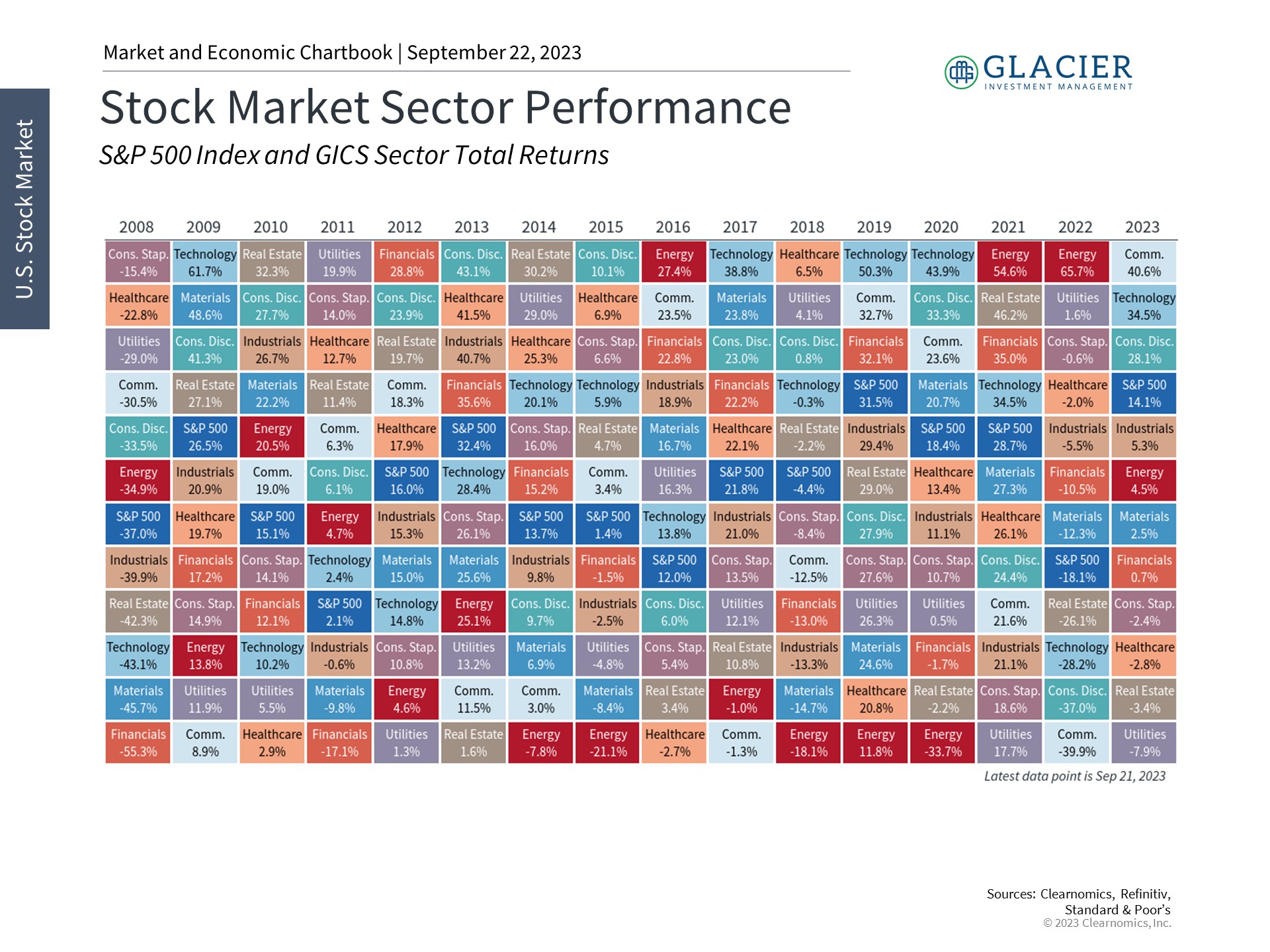

While it remains uncertain, recent economic data are consistent with an economy that is robust but slowing, alongside improving inflation. This matters not only for the broad market but for sectors as well. Sectors are defined by the types of activity that businesses perform. There are many classification systems including the North American Industry Classification System (NAICS) used by the federal government, but most investors tend to use the Global Industry Classification Standard (GICS) from Standard & Poor’s. This divides the S&P 500 (or any index) into 11 sectors ranging from Information Technology to Real Estate, which can then be broken down further into Industry Groups, Industries, Sub-Industries, and finally to individual stocks.

