On August 1, Fitch, a credit ratings agency, downgraded the U.S. debt from AAA (the highest rating) to AA+. Fitch had warned of a possible downgrade during the debt ceiling crisis earlier this year and has sounded alarms since 2011 when a similar crisis occurred. While it seems that few investors, economists, and business leaders view the downgrade itself as meaningful, especially because AA+ still represents an extremely low default risk, that does not mean it has not impacted financial markets. After all, investors have benefited from markets mostly moving upward this year, leaving some investors unprepared for even small stock market swings. What drove the downgrade of the U.S. debt and how can long-term investors maintain a balanced perspective?

The national debt has grown dramatically over the past twenty years

What, Me Worry?

With investing, as in life, it’s important to know not just what to worry about, but when to do so. The national debt is rightfully a source of investor worry but this has been the case for decades. As citizens and taxpayers, there are important ways to voice and act on these concerns. As investors, however, focusing too much on these issues, especially at the wrong times, can lead to poor financial and investment decisions in the worst case, and unnecessary anxiety in the best case. Understanding how these issues impact a properly constructed portfolio that meets the needs of a long-term financial plan is what’s most important.

Unfortunately, there are few examples of the federal government not just running a balanced budget, but operating at a surplus. This last occurred during the dot-com boom under the Clinton administration and, before that, in the early 1970s under President Nixon.

Fitch’s downgrade reflects the fiscal and political climate with which investors are already familiar. While their decision was based on the familiar factors of worsening government revenues, Fed tightening, and the possibility of a recession, it was largely driven by the “repeated debt-limit political standoffs and last-minute resolutions” in Washington. This is important because it draws a distinction between the ability to pay the country’s debts versus the willingness to do so. Most investors would likely agree that national politics has only grown more divisive over the past two decades. It has only been two months since the last debt ceiling standoff was resolved and the agreement only kicked the can down the road to January 2025.

The U.S. now has ratings of AAA from Moody’s, AA+ from Standard & Poor’s, and AA+ from Fitch. Only nine countries, plus the European Union, maintain the top ratings across the three major credit ratings agencies, including Germany, Switzerland, Australia, and Singapore.

