A lot of ink has been spilt about inflation. Interest rate volatility has received considerably less attention. While rising inflation levels have certainly contributed to rising interest rates, they aren’t the only driver of the trend and may not be the primary one either.

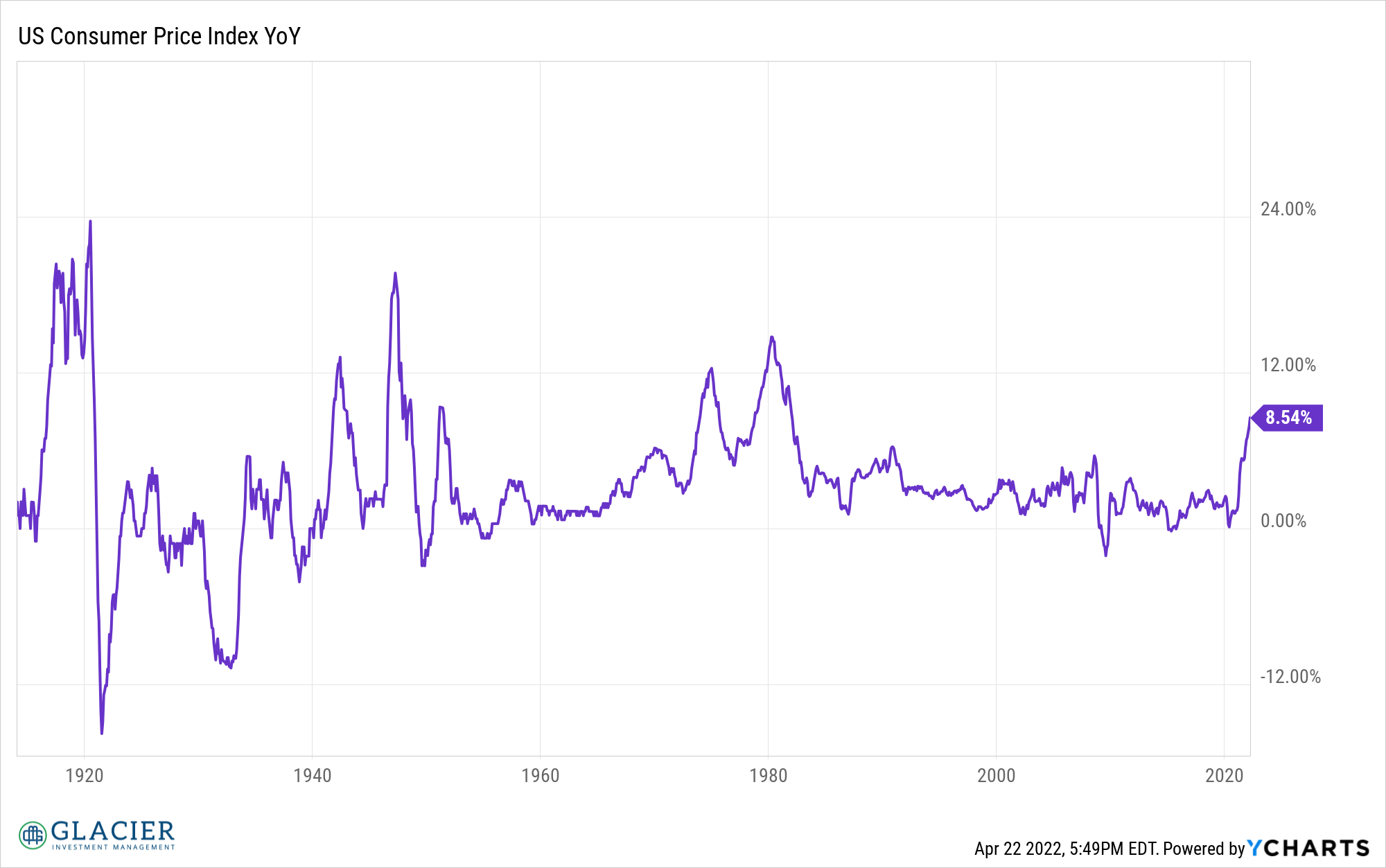

Elevated inflation is not a permanent condition. It never has been in the US. Yes, we have experienced bouts of high and uncomfortable inflation, but it has always settled down and stabilized at lower and more reasonable levels. While we may not return to a 2% run rate, a 3-4% run rate is considerably lower than the 8-9% prints we’ve observed lately.

