It’s always fun to speculate about what’s going to happen, especially at the beginning of the year. The truth is nobody knows what’s going to happen. For me, part of the fun is watching as events unfold expectedly or unexpectedly. While I dislike negative surprises as the next person, they too are part of the journey. The Boy Scout motto, “Be Prepared”, is always a good approach to any situation, especially financial and investment situations.

Here are some of the things I’m thinking about at the start of 2023.

Monetary policy is still tight: The stock market continues to try to time the Fed pivot in spite of the Federal Reserve officials sticking to their story of higher rates for longer. We talked about that here last year that nobody seems to believe the Fed. It appears the don’t fight the Fed mantra only applies when stocks are going up.

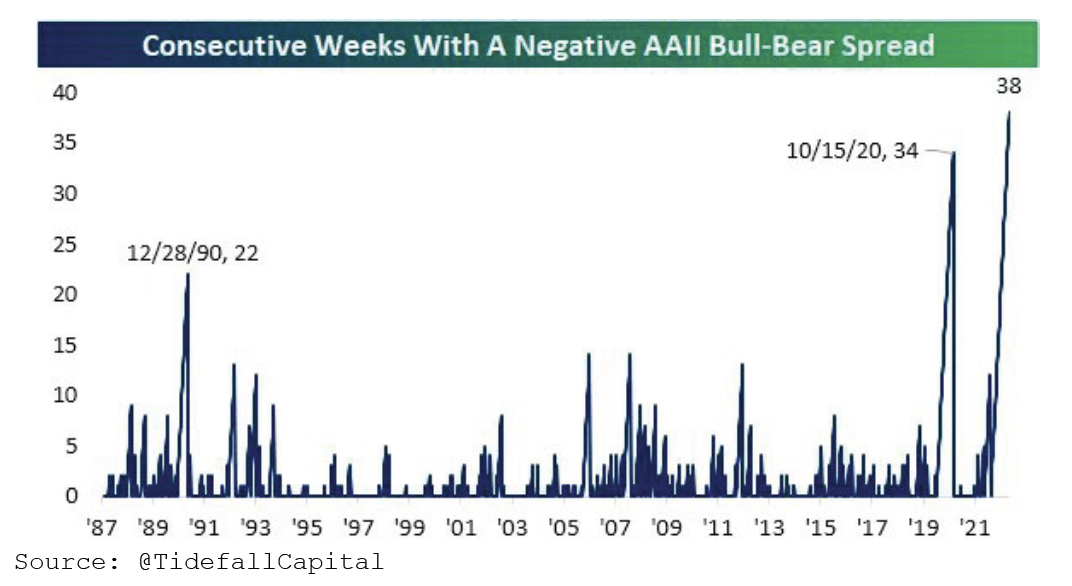

Two consecutive years of stock market declines are rare: According to Ben Carlson, the stock market has experienced declines in two consecutive years, eight times since 1928. I’m not suggesting the stock market won’t or can’t be down again in 2023. It’s simply an uncommon occurrence (8.5% of the time over a 94-year time period). Sentiment continues to be negative with the AAII’s bull-bear survey clocking in 38 consecutive weeks of more bears than bulls. Chart below courtesy of Tidefall Capital via Jared Dillian at the Daily Dirtnap.