Sectors

Since it’s difficult to be knowledgeable about all sectors, what can long-term investors do to understand the most important trends? One way is to focus on cyclical versus defensive sectors. Cyclical sectors are ones that perform well in the recovery and expansion phases of a business cycle, sometimes referred to as being pro-cyclical. For example, Consumer Discretionary businesses benefit from growing consumer spending and confidence which, in turn, depends on the health of the economy. In contrast, defensive sectors are those that perform well relative to the broader index when the economy is slowing or contracting. Utilities stocks, for example, have relatively stable demand and tend to have higher yields, two attributes that make them attractive when the economy and market is uncertain.

Sectors can be cyclical or defensive relative to the business cycle

One of the key takeaways from any chart of sector performance is how difficult it is to predict how any group will do in any given year. In 2020 and 2021, Energy stocks outperformed by a wide margin after struggling almost every year since 2014. This year, technology-related sectors have outperformed due to trends such as the enthusiasm for artificial intelligence, but this is a sharp reversal of last year’s dynamic. Given this history, it makes sense for disciplined investors to stay diversified across sectors – possibly with the occasional portfolio tilt – in order to take advantage of trends across all areas. In other words, the principle of diversification is as true across sectors within a market as it is across broad asset classes.

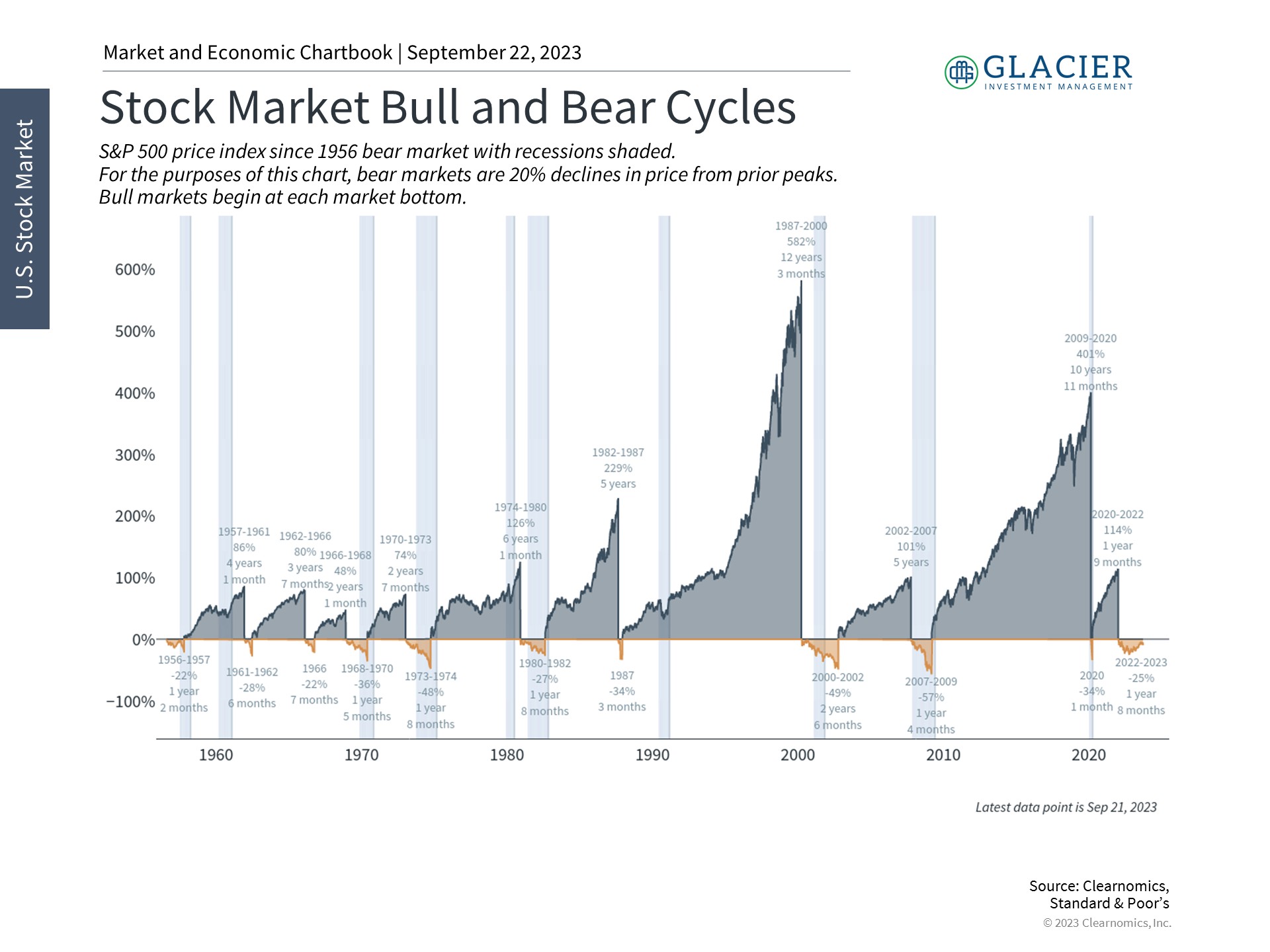

The Cyclicality of Things

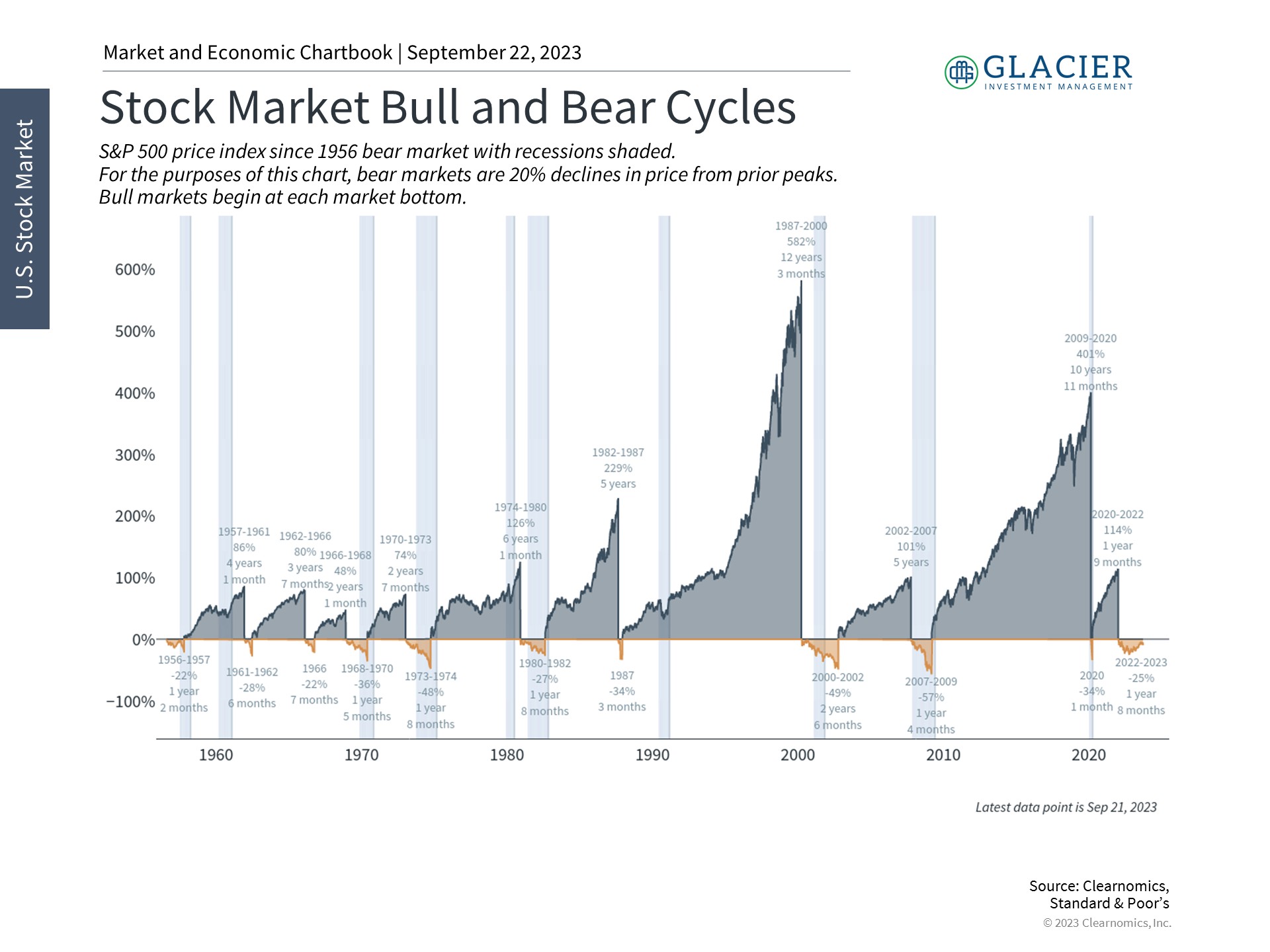

This is especially relevant today given the uncertainty around the business cycle. Many investors who came into 2023 certain that there would be a recession likely focused on the defensive areas of the market that did well last year, only to then have cyclicals outperform. From a longer run perspective, the pace of economic growth has slowed but is back to pre-pandemic trends. While the S&P 500 is still recovering from last year’s bear market, history shows that bull markets can happen swiftly, often when they are least expected. This was true in both 2009 and in mid-2020. In all cases, having an appropriate set of sector exposures across both cyclicals and defensives can help investors to stay balanced regardless of what may come next.

Market cycles have increased in length over time

The Bottom Line