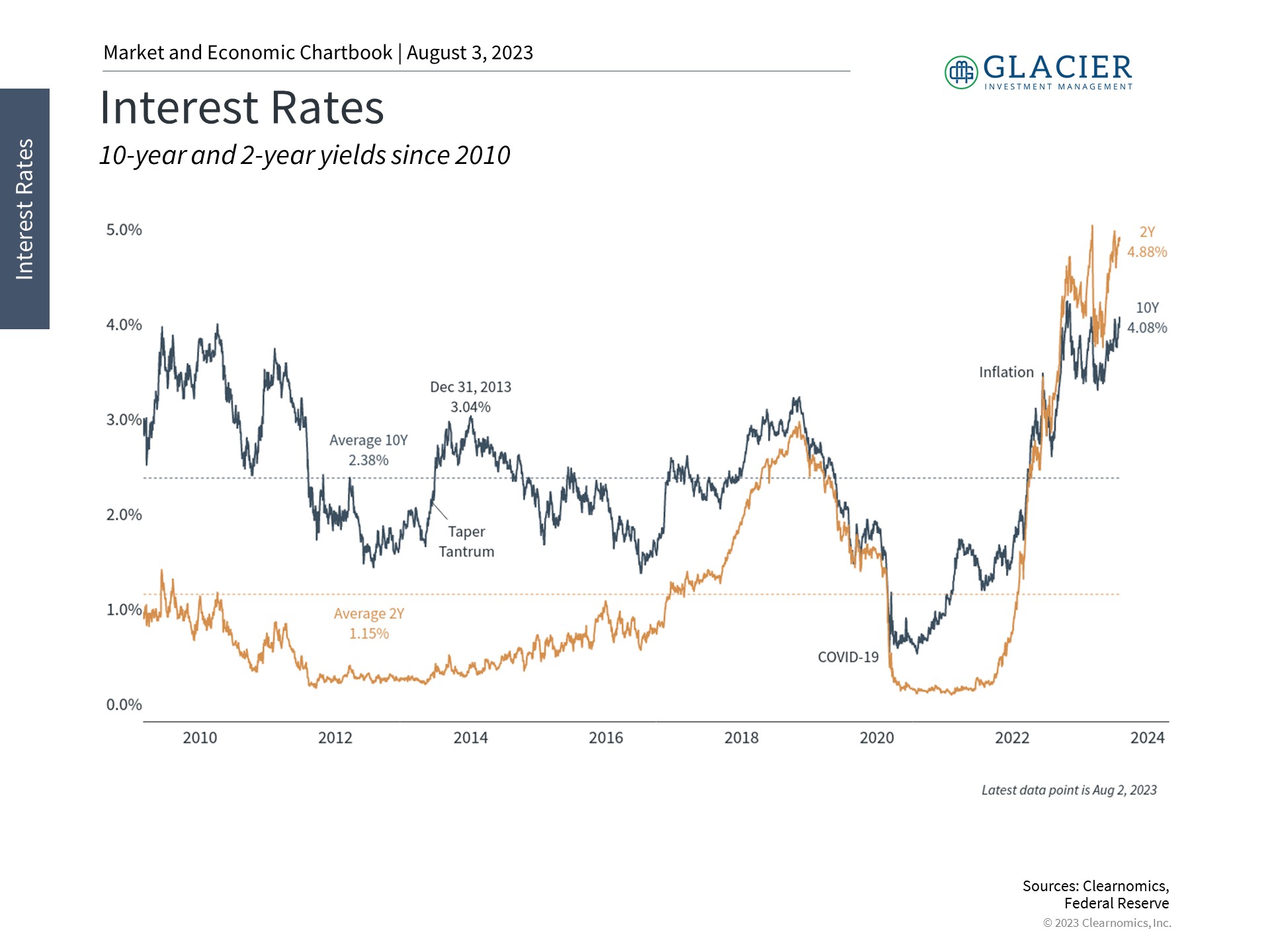

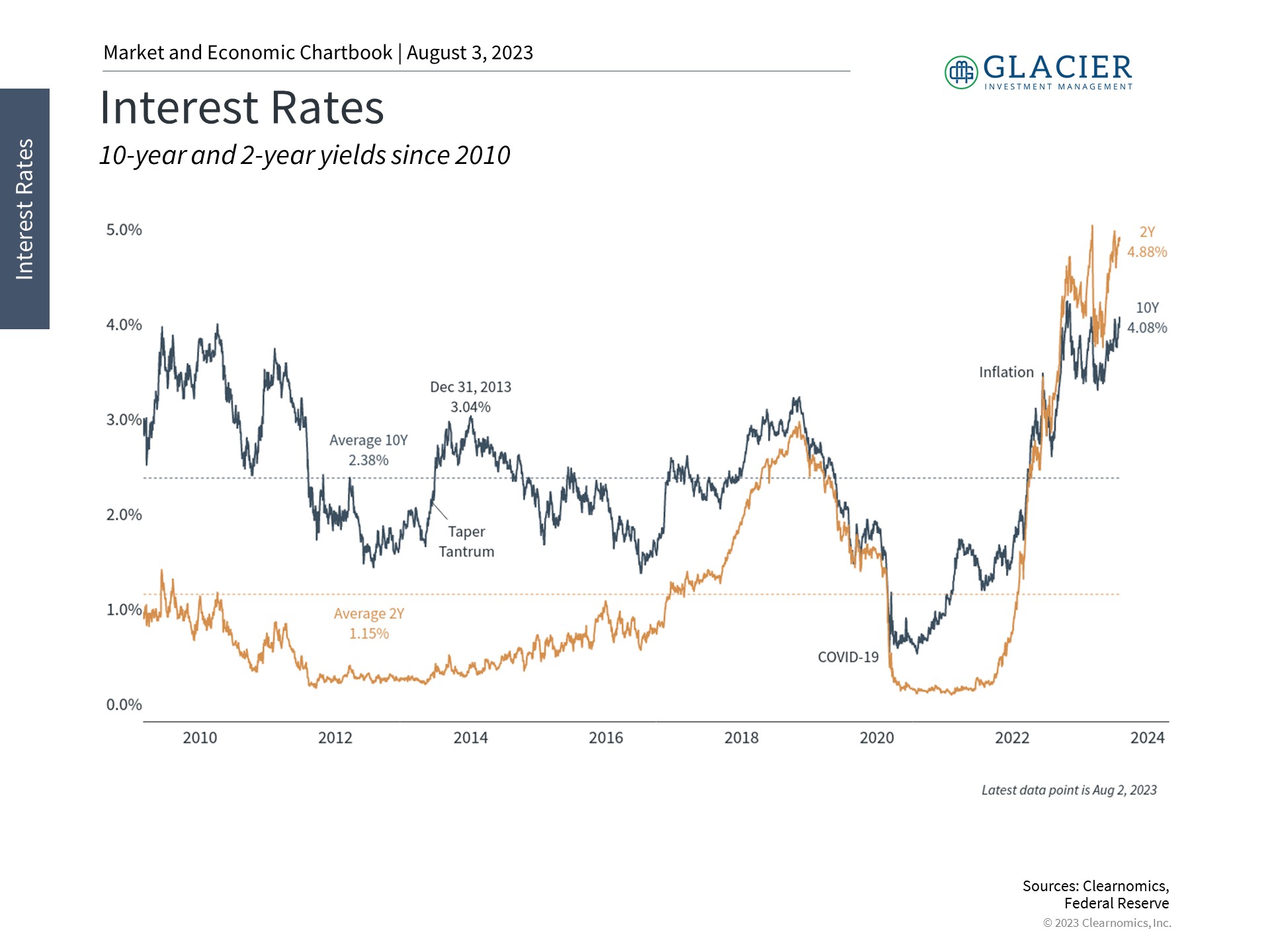

Interest rates have jumped following the downgrade

Why does this matter? Despite periods of brinkmanship, the U.S. has never defaulted on its debt. The creditworthiness of U.S. Treasuries is critically important not only to everyone that holds these securities – from the largest pension funds to everyday households – but the global financial system is built on the premise that Treasuries are unquestionably risk-free. While the situation is still evolving, the immediate impact of the downgrade has been higher interest rates.

2011?

There are some parallels to the summer of 2011, almost exactly 12 years ago to the day, when Standard & Poor’s was the first credit ratings agency to downgrade the U.S. debt. At that time, only a couple of years after the 2008 financial crisis, the global economy was facing many challenges including the debt crisis in Europe that led to the Grexit situation. This was a drag on markets even before the U.S. debt downgrade.

During that period, the stock market fell into correction territory with the S&P 500 declining 19%. Ironically, the prices on Treasury securities increased during the 2011 debt ceiling crisis because, even though these were the exact securities being downgraded, investors still believed they were the safest in the world at a time of heightened uncertainty. The debt ceiling was eventually raised and a new budget was approved, allowing markets to bounce back and reach new all-time highs only six months later. At the time, the market reaction was not only difficult to predict, but was unintuitive to many. For most investors, focusing on the long run while holding an appropriate portfolio, ideally with the guidance of a trusted advisor, was the best way to navigate that year.

Markets have been calm this year amid the strong rally

Investor Impact