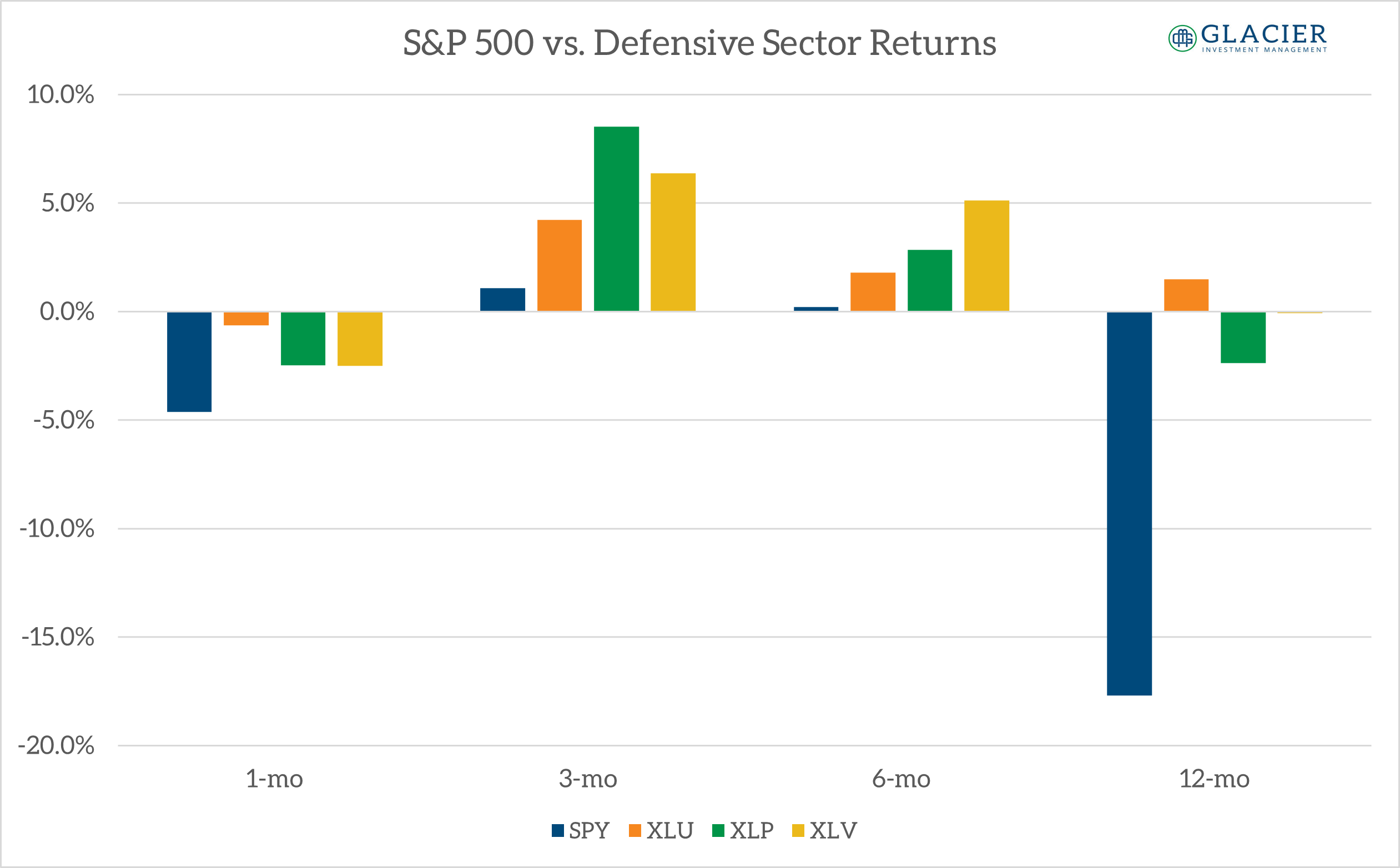

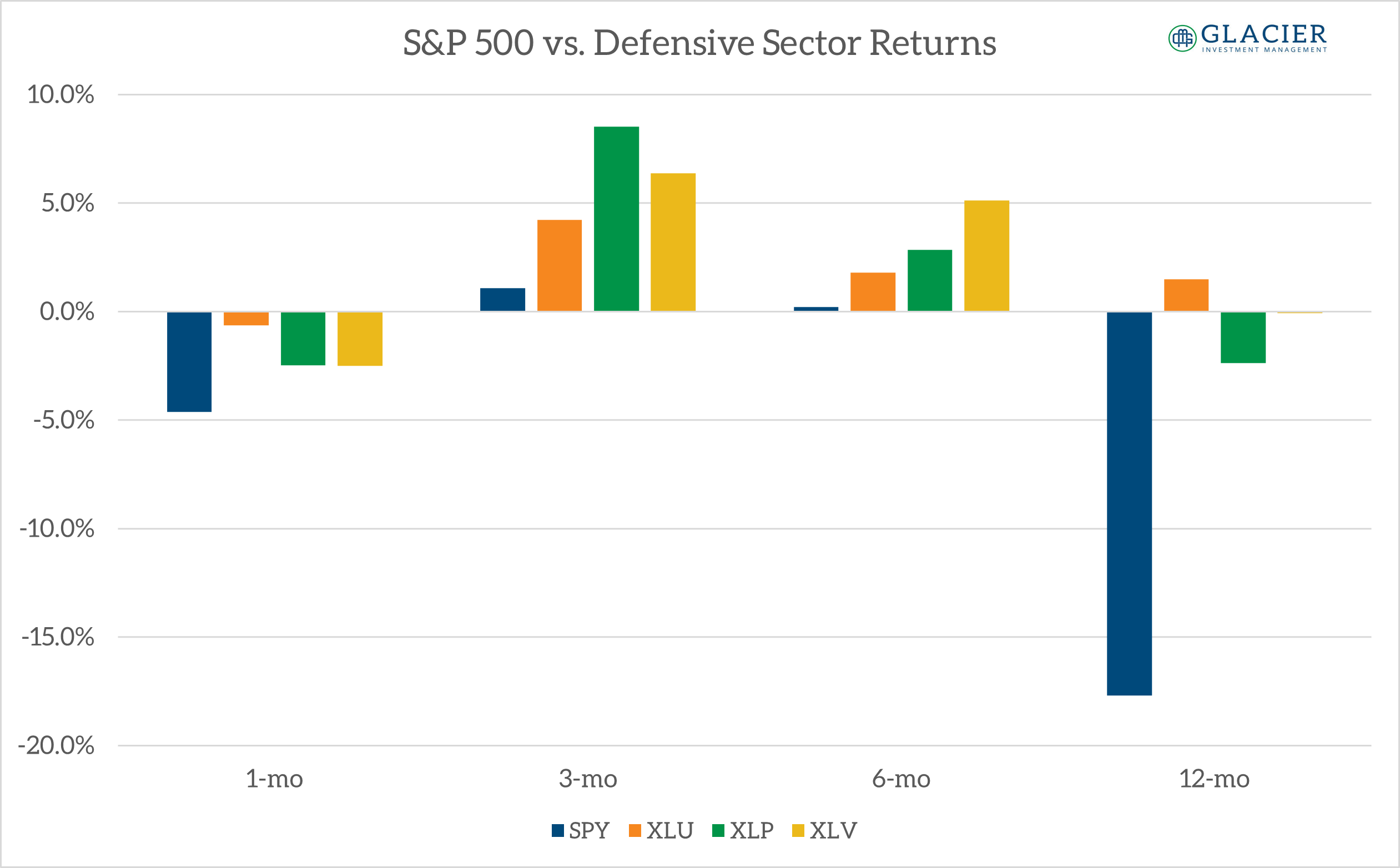

The recession drumbeat grows louder: I know the effects of the interest rate increases are lagged and we will eventually encounter a recession again. A lot of leading indicators are suggesting we’re in a recession or a recession is imminent. I don’t know if we’re in a recession or when the next one will start. On a 1-, 3-, 6-, and 12-month basis, some of the more defensive sectors within the S&P 500 have been outperforming. That could imply recession or simply a defensive posture in a what has been a fairly volatile and unfamiliar environment for many investors. Interest rates have come down, but it’s unclear if they’ve come down because of recession fears or lower inflation expectations. Perhaps it’s both. Suffice it to say, we appear to be in a transition period, unfamiliar to many of us today. The days of easy money appear to be gone but it remains to be seen how long they will be gone.

The recession drumbeat grows louder: I know the effects of the interest rate increases are lagged and we will eventually encounter a recession again. A lot of leading indicators are suggesting we’re in a recession or a recession is imminent. I don’t know if we’re in a recession or when the next one will start. On a 1-, 3-, 6-, and 12-month basis, some of the more defensive sectors within the S&P 500 have been outperforming. That could imply recession or simply a defensive posture in a what has been a fairly volatile and unfamiliar environment for many investors. Interest rates have come down, but it’s unclear if they’ve come down because of recession fears or lower inflation expectations. Perhaps it’s both. Suffice it to say, we appear to be in a transition period, unfamiliar to many of us today. The days of easy money appear to be gone but it remains to be seen how long they will be gone.

It’s going to take more: The current investor psyche appears to remain preconditioned to expect relatively easier monetary conditions. The Fed assist may not be dead, but it appears the Fed wants everyone to believe it’s dead. It seems like it’s going to take more restrictive policy from the Fed to drive home the point to the broader investment community. At this point, it may be a game of chicken. Who will relent first, investors or the Fed?

