Whether to convert or not convert a Traditional IRA to a Roth IRA is a popular question among clients and prospects alike. The topic has only gained in popularity as back-door Roth contributions have once again come under increased political scrutiny with the Build Back Better legislation.

By converting a Traditional IRA to a Roth IRA, the accountholder gains the following benefits:

- All future gains and withdrawals will be free from taxes, assuming no withdrawals are made prior to age 59 ½ (certain exceptions apply).

- The accountholder will not be required to take minimum distributions during his/her lifetime.

The downside to converting a Traditional IRA to a Roth IRA is the taxes on the contributions and gains to date are due upon conversion. While the tax bill can be paid out of the proceeds from the conversion, the conversion itself might not make economic sense if the total proceeds are reduced by the tax bill. If you’re under age 59 ½, paying the taxes out of the conversion proceeds would result in a 10% early withdrawal penalty, which would likely make the conversion unattractive. Having the liquidity in other accounts to cover the tax bill is generally a best practice for Roth conversions.

Beyond that, there are a few important factors to consider when contemplating a Roth conversion.

Other costs

The funds being converted from a Traditional IRA to a Roth IRA are included in your adjusted gross income, which is used to determine your marginal tax bracket. A poorly planned conversion would push the accountholder into higher tax bracket, leading to higher than necessary taxes.

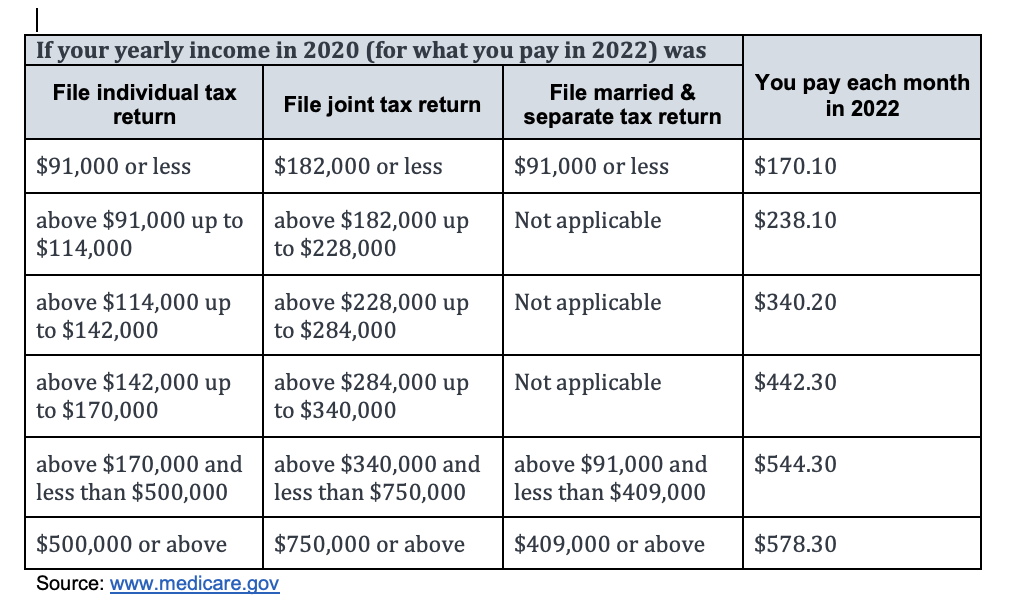

Additionally, depending on your income levels a Roth conversion could trigger a Medicare Income Related Monthly Adjustment Amount (IRMAA) or prevent you from receiving the Premium Tax Credit. IRMAA is an extra charge added to your Medicare Part B premium when your income exceeds certain levels

The Premium Tax Credit is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace (see here for more information).

The Premium Tax Credit is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace (see here for more information).

Permanent

A Roth conversion cannot be reversed. So, if you converted a Traditional IRA in a given year and unexpectedly pushed yourself into a higher tax bracket you would be stuck. You wouldn’t be able to undo the conversion.

The Big Picture

Roth conversions should be done within the overall context of the accountholder’s lifetime plan. Looking at a Roth conversion otherwise can lead to unintended consequences and future tax inefficiency.