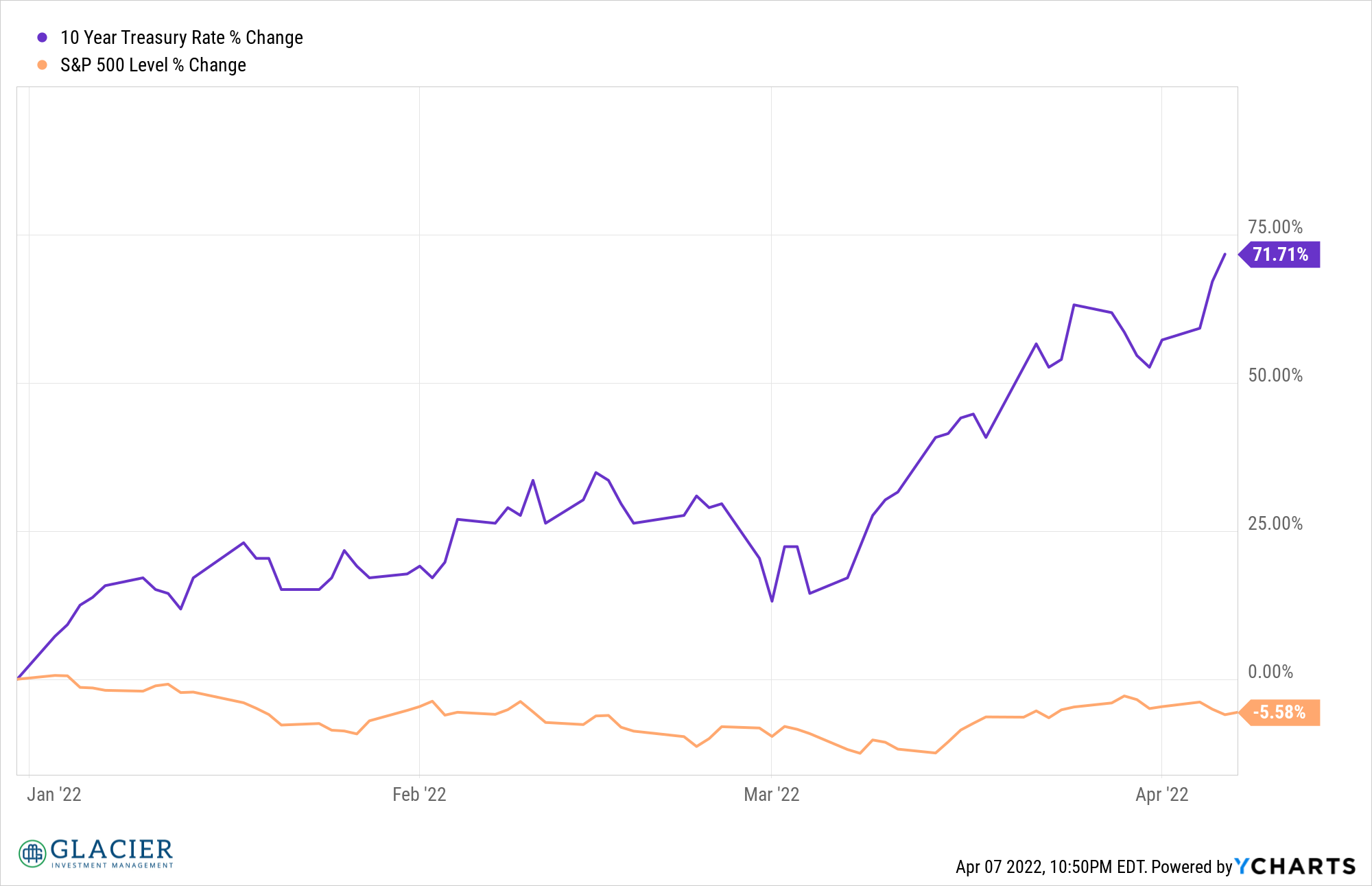

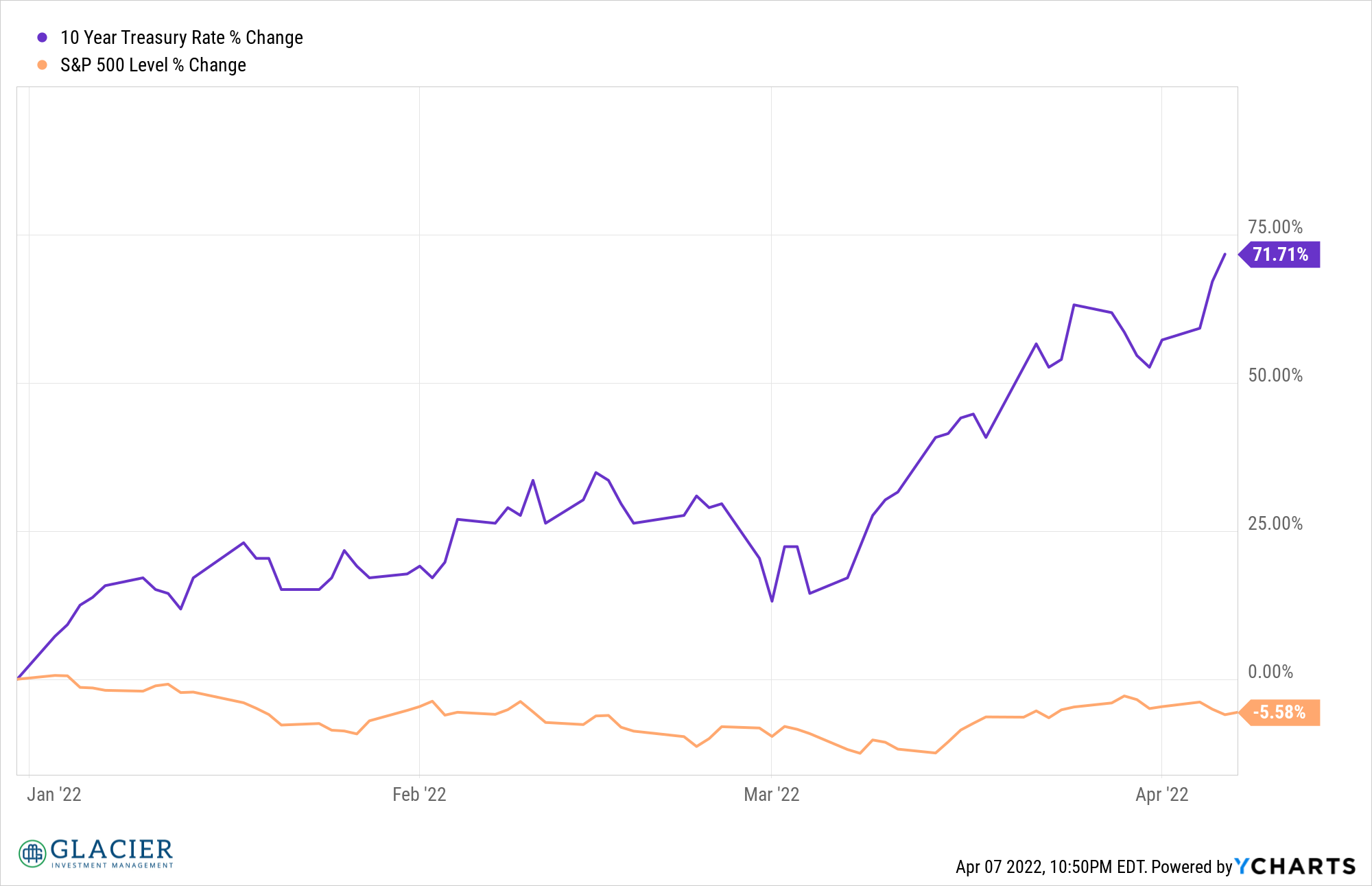

The rebound in stocks in March wasn’t surprising but there was a surprising sideshow. Volatility dropped sharply as you would expect in a reflexive rebound after a sharp increase in volatility/sharp decline in stocks. What stood out though was the dramatic increase in interest rates in March as stock prices pressed higher.

The 10-year UST is up over 70% YTD and the stock market is only down 5.5%. I would have expected stocks to be down far more than 5.5% in the wake of such a dramatic increase in rates in a fairly short period of time. Granted, we don’t know the full impact of the rise in rates but the market usually discounts most of the impact well in advance. Could it possibly be that the stock market is on better footing than we realize and thus better able to absorb the rate normalization process? Or is this rally simply a dead cat bounce with further downside ahead as rates continue to climb higher?

It appears as if the stock market is simply digesting rate normalization while anticipating Fed balance sheet normalization and ongoing inflation trends. Perhaps the economy is doing the same, which might explain some of the slowdown in economic indicators. Regardless, the divergence in stock market sector performance certainly appears to be foreshadowing a recession.

