This post is an effort to solidify my understanding of what’s going on in the world right now by getting it down in writing. Much of the post is a series of observations and insights I have gleaned from reading and listening to different analysts including Luke Gromen, Louis Vincent Gave, Jeff Snider, and John Mauldin. I sprinkle some of my own insights into the post as well.

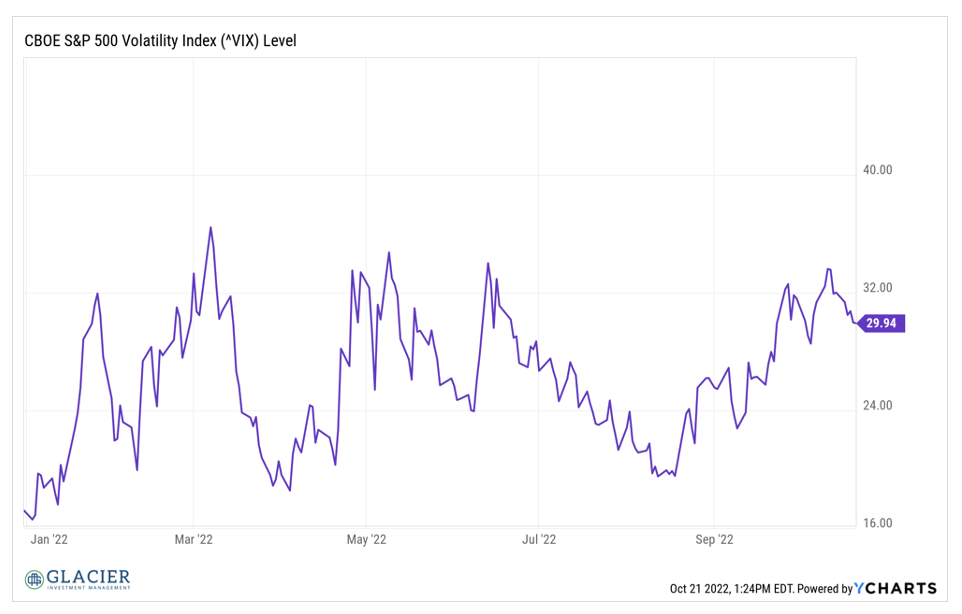

Volatile

After a brief reprieve over the summer, volatility picked up again in September and has continued in October as the market now believes the Fed is going to do what it says its going to do. While stock market volatility has been relatively tame, interest rate volatility has been insane. “Insane” is a strong term, but there’s no other way to describe what has been taking place in the rates market.

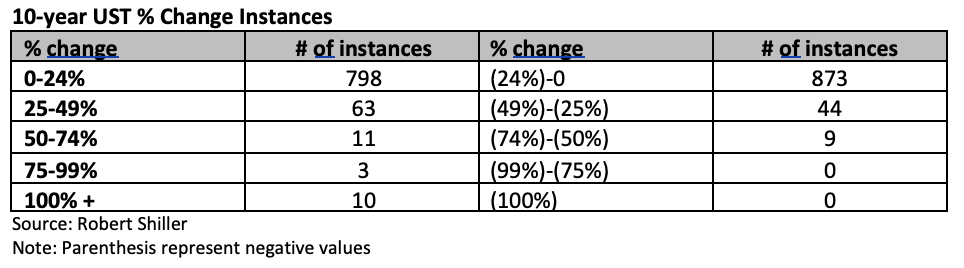

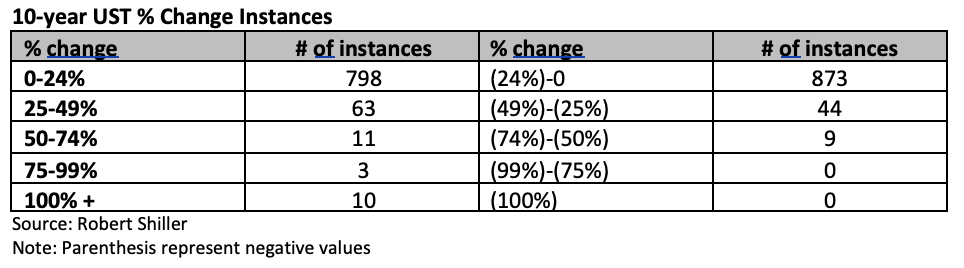

We often fixate on the level of interest rates without considering how rapidly rates have moved to get to that level. At the end of October 2021, the 10-year US Treasury (“10-year”) yield was 1.58%. As of the close on October 21, 2022, the 10 year was at 4.22%, a nearly 170% increase in about a year! That is one of the sharpest increases in the 10-year UST yield over a 12-month period ever going back to 1871. The 10-year has only increased by 100% or more over a 12-month period ten times since 1871. All ten of those instances have occurred since the beginning of 2021. The rates market is in an unprecedented era, at least in terms of percentage increase over a 12-month period. The table below shows the number of times the 10-year yield has changed per percentage change ranges. For example the UST yield has increased by 100% or more over a 12-month span 10 times since 1871 using month-end yields.