Other contributors to this year’s rate volatility are the Fed’s explicit rate hike trajectory and its intention to stop buying assets and let maturing bonds roll off its balance sheet (i.e., not rollover the proceeds; shrink its balance sheet).

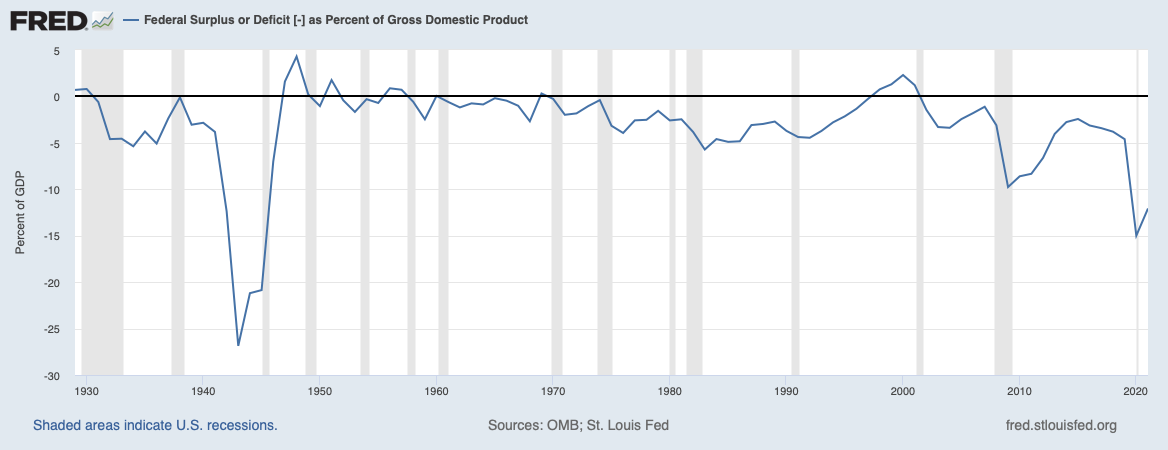

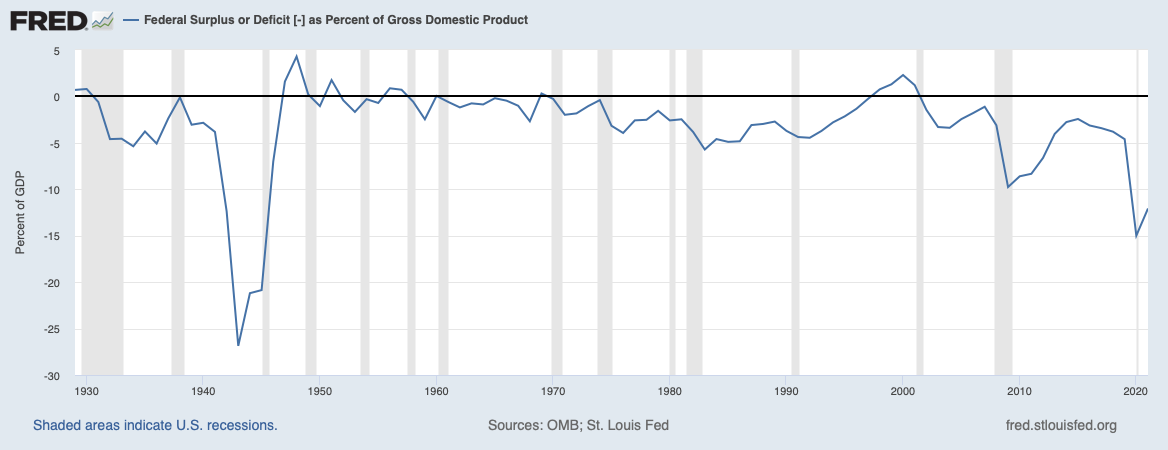

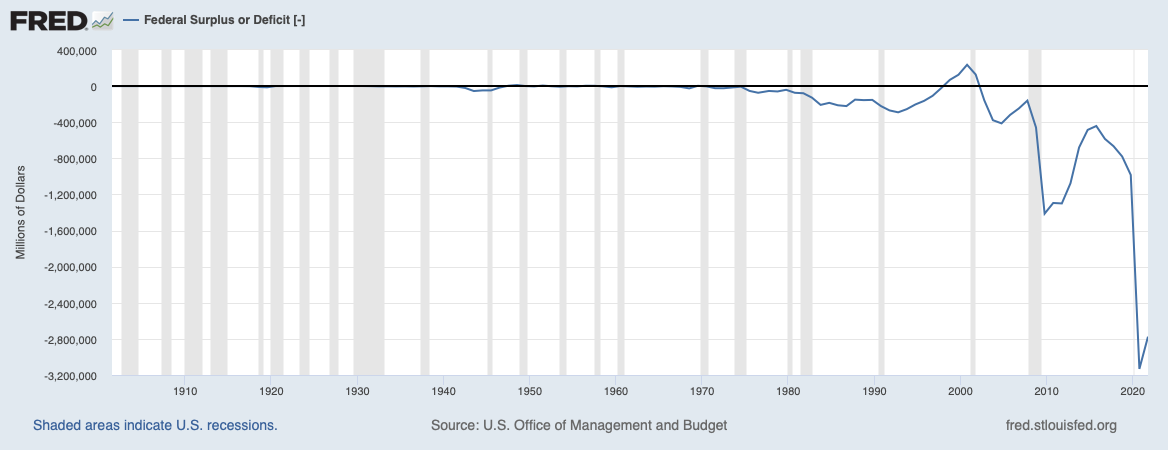