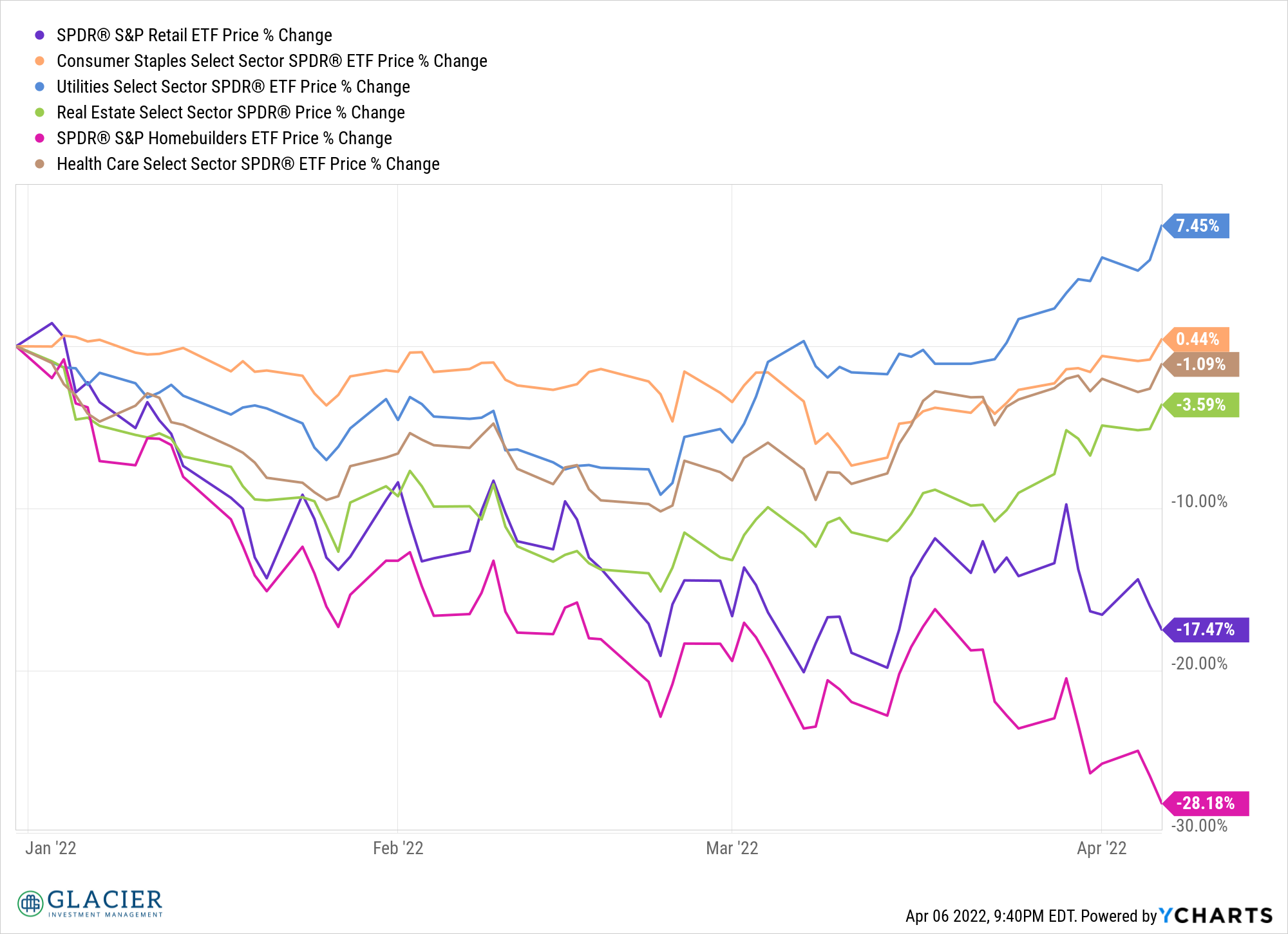

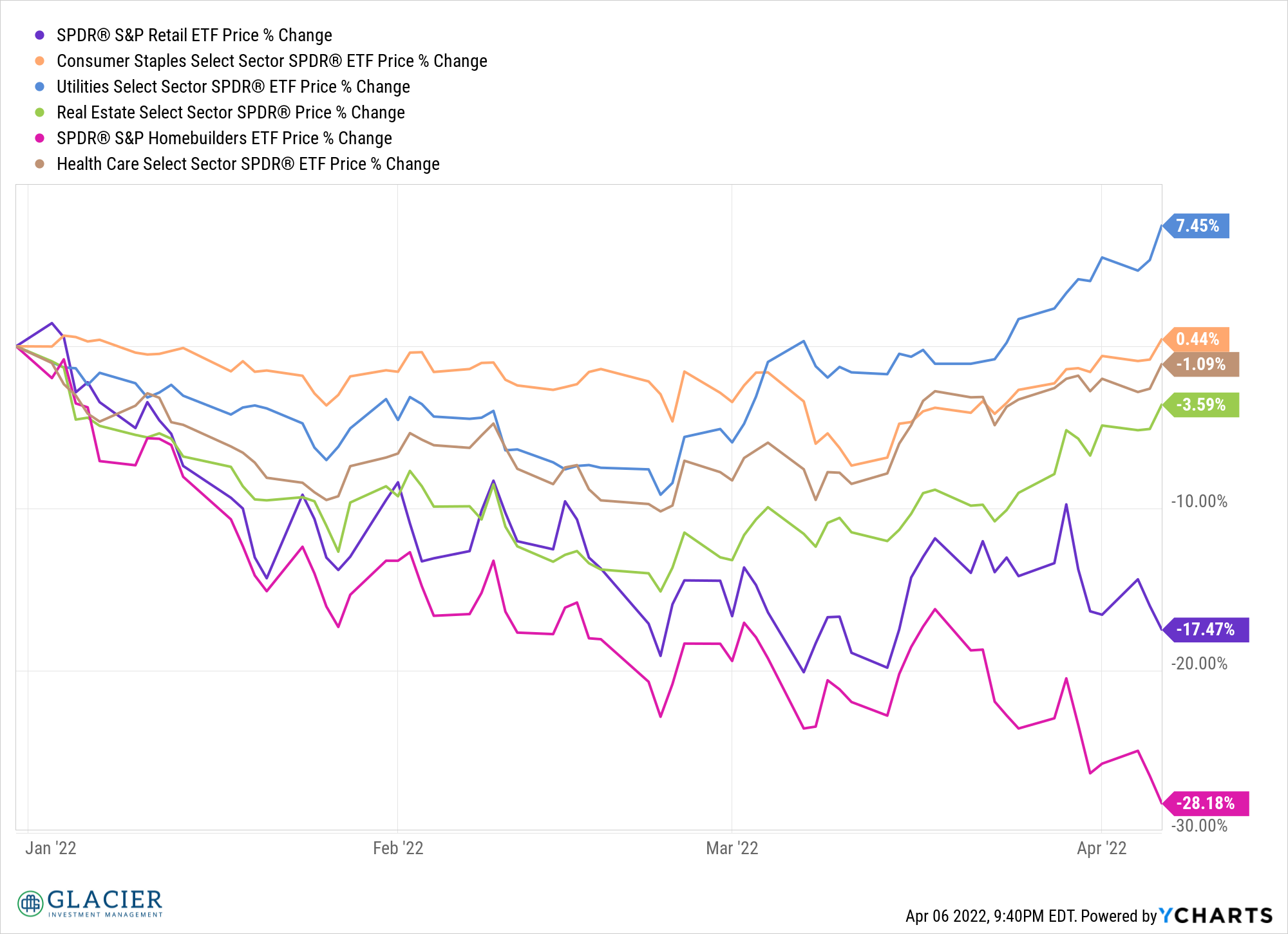

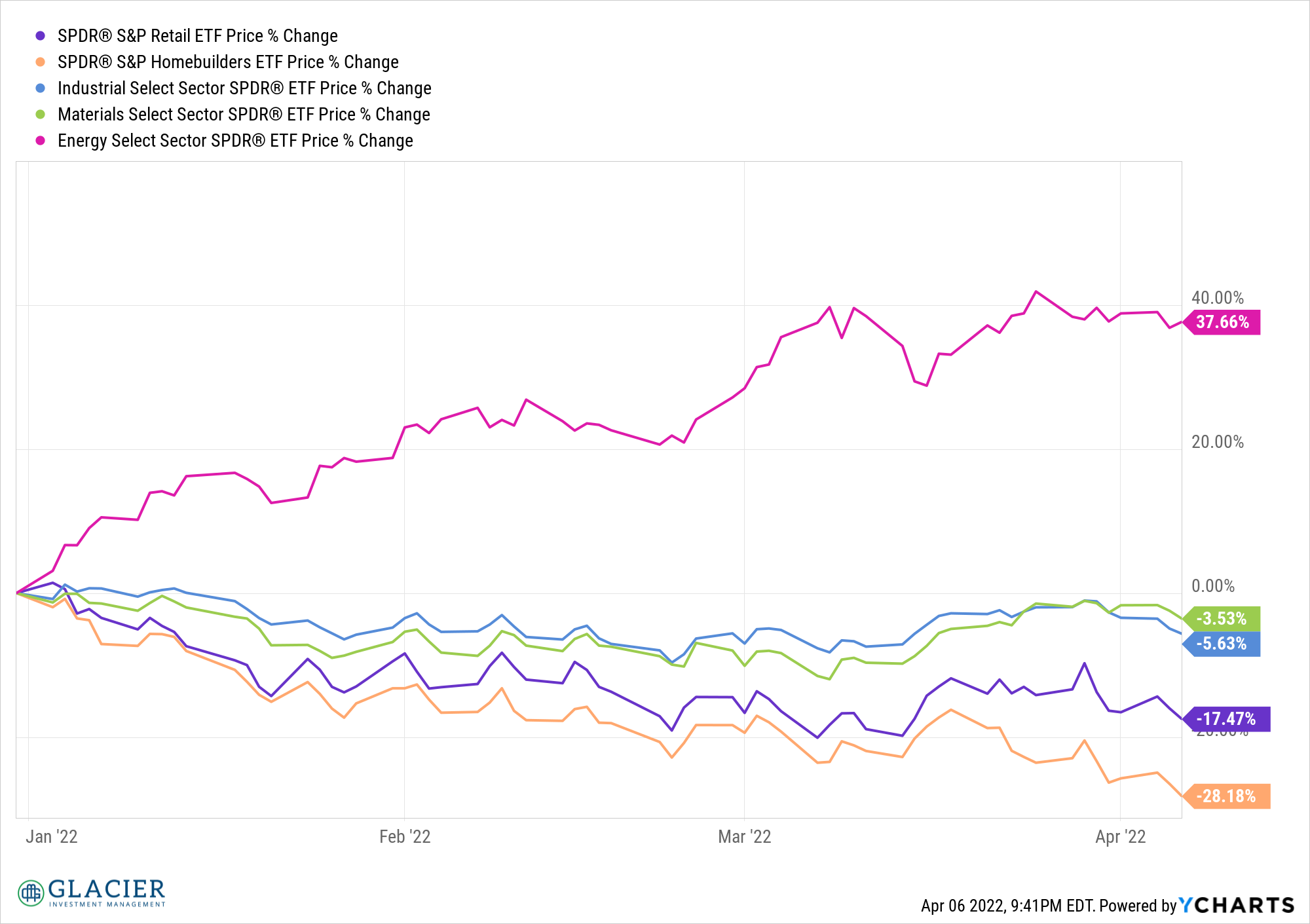

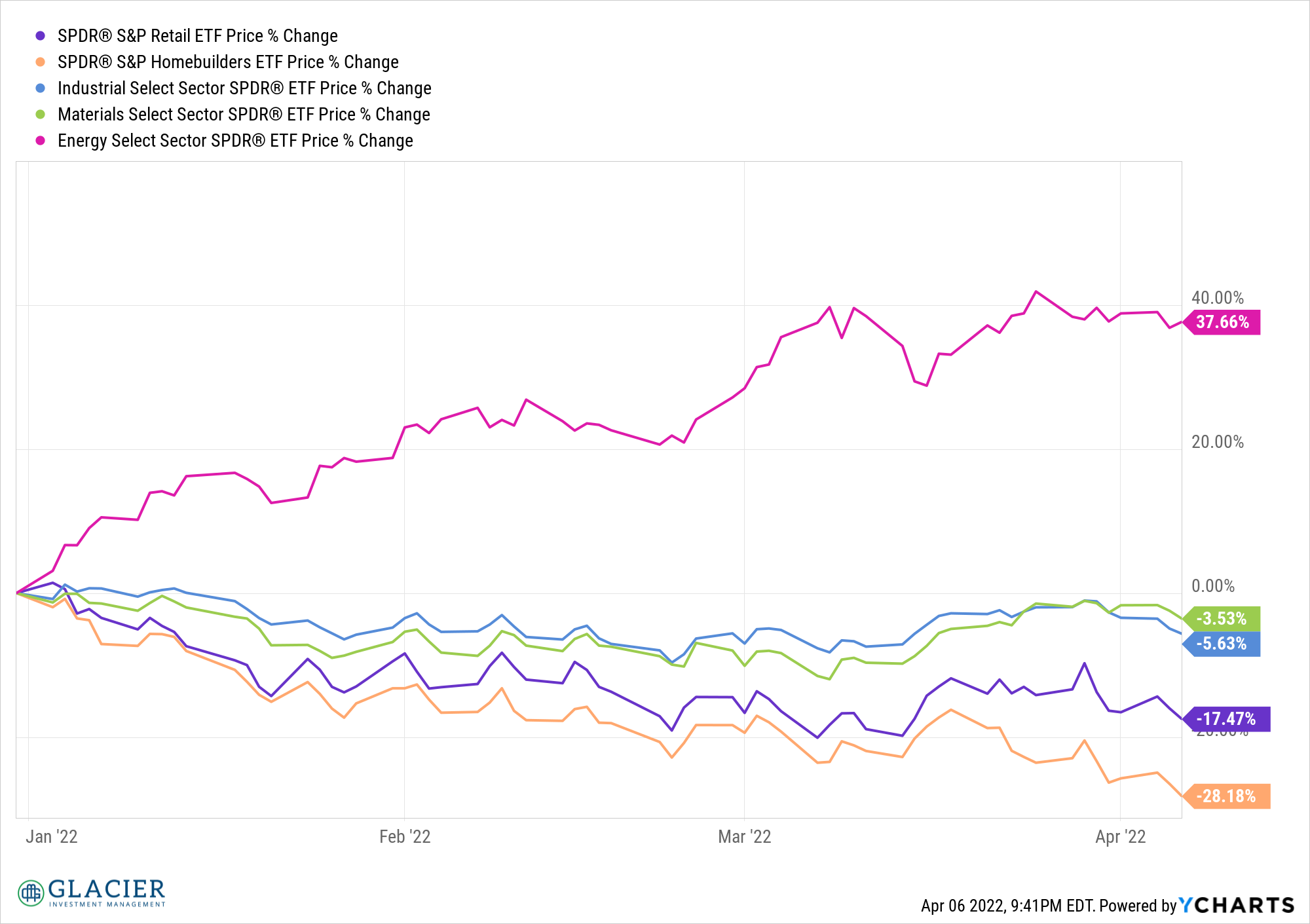

