Inflation has been the center of attention in 2022. I wonder when that will change. I imagine a lower print on the CPI this Wednesday would shift the focus off of higher inflation and maybe more toward recession. Regardless, increasing recession concerns are likely to steal some of the limelight.

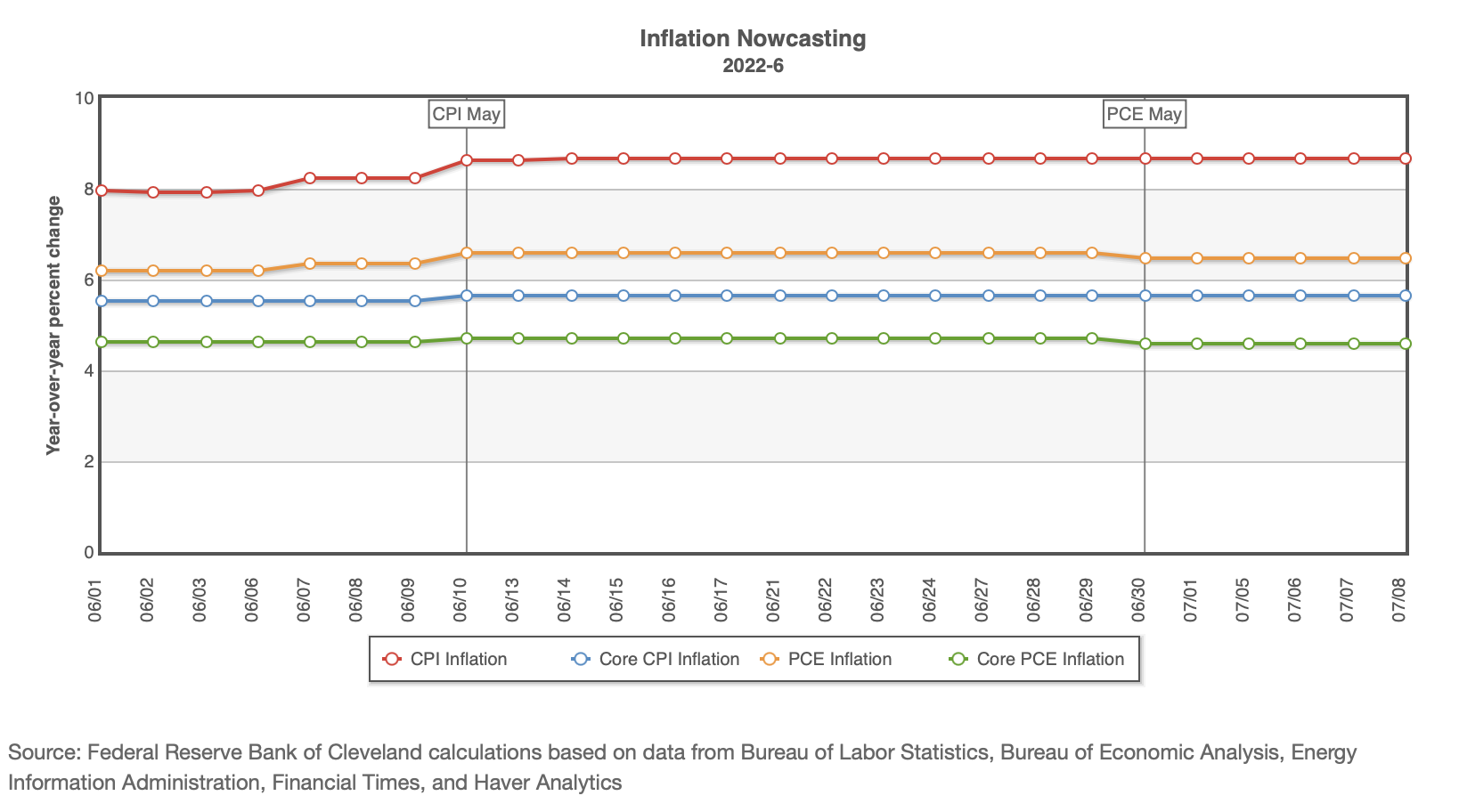

There’s been some talk about peak inflation for this cycle with the May CPI print of 8.58%. Consensus expectations for June are at 8.8%, according to Trading Economics while the Cleveland Fed’s Inflation Nowcasting forecast is calling for a month-to-month change in CPI of 0.97% with the year-over-year change of 8.66%.

Interestingly, and on a side note, the Cleveland Fed’s monthly Inflation Nowcasting forecasts have been lower than the actual monthly CPI prints all year, which probably explains, at least in part, the higher consensus expectations for June. I wonder if the mirror opposite trend (Nowcasting forecasts > actual results) will emerge when inflation begins to decelerate in the future.