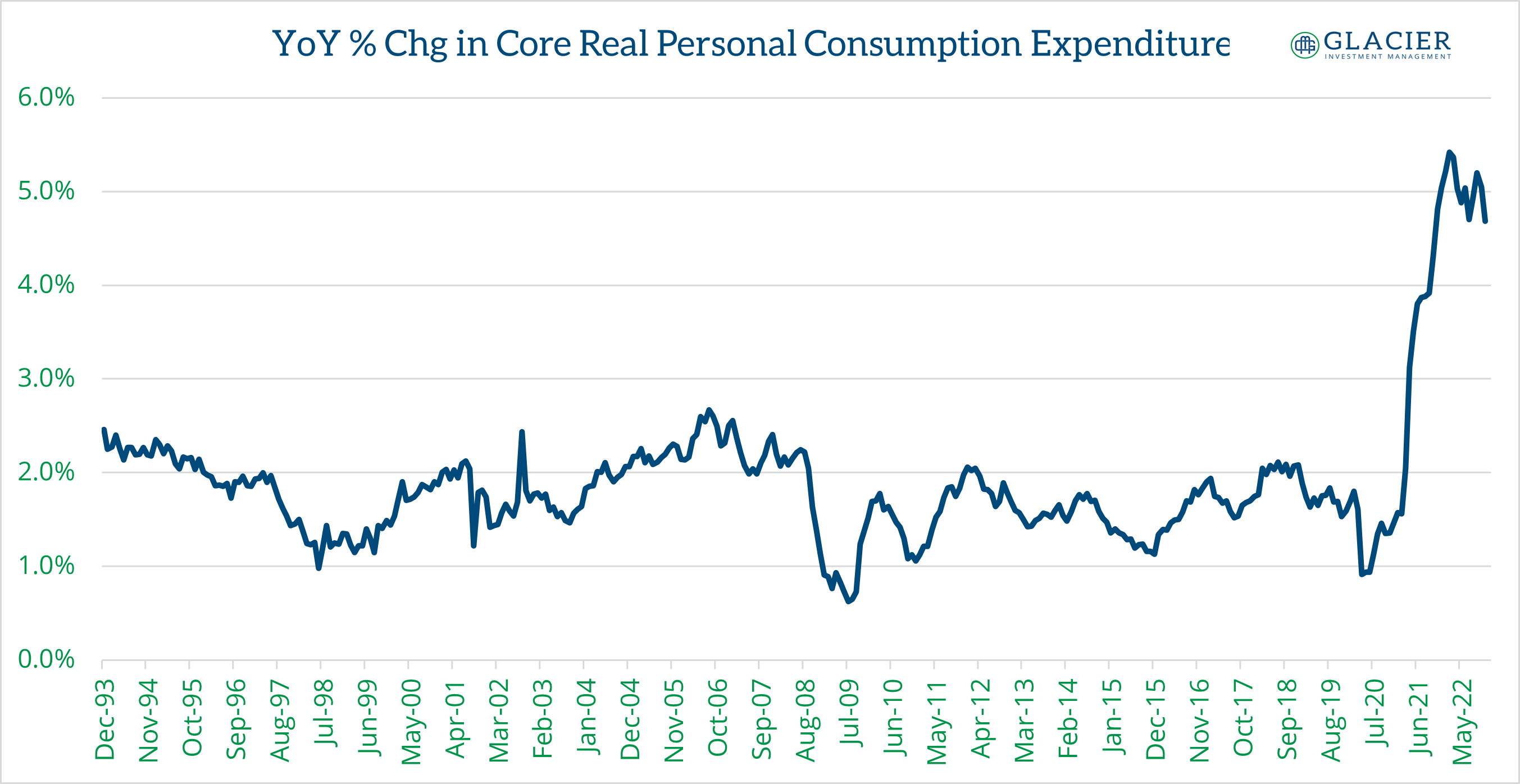

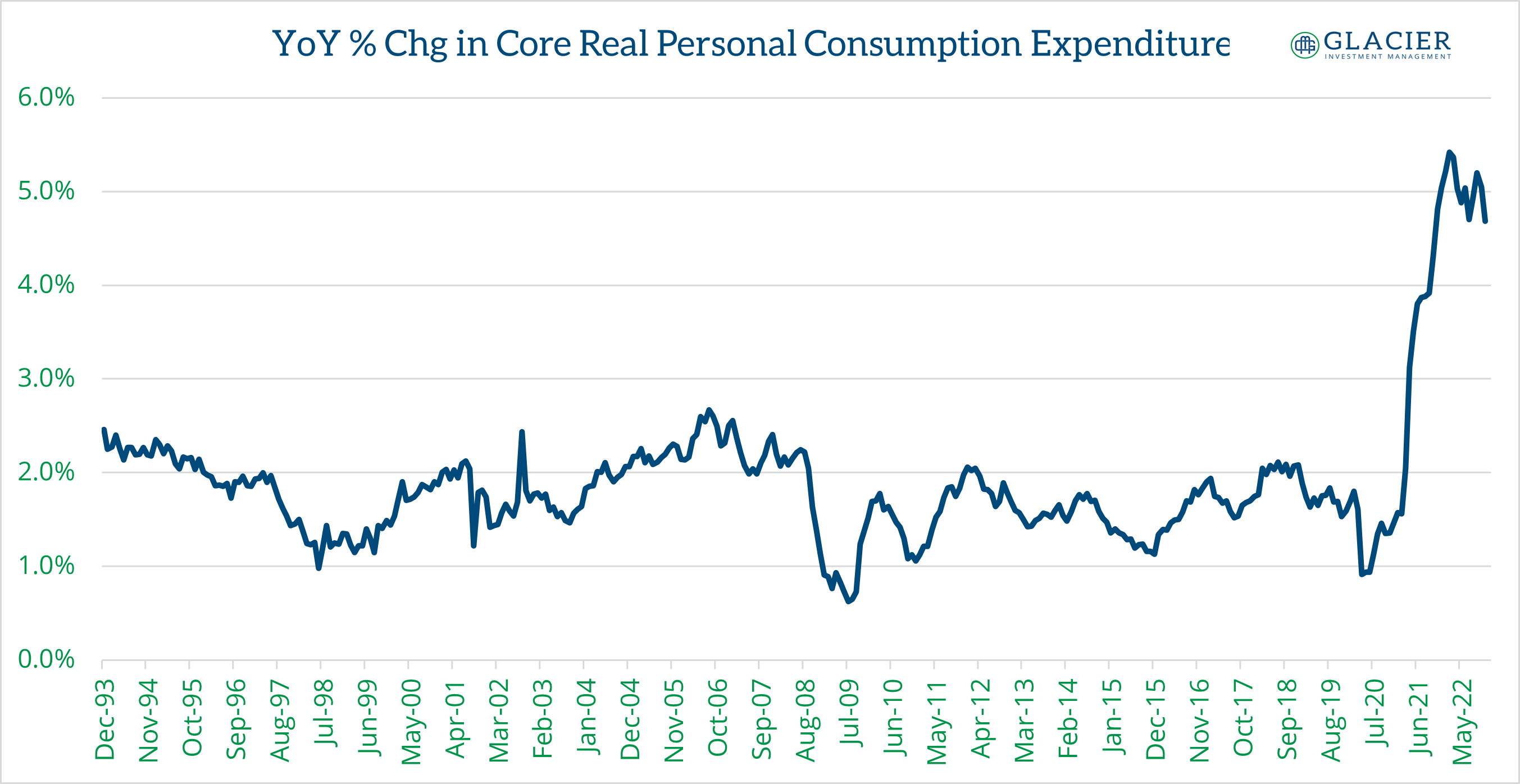

Inflation is old news: While we’re all tired of hearing about inflation, I don’t think it’s going away. A continual reprieve is very likely but at a structural level inflation may be higher going forward than we’ve become accustomed to in the past 14 years.

One parting thought: if you find yourself being consumed by something you can’t predict (i.e., when will the Fed pivot, when will the next recession arrive, etc…), ask yourself why do you care? In a recent memo, in classic fashion Howard Marks recounted an experience he had with people asking him which central bank would be the first to raise rates. He asked the questioners, why they cared. Would it change what they did? In a direct quote from his memo, “The vast majority of investors can’t know for sure what macro events lie just ahead or how the markets will react to the things that do happen.” This is sound wisdom to keep in mind as 2023 gets under way. Best of luck out there.