Few emotions are as strong and poignant as losing money. Daniel Kahneman and Amos Tversky scientifically demonstrated that humans are twice as concerned about losses than they are about achieving gains. While some of us recognize and accept this truth at face value, some of us don’t really understand until we experience meaningful losses.

When putting money at risk, a whole cadre of behavioral biases and inefficiencies come in to play such as selling winners too quickly and holding onto losers. For example, a stock goes up 20% and we feel really good about our gain and want to lock it in because we’re afraid of giving it back (i.e., losing money). So, we sell, lock in the 20% gain and give up future upside (absent reinvesting in the stock at a future date).

Alternatively, we purchase an investment and find ourselves sitting on a 20% loss. Many of us won’t sell it because realizing the loss is too painful. So, we sit on the investment hoping we recoup the loss because we can’t bear selling at a loss even though there may be better opportunities to invest elsewhere.

This is just one example of how our emotions can get the best of us when investing.

It’s Tricky

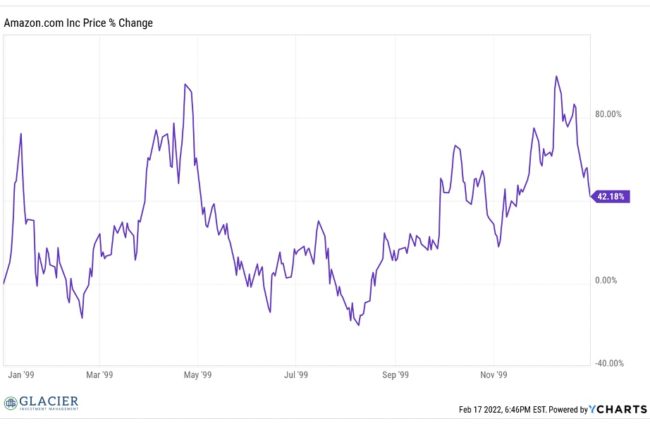

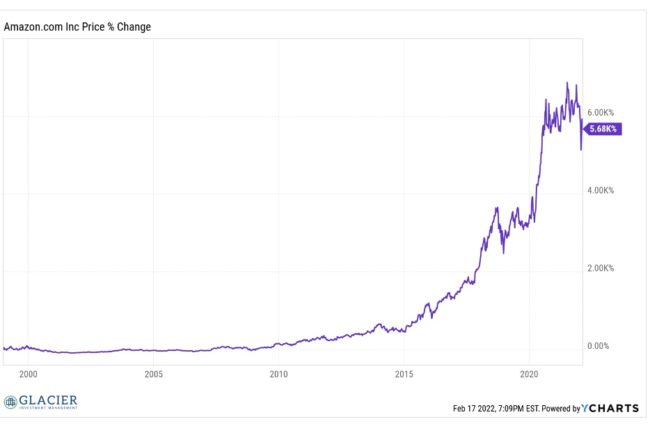

Let’s look at a real-world example. You could have bought Amazon for around $53 at the beginning of 1999 and sold it at the end of the year for a 42% gain. By all measures, a great return on investment.

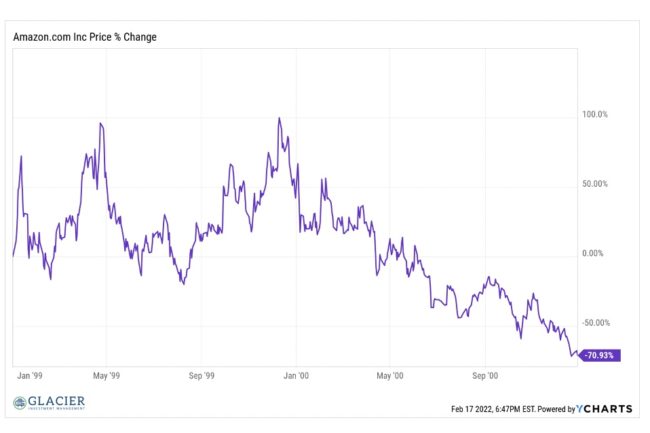

Or you could have held onto the stock for another year and experienced an 82% loss from the peak or a 71% loss on your original investment. A very painful experience to be sure.

Most of us would agree selling at the end of 1999 would have been a win while holding on through 2000 would have been a loss, a big loss for that matter. My guess is most of us that decided to hold on into 2000 would have likely sold because the pain was too great to bear. We do reach a point where we cry uncle and throw in the towel on losses. It’s usually at, or close to, the worst possible time to sell.

So, if we would have sold Amazon at a 70% loss in 2000, we would have saved ourselves more agony as the stock eventually experienced an 88% loss (in 2001) from the 1999 opening stock price. It wasn’t until 2007 that our investment would have gotten back into the black only to go back into the red in 2008. So, selling out at the 70% loss would have been painful but it would have saved us years of frustration.

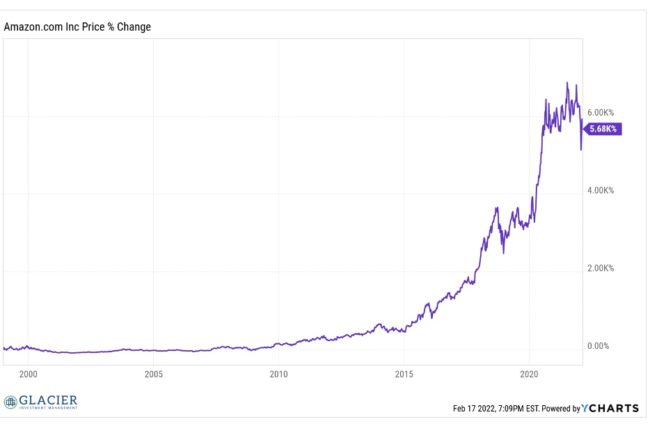

Fast forward to today, and if you would have been able to hold onto Amazon through an 88% drawdown and years of underperformance you would be sitting on a 5,680% gain. In hindsight, we would all agree the pain and suffering would have been worth it. However, very few of us, if any, would have been able to ride that turbulence and uncertainty out.

It’s impossible to avoid losses in investing without refraining from investing altogether. While it may seem counterintuitive, losses are a necessary part of making big, long-term gains. Keep this in mind as the stock market is bouncing all over the place. Don’t allow yourself to get shaken out at the worst possible time.