Inflation

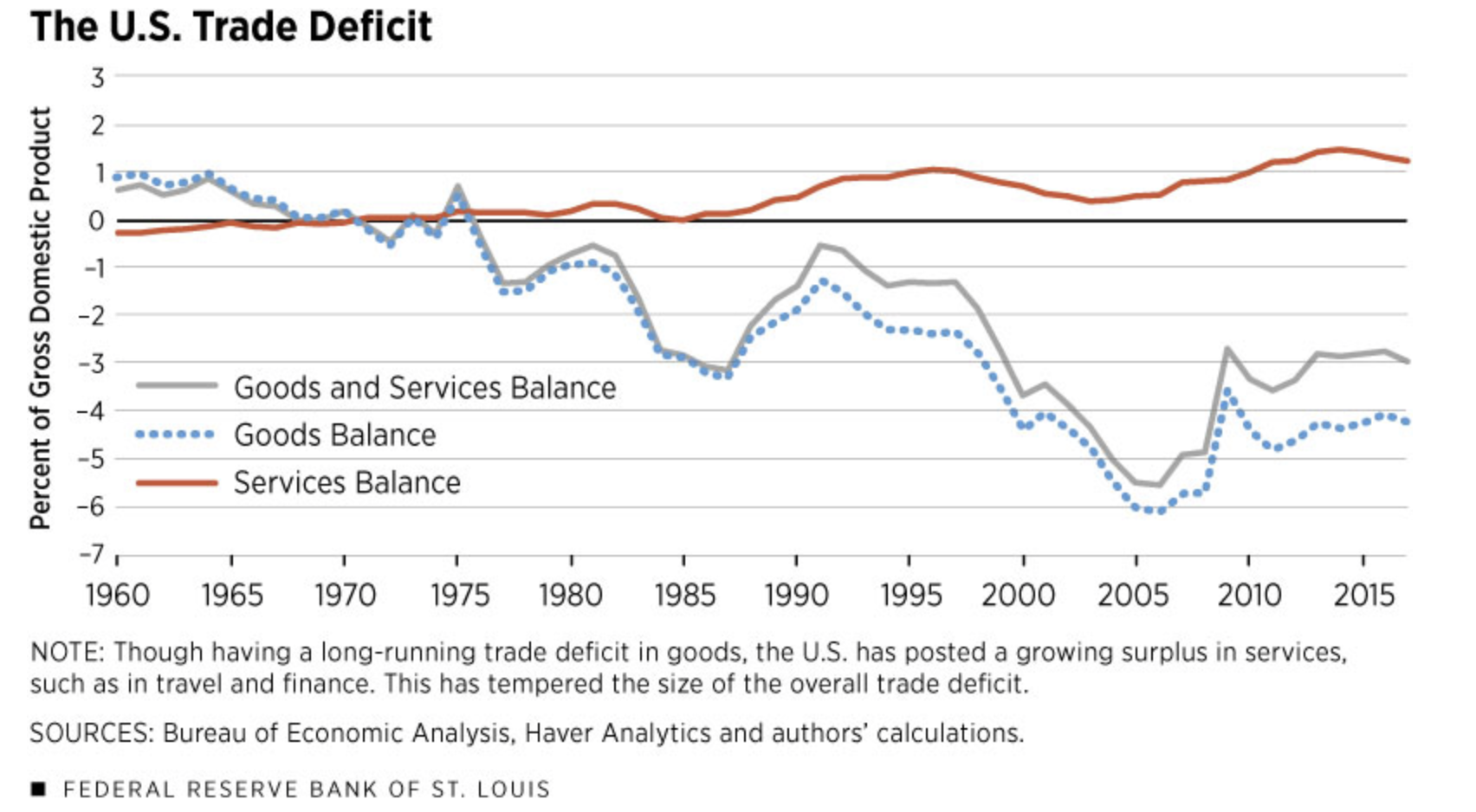

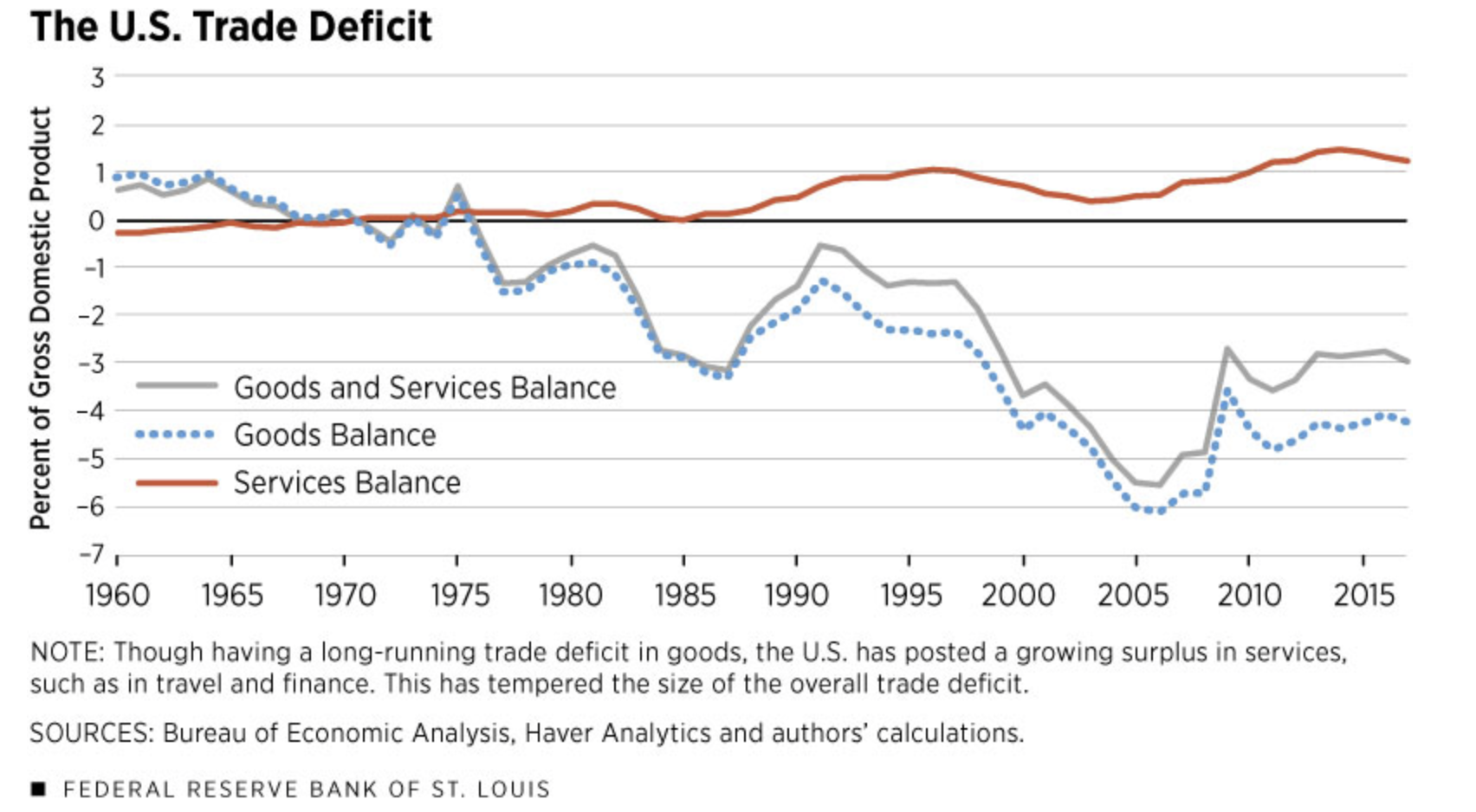

Inflation has been the bugaboo for interest rates this year, but other variables may be at play too. To elaborate, a quick history lesson is in order. At the end of World War II, the US Dollar (“USD”) became the global reserve currency, giving the US quite a lot of power and privilege. In the early 1970s, USD went off the gold standard. By the mid-1970s, one of the most, if not the most, important economic inputs (oil) began to be priced exclusively in USD. Within a few years of oil beginning to be priced in USD, the US began running trade deficits (buying more from global trade partners than selling to global trade partners). Note that trade balance data is somewhat spotty prior to 1992 so I’m relying on a 2018 paper by the Federal Reserve Bank of St. Louis (see chart below).