So, what does the latest U.S. debt downgrade mean for investors? In truth, nothing has changed in recent weeks regarding the health of the economy or the long-term fiscal situation for the country. Given how heated the topic of federal spending can be, it’s important for investors to distinguish between their political feelings and how they manage their portfolios. Investors should always be prepared for periods of market uncertainty, especially given the low level of volatility this year. The accompanying chart shows that there has only been one pullback of 5% or worse this year which occurred in March during the banking crisis, compared to the average year which experiences several.

Two long-term debt concerns that some investors often have are the growing interest payments on the national debt and the reliance on foreign borrowing. Neither has a simple solution. The fact that interest rates have been and remain relatively low compared to history has helped to keep these payments manageable. Deficit levels, and the growth of the national debt, will also naturally improve as the economy recovers. When it comes to our foreign dependency, over 75% of the U.S. debt is still held by American households and institutions, compared to foreign holdings of 3.5% by Japan, 2.7% by China, 2.1% by the U.K., and so on. While this is an issue that matters from the perspective of fiscal responsibility, it is unlikely to be something that should drive portfolio decisions.

The national debt and the fiscal standing of the U.S. matter for many reasons. But from an investment perspective, the irony is that the best times to invest have been when the deficit has been the worst. This is because government spending increases – both in absolute terms and relative to GDP – during recessions and crises. In hindsight, these periods coincide with the most attractive prices and valuations. Ultimately, history shows that investors are rewarded for investing when others are fearful.

The Bottom Line