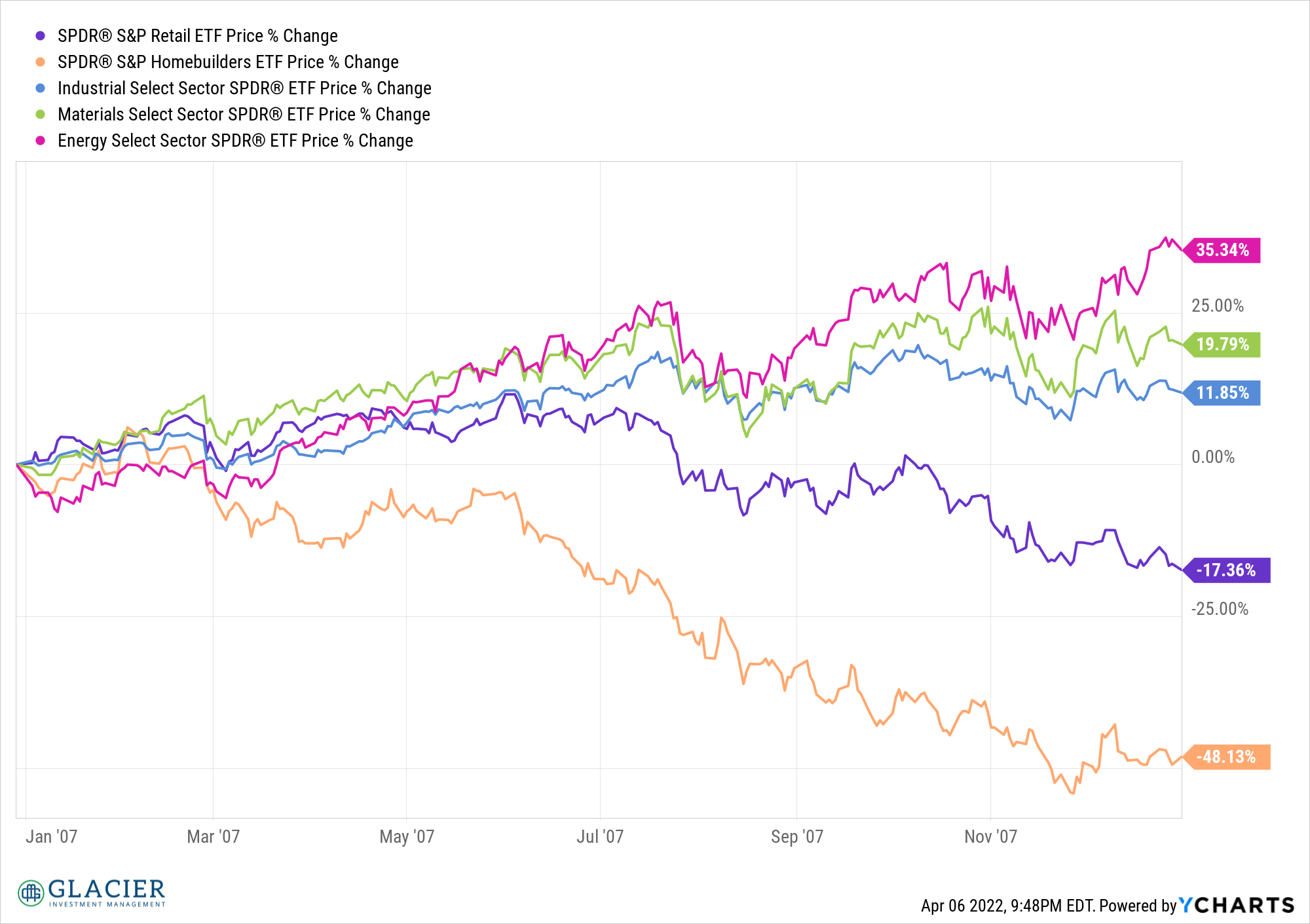

A closer look at individual sectors shows a stark divergence between consumer cyclical (retail and homebuilders) and defensive sectors (utilities, staples, real estate, health care). It would appear the market is at least pricing in a consumer recession. Whether other cyclical sectors like industrials, materials, and energy follow suit is another story. If we don’t get follow through on the downside from those sectors, a potential recession may be fairly mild or not even happen at all.

What’s the deal?