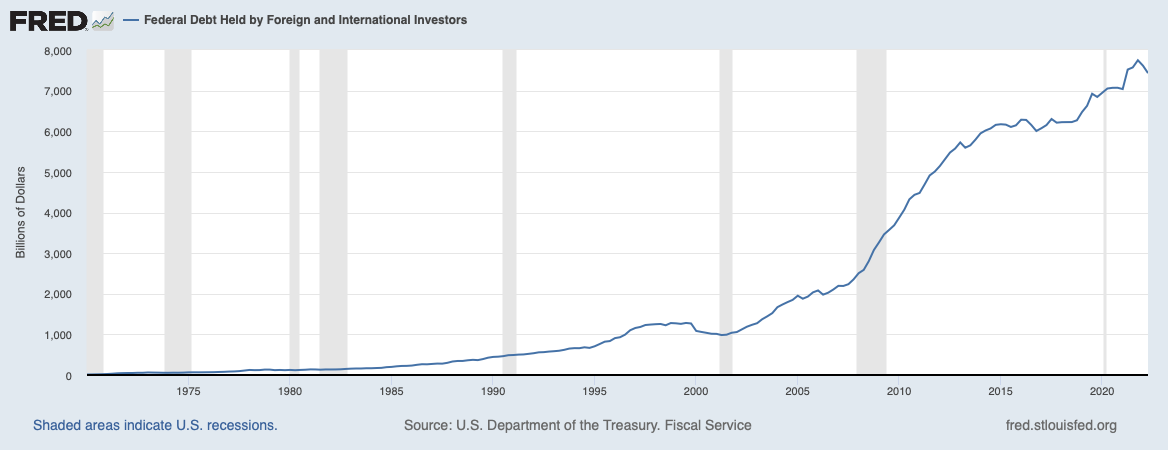

Once our international trading partners didn’t have anything to buy with their excess USD, they began purchasing our government debt, making US Treasuries the de facto global reserve asset.

With that brief historical recap, let’s fast forward to today. Russia and China have made no secret about their desire to dethrone USD as the global reserve currency and by extension US Treasuries as the global reserve asset. Their motives for wanting to do so make sense in the context of their own national interests and security. Whether we as Americans agree with their motives and actions is another story.

World War III

Wars are inflationary. The war on COVID has led to inflation. The war in Ukraine has contributed to the inflationary pressures released by the global COVID response. Some very smart and in the know people believe World War III has started, but it’s not taking place on a physical battlefield with tanks and guns. Rather, it’s an economic war being fought through policies, cyberspace, and other means. This type of war is inflationary as well.

Continued higher inflation will lead to higher and higher interest rates based on the Federal Reserve’s current policy approach. Higher interest rates will lead to lower asset prices, higher debt burdens and most likely a stronger USD (at least for a while). This is all a self-reenforcing cycle of events that will continue until something or someone breaks. A stronger USD is very problematic for the world that continues to purchase oil in USD. The higher USD goes, the more local currency units each country will have to expend to meet its USD and energy needs. The higher the demand for USD, the higher USD will go. Another vicious self-reenforcing cycle.

If a country is unable to obtain USD through trade or other means it has relied upon in the past, it may be forced to sell its US denominated assets (think US Treasuries) to obtain the USD it needs to meet its energy requirements. If an increasing number of holders are selling US Treasuries and demand is remaining fairly constant, it’s not unreasonable to assume supply

may overwhelm demand at some point leading to lower bond prices and higher interest rates. Another self-reenforcing cycle. This may already be happening.

USD can’t go up in perpetuity. It will create too many problems globally (see UK pension crisis from a few weeks ago). In the past, these periods of a strong USD have led to agreements or accords between the world’s central bankers in an effort to restore order to global currency and financial markets. I’m not sure how or when that will happen, but we can’t continue on the same path we’re currently on without inflicting substantial financial harm to the US and global financial systems.

Zero COVID

China has been locked down for nearly a year now because of its zero COVID policy. This has naturally led to reduced global demand, which has helped put a lid on commodity inflation for the time being. What this has also done is reduce the recycling of USD. China accounts for about half of the US trade deficit. Since China and its economy have been locked down for nearly a year, tens of billions of dollars that may have been used to purchase energy and other goods have either remained trapped in China (for lack of a better phrase to describe what’s occurring) or been put to use in other ways.

We touched on the impact of reduced access to USD globally. To restate, it likely pushes USD higher and leads to higher interest rates as an increasing number of foreign holders sell US Treasuries. The other interesting impact of China’s zero COVID policy is its impact on inflation. Inflation is a major concern right now. Imagine what will happen to inflation when China reopens its economy? Perhaps that’s why China remains locked down. According to Louis Vincent Gave of Gavekal Research, keeping inflation under control is priority number one for Chinese leaders.

The Path Forward

We all want to get past 2022. It has been a terrible year in financial markets and investment portfolios. At some point, we will start to see green shoots of stabilization. However, something has to change course for meaningful change to occur. Most everyone is waiting for the Federal Reserve to pivot. Is that the change that will bring about stabilization? Maybe. We probably won’t know until after the fact (in hindsight). For now, higher rates and restrictive monetary policy into 2023 seem to be in the cards. However, don’t make the mistake of extrapolating what’s happened in 2022 too far into the future because financial market trends have a penchant for reversing on a dime. I’ll plan on discussing the disinflation/deflation thesis next week.