Flow Through

An important point to consider is how much of an impact the Fed’s tightening-to-date has had and is having on price increases and when that impact will be manifested in reported inflation figures. We’ve certainly observed declines in certain raw material and energy prices, but I’m not sure those prices have fallen enough to have a meaningful impact yet. It doesn’t appear we will see any reprieve in June. Maybe the flow through impact of the Fed’s tightening will begin to manifest in July’s number.

Higher Inflation

I’ve gained a few important insights over the past few weeks that I’m still processing but that I think are highly relevant right now.

First, as we’ve come to realize this year if there’s inflation bonds don’t have to rally even if there is a sharp drop in stocks (See the 1960s).

Second, once CPI breaks out above 6% it can move considerably higher before reverting lower. Julian Brigden of MI2 Partners on a Macrovoices podcast two weeks ago showed this in his slide deck. It’s a worth a look.

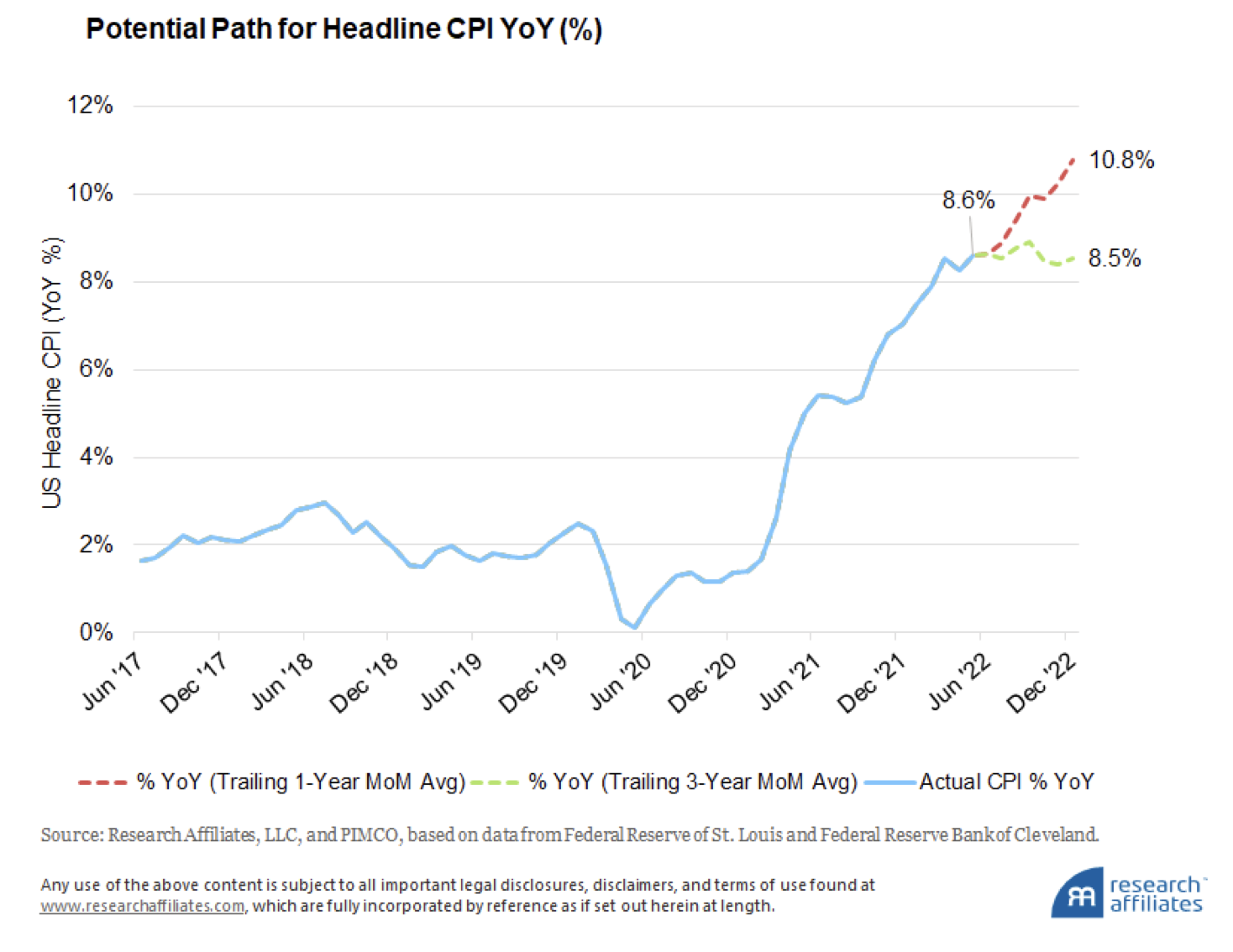

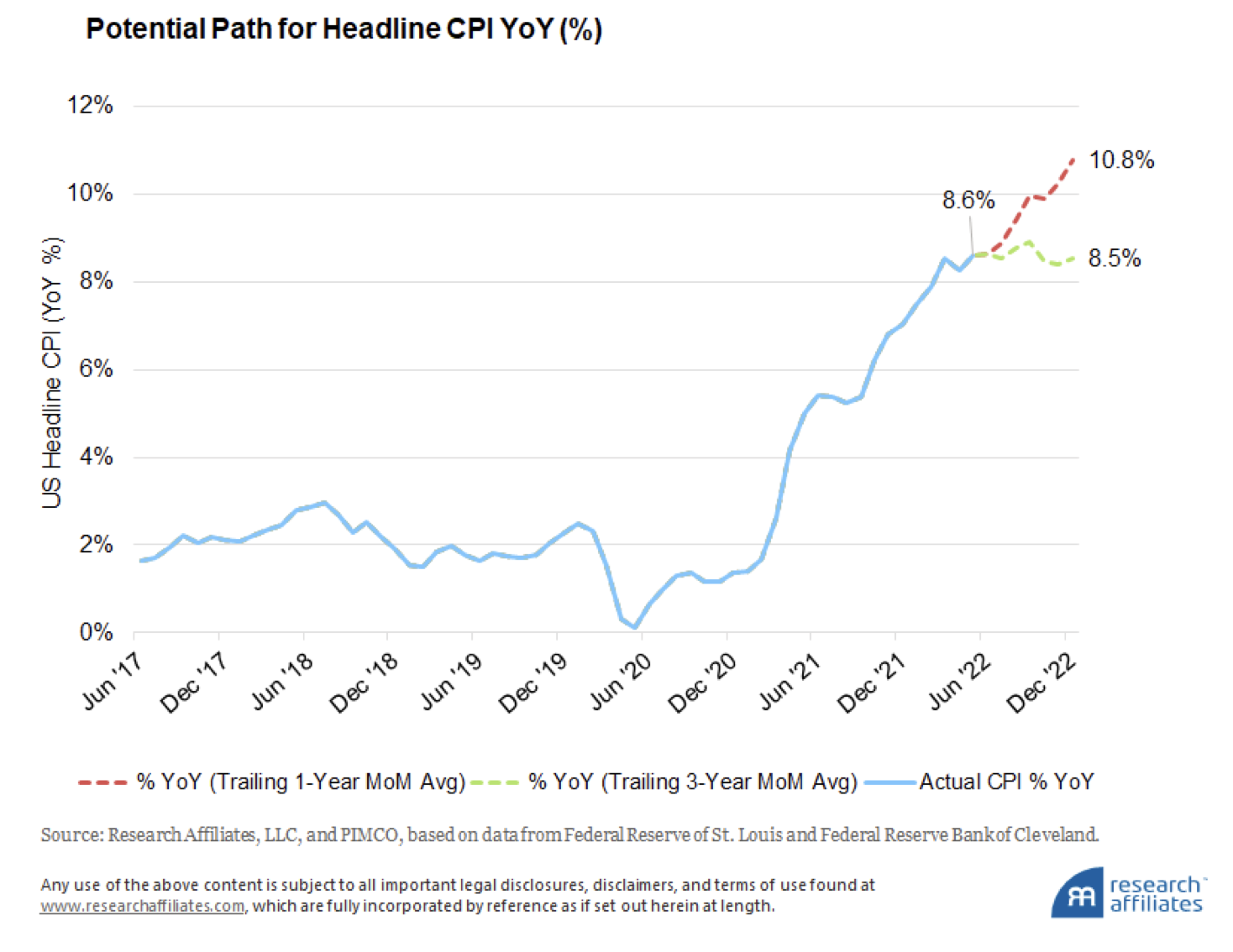

Finally, I’ve come across two forecasts (here and here) of peak inflation that are above May’s level and aren’t expected to be hit until year end. I think a lot of us that haven’t lived through a period of high inflation don’t know what to expect going forward. The easy expectation is to assume inflation will come down quickly to levels we’re accustomed to experiencing. Kind of like a familiarity bias. It’s hard for us to imagine inflation moving higher from recent peaks and remaining higher for a longer period. Of course, recency bias may be playing a part in the referenced forecasts.

It’s pretty safe to say long-term future inflation will be lower than where we are now. However, the path and length of time to get there is uncertain and may be uncomfortable. The arguments for higher inflation from here in the short-term (through year-end) are compelling, especially since some components of the CPI lag the real economy (e.g., housing inflation as measured by OER). The important question to consider is if/how the market’s expectations will change if higher inflation prints in the coming months actually materialize. With a recession (and deflation…at least short-term) appearing to be priced in, I think higher inflation prints may come as a surprise to some.