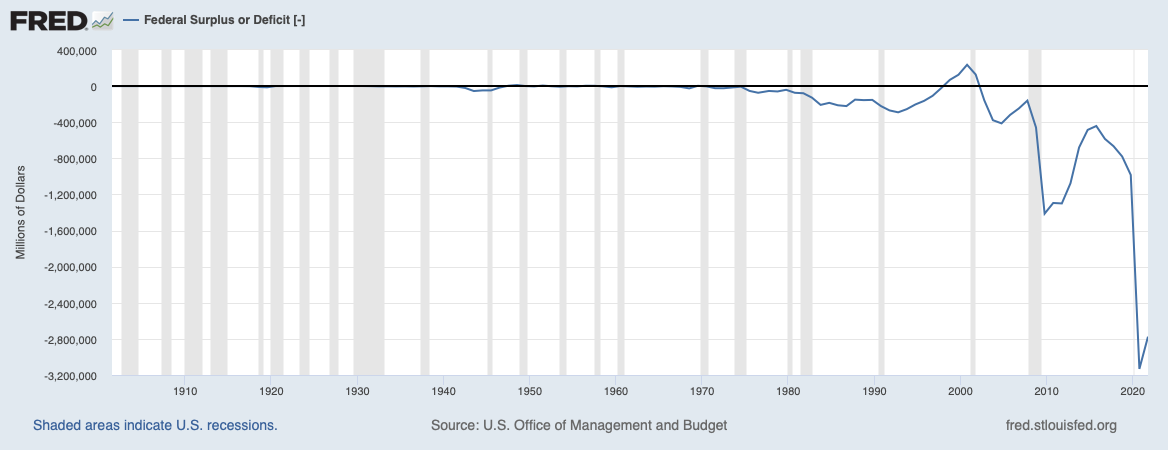

The Fed’s cessation of asset purchases has been an important driver of rate increases and volatility this year, in my opinion. The primary reason being that the Fed has been the marginal purchaser of government bonds as deficits have widened. If the Fed isn’t going to be filling the gap, who will be the marginal buyer?

