For many households, college decisions are a cause for celebration. However, college also represents one of the largest expenses and sources of financial stress in our lives, on par with retirement or buying a home. These feelings are only worsened by the current market environment as investors adjust to high interest rates and a less certain path of Fed rate cuts, more stubborn inflation, and stock market volatility. Naturally, these financial concerns can raise questions around college planning and decisions. What long-term perspectives should investors and their families consider as they make these important financial and life decisions?

Education Inflation

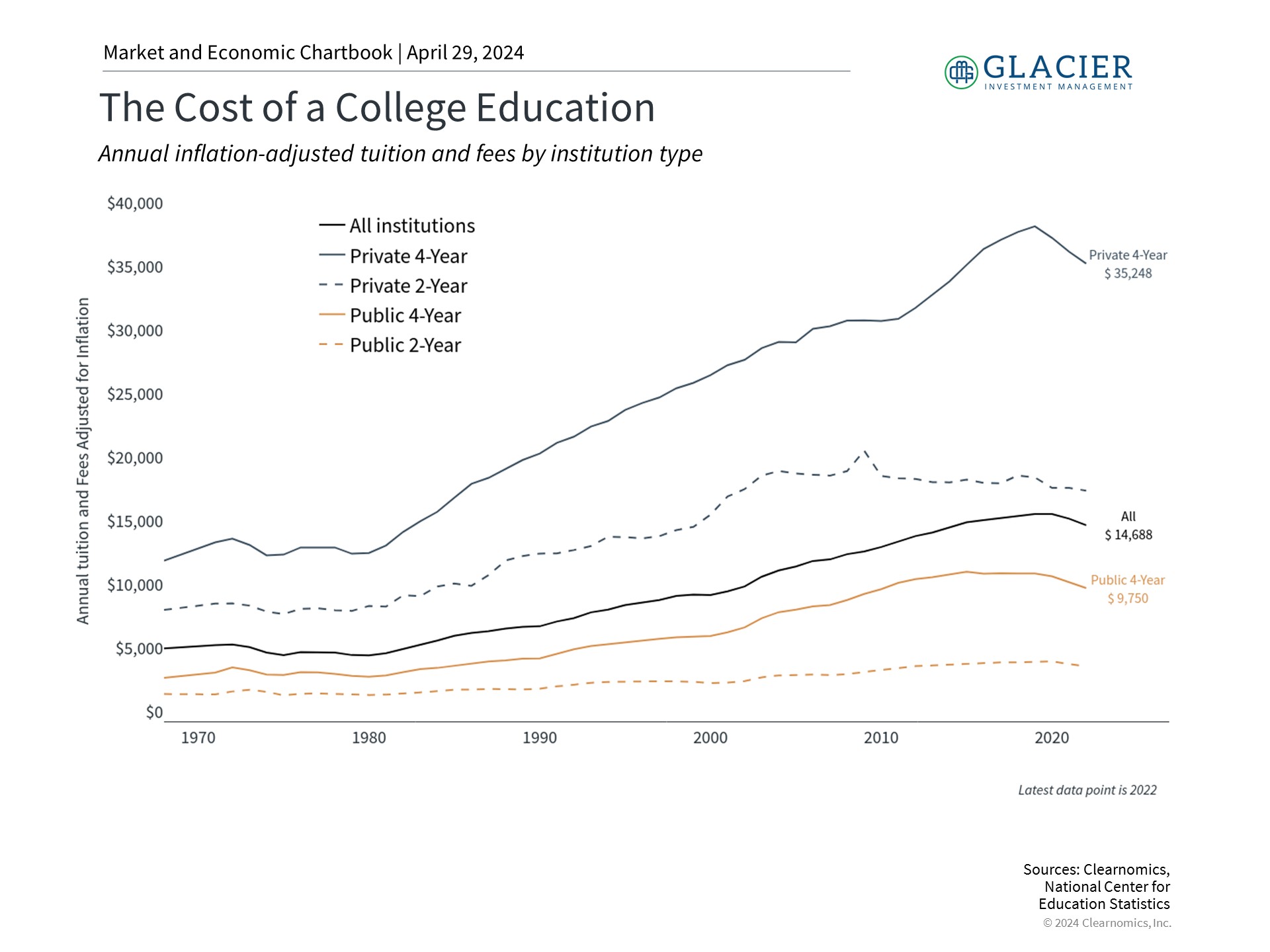

It’s well known that the cost of college has risen far faster than inflation over the past 40 years. The chart below shows the average level of tuition and fees after adjusting for inflation – i.e., increases shown on the chart are above and beyond inflation – according to the National Center for Education Statistics. For example, the average cost of tuition and fees alone for the 2022-2023 school year was $35,248 for private four-year institutions and $9,750 for public universities.

College costs have outpaced inflation

Tuition figures can vary greatly depending on the institution. Students and their families can also expect other expenses beyond tuition and fees such as the cost of room and board which average over $13,000 a year. At the most expensive colleges, the total cost of attendance can be around $85,000 per year for a total four-year cost of $340,000 or more. The cost of two-year colleges has not risen as much but has still outpaced inflation. These ever-rising costs are one reason many have grown disenchanted with higher education.