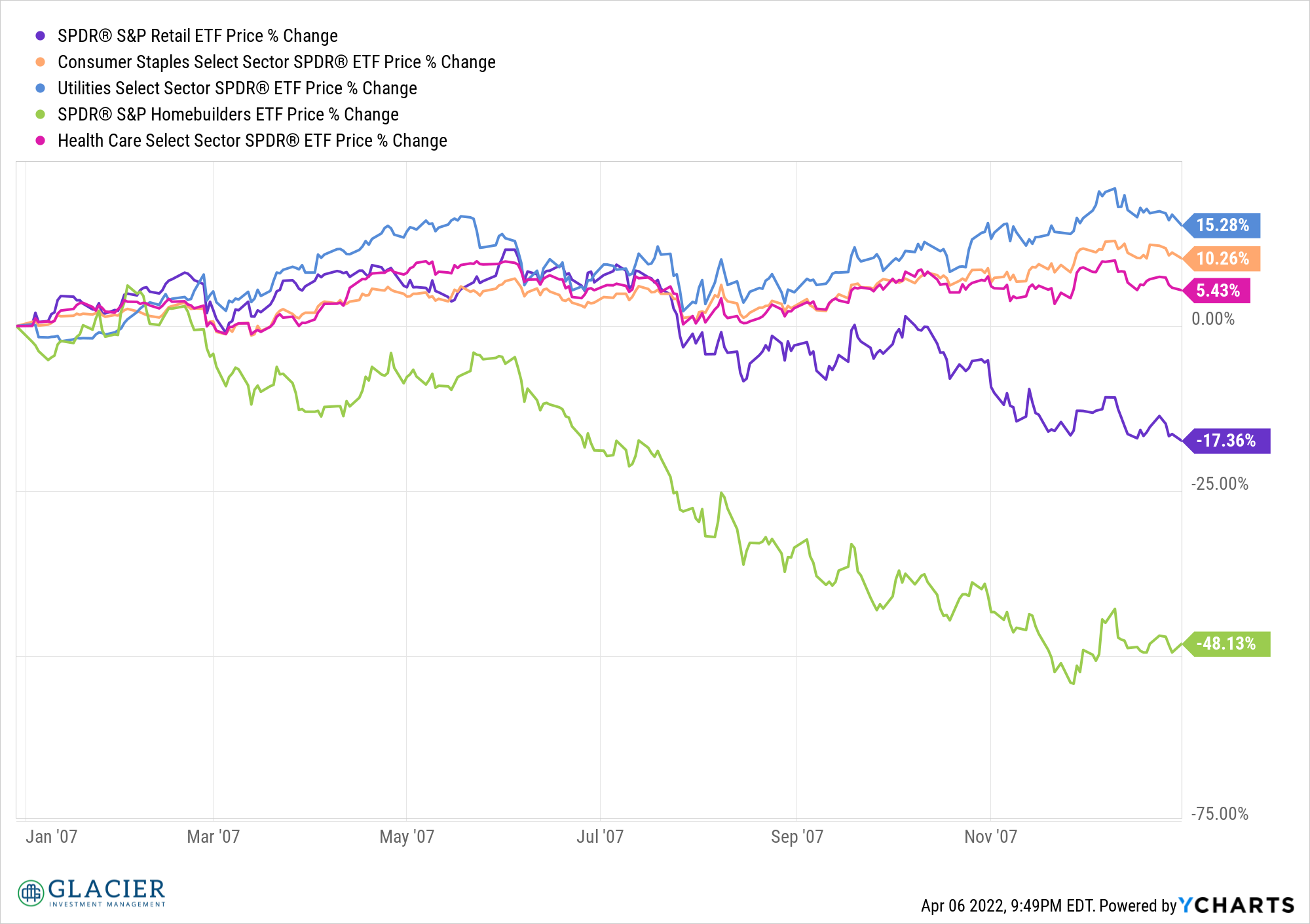

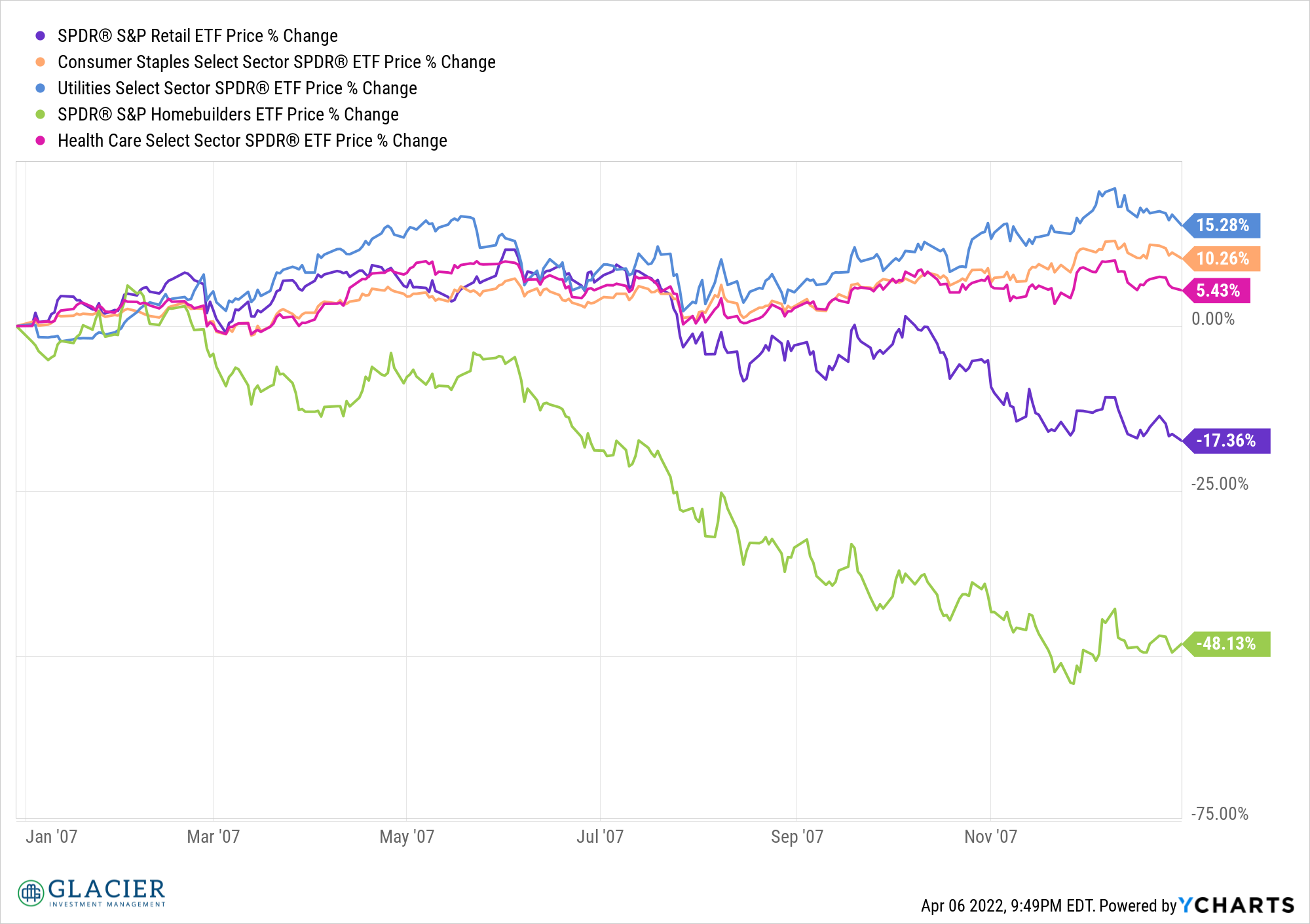

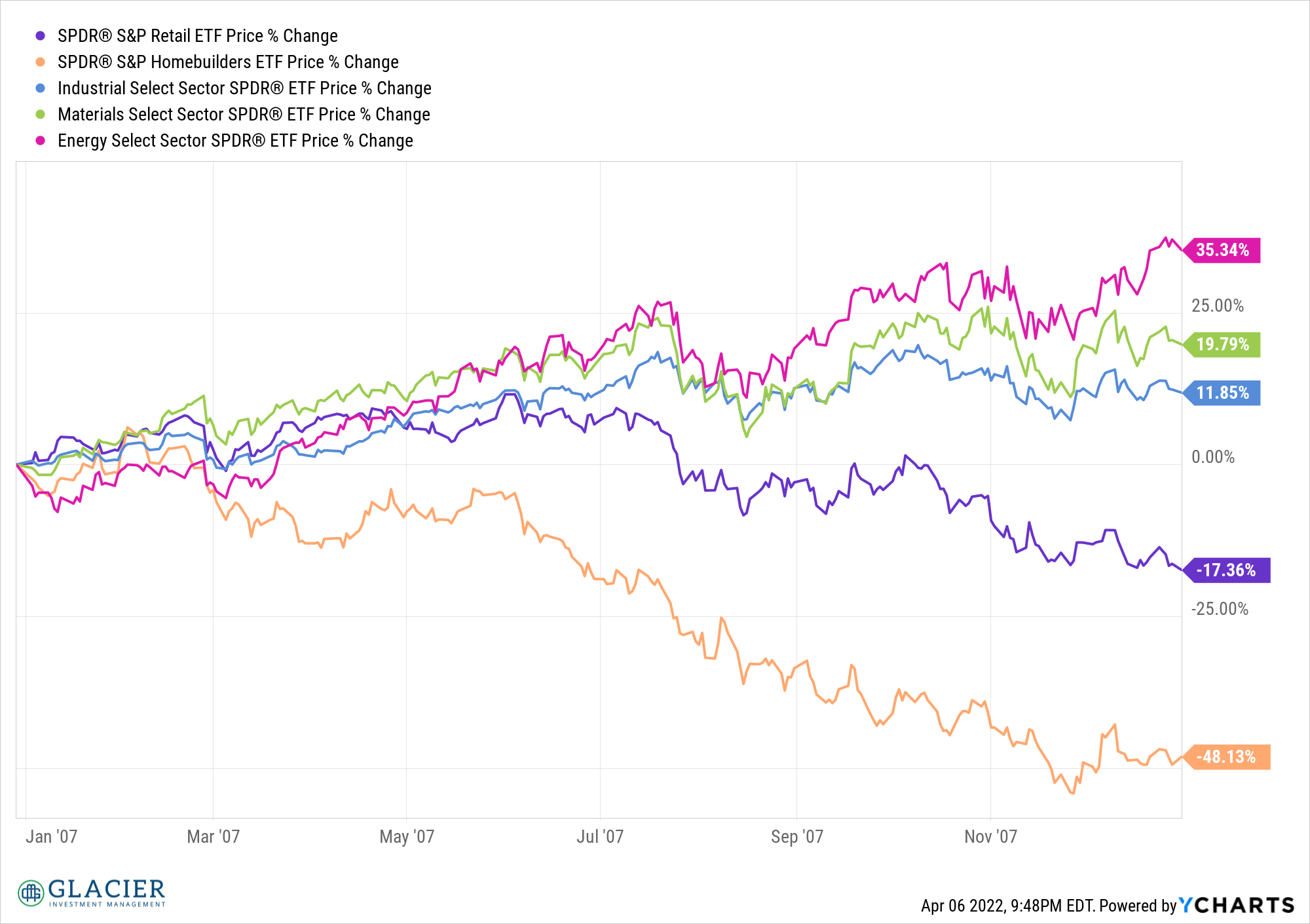

The inflationary backdrop clearly has something to do with the relative strength in energy and materials. I’m not exactly sure why industrials are holding up as well as they are if a recession is on the table, but we saw a similar pattern prior to the recession that began in the fourth quarter of 2007.

It’s uncanny how it’s pretty much the same playbook. Notice how energy and the same defensive sectors are leading the charge while the weakest sectors are the consumer cyclical sectors. Is this simply a self reenforcing, reflexive trend that is bound to play out in this manner as investors pull from past experience? Could we possibly avoid a recession? Important points to consider.

The Best Month for Stocks

April has historically been the best month for stock returns in the US. With March having turned in such a strong performance, I wonder if April’s performance was pulled forward. I imagine 1Q earnings season will have a lot to say about April stock performance, especially the outlooks provided for the rest of the year with high inflation, war induced economic disruption, a softening economy, and higher interest rates front and center.

Beyond April

Your guess is as good as mine. We know the Fed is going to start QT in May. Presumably another rate hike is on the way in May as well. Barry Ritholz had a great write up the other day on inflation and the Fed’s path forward. I appreciate his voice of reason and objectivity amidst the constant barrage of sensational commentary and headlines. It’s always good to take a step back, reflect on the big picture, and think rationally. Maybe the Fed knows what they’re doing more than we realize?