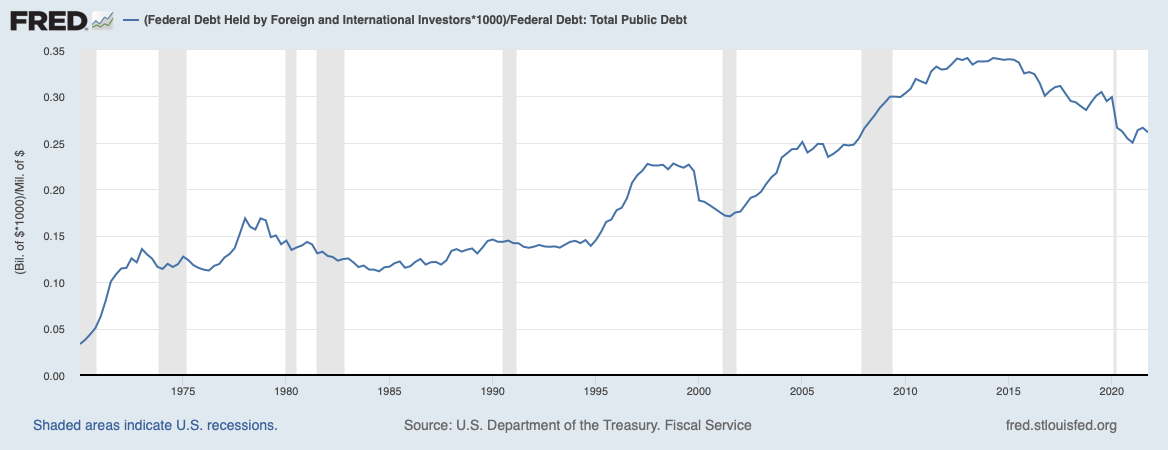

Foreign ownership of US government bonds has been in decline since 2013/2014 for various potential reasons that are outside the scope of this post. I have to wonder if the foreign ownership percentage will continue to decline from here with larger and larger deficits and a strong dollar making purchasing new Treasuries less appealing. Fewer buyers (less demand) in the face of the same or greater supply will lead to higher rates to attract incremental buyers. Nobody wants to be caught holding bonds if this scenario materializes.

Note: Since I penned this post, the most recent 20-year Treasury auction happened. The auction this week appears to have gone well so finding incremental buyers may not be the challenge I present above. If rates get high enough, there will be buyers. I wasn’t sure if current levels were high enough.

The ultimate endgame is uncertain. Whether the Fed is forced to step in and be the marginal buyer of Treasuries or it has to implement yield curve control as it did after World War II, effectively putting a cap on Treasury rates, or the necessary buyers surface, providing the opportunity for the US to work its way through this transition period, rate volatility is likely to remain elevated until we have more clarity on how deficits will be funded going forward. Inflation may continue to be elevated for the foreseeable future, but it will recede at some point.

Extraneous thought

It’s becoming clearer the US may not be able to project as much power globally as it once did. I have to wonder if this observation is contributing to rising rates and the accompanying volatility. If US power is diminishing, what does that mean for the US dollar? The answer to this question is also beyond the scope of this post. For now, USD has been noticeably strong, at least against the Euro and the Yen. Interestingly, USD is back to where it was versus RUB prior to the outbreak of war in Ukraine. Does a reserve currency other than USD mean structurally higher Treasury rates? I would think it does since inflation would likely be structurally higher in that scenario.

Parting shot

Interest Rate volatility is almost at pandemic levels, suggesting we’re in extreme territory now. We’re still only at half the level of the GFC. I’m not sure we will come close to the GFC rate volatility levels. Even if you’re base case is USD being dethroned as the global reserve currency, that’s not going to happen overnight. A recession and lower Inflation will likely occur before then. While I have no way of knowing where rates will end up, rate volatility will eventually settle down as rates stabilize, or even decline. As volatility declines, bonds will catch a bid at some point. They aren’t dead yet.