The Payoff

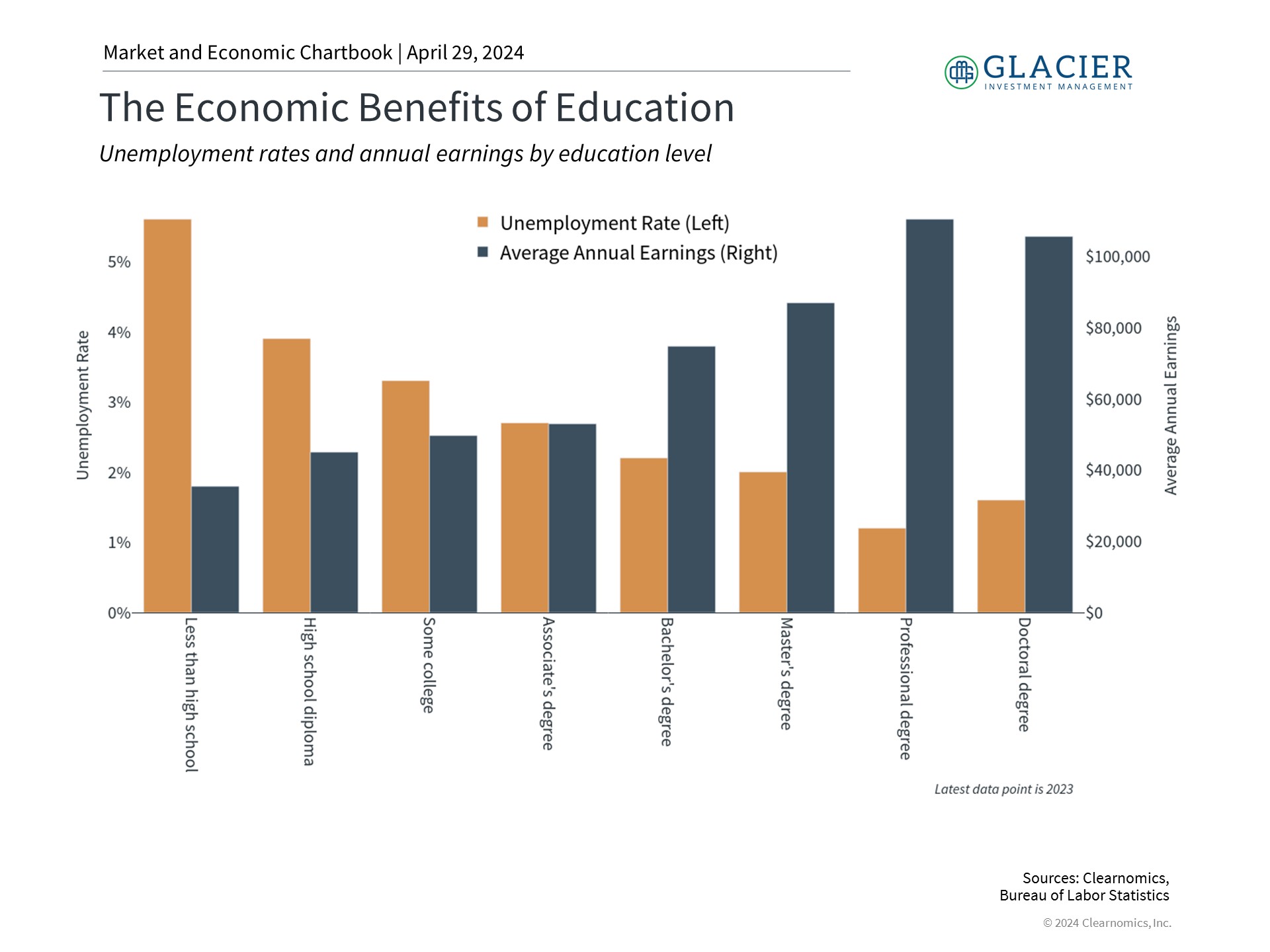

Despite rising costs, there is clear evidence that, on average, college graduates earn more and are more likely to be employed than those with lower levels of education. The chart below shows that, according to the Bureau of Labor Statistics, the unemployment rate for those with a college degree was just 2.2% in 2023 compared with 3.9% for those with a high school diploma alone. The median annual earnings of college graduates was $74,650, significantly higher than the $44,950 median for those with a high school diploma alone.

Higher education is still valuable

This pattern continues for increasing levels of education including master’s, professional, and doctoral degrees. These figures are the primary reason college is still seen by many as the best path to financial success. Of course, these statistics only show overall trends and do not consider individual circumstances, including opportunity costs and the choice of college major.

For example, economic theory would suggest that current low unemployment rates and wage gains may make the opportunity cost of spending four years in college less attractive when compared to gaining work experience, on-the-job training, two-year colleges or trade schools. This calculus is reversed during economic downturns when the opportunity costs are lower, thus driving up the application and attendance rates of college and professional degree programs such as business school, medical school and law school.

Another long-term concern among investors and economists is the aggregate level of student loan debt across the country, which now exceeds $1.6 trillion according to the NY Fed’s Consumer Credit Panel. This has become a hot button issue across the country and in Washington. The White House, for instance, has announced a new plan to forgive student loan debt for 30 million Americans, with $146 billion in debt relief approved through executive actions so far. Given the size and scope of this challenge, the topic of higher education and student loans will likely continue to be a divisive political issue.

Major Matters

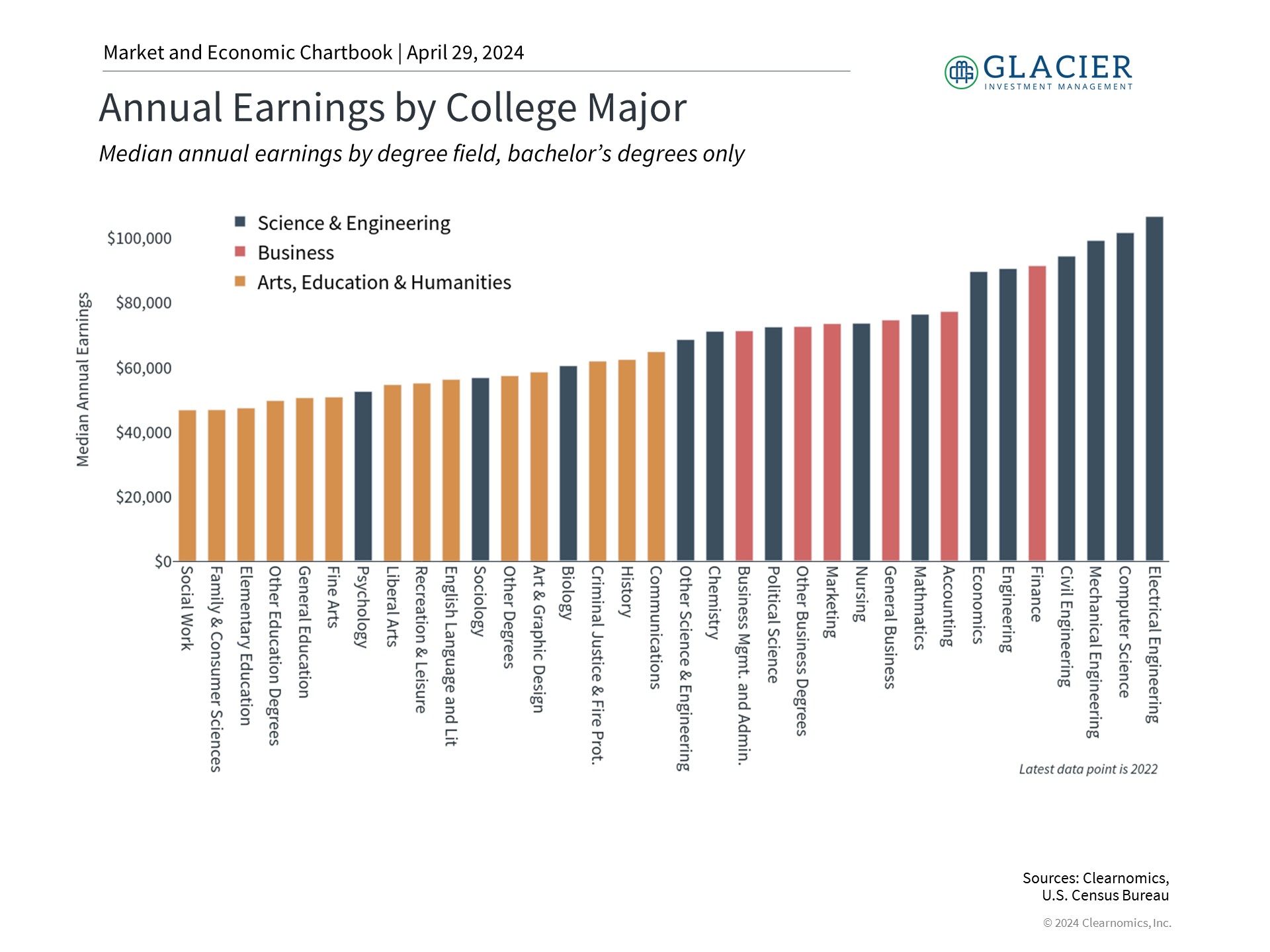

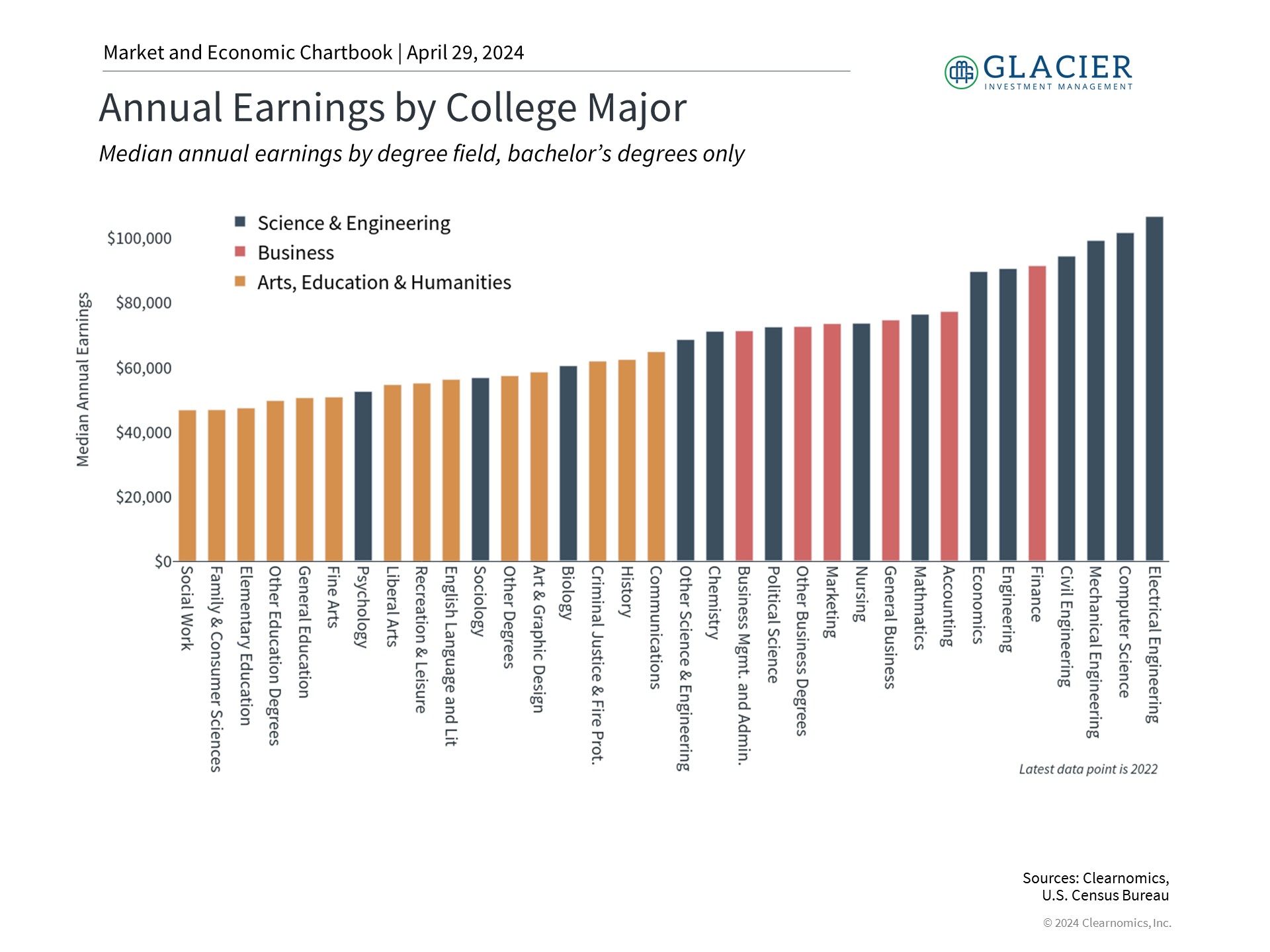

When it comes to student loans and individuals, the ability to repay these debts varies greatly by college major. The chart below shows the average level of earnings for those with a bachelor’s degree only. It may come as no surprise that science, engineering and business degrees have generally resulted in the highest annual earnings, compared to degrees in arts, education and humanities fields. These figures are averages across all professionals, not just new graduates, and thus capture the long run earnings potential of each major.

Earnings vary greatly by college major

For example, the median salary for a graduate who studied social work is under $50,000 while the average graduate who studied electrical engineering makes over $100,000. Thus, college major and post-graduate employment opportunities are important to consider when deciding whether to borrow money for college. Choosing to pursue a field of study that has high earnings potential across one’s career can help to mitigate the burden of financing a degree with student loan debt.

That said, financial considerations are important, but they are not the only factor when considering higher education. Pursuing one’s interests and achieving personal fulfillment are arguably just as important, even if they are harder to measure and quantify.

The Bottom Line

While the cost of college has risen dramatically in recent decades, there are still many financial benefits to higher education. Whether to attend college, what type of program, and which major are all personal considerations that need to be considered carefully.