Recession has become a popular topic of late as the stock market has corrected, the yield curve inverted briefly (short-term rates are higher than long-term rates), and the Fed has become more restrictive in its monetary policy. While I can’t say with certainty if we’re in a recession or not, there’s enough hard data and anecdotal evidence that important economic growth variables are slowing. Many are still positive though. Many believe negative readings for these variables is inevitable, but it is possible that we’re merely in a soft patch for a brief period. See here for a brief analysis of whether we’re in recession right now or not.

Given the Fed’s apparent determination to beat inflation, it sure seems like a recession is inevitable but that could still be quarters away. Regardless, let’s look at some of the more pertinent high level economic data points and where they stand right now.

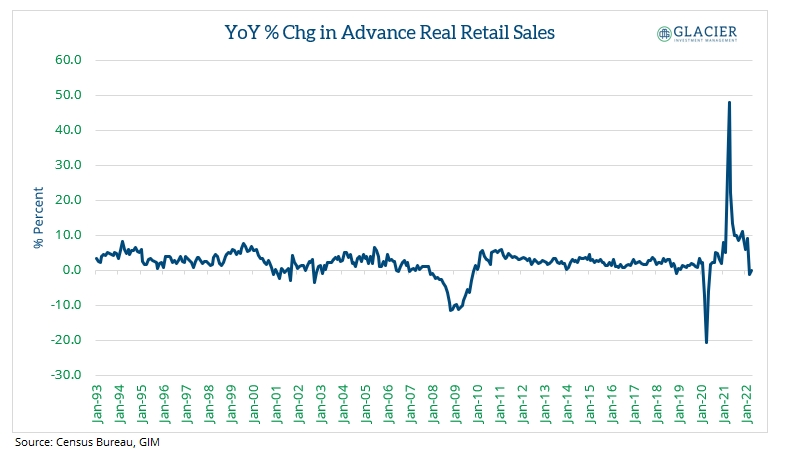

Real Retail Sales

Two consecutive months of negative readings don’t bode well for the health of the US consumer. That doesn’t imply a recession is imminent but if the trend continues a recession is likely as the consumer is still the largest piece of the economic pie.

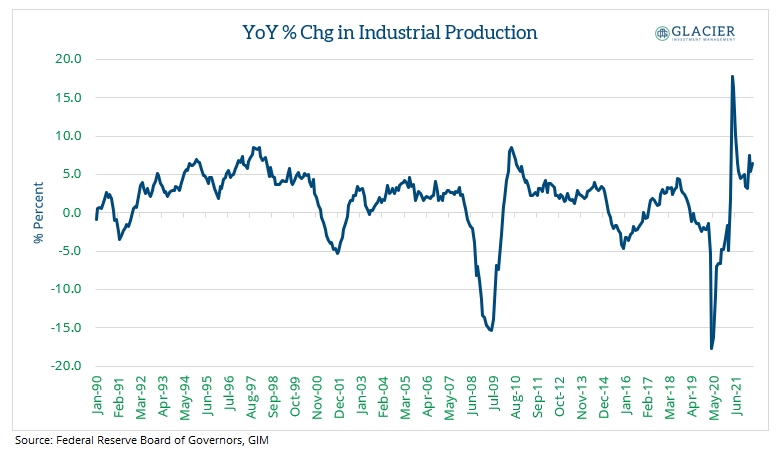

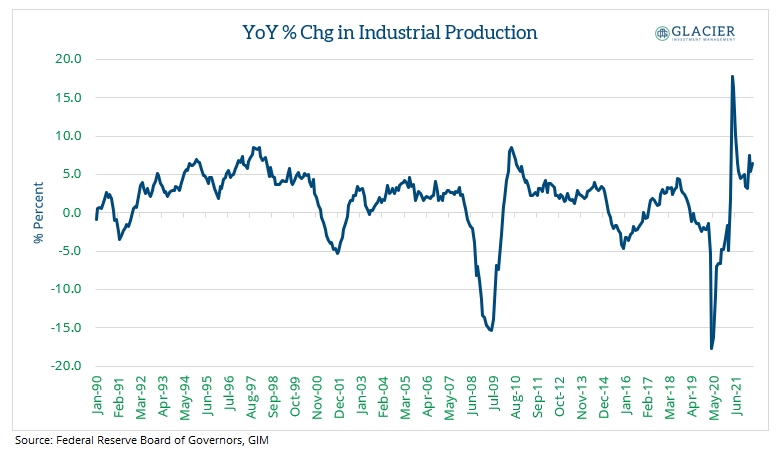

Industrial Production

Industrial production is still strong and not showing any signs of letting up. We could continue to see solid readings on this metric if companies and leaders are committed to increasing our nation’s resiliency through the onshoring of manufacturing.

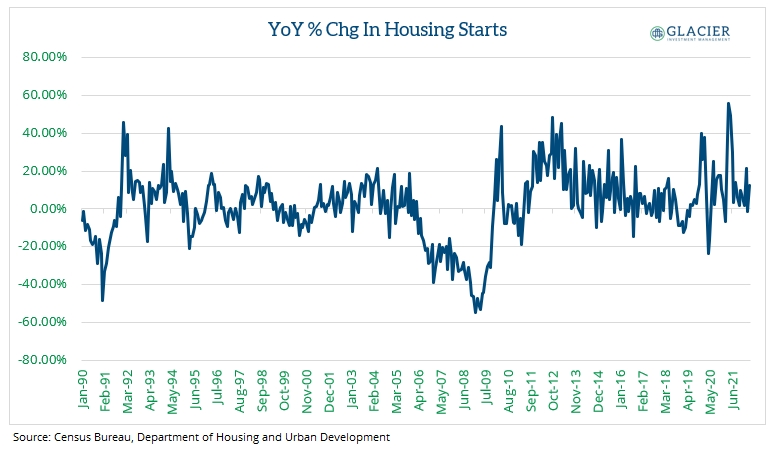

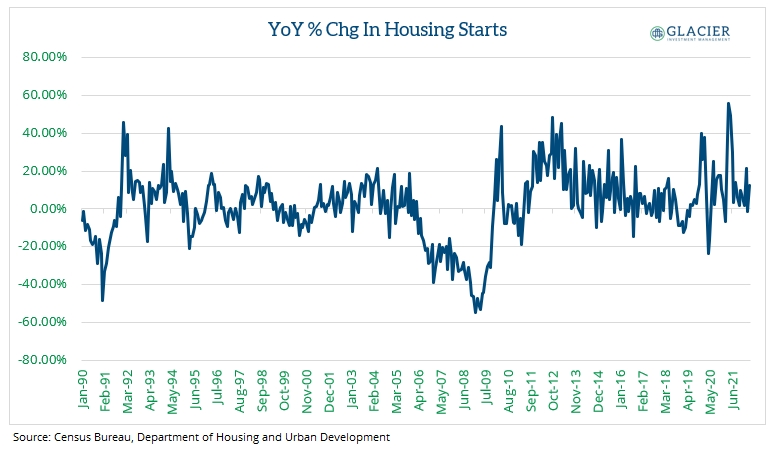

Housing Starts

A very volatile metric but important as the housing market is a key component to the nation’s economy. We all know the white-hot housing market has slowed as mortgage rates have climbed. Price reductions are picking up but that could simply be a normalization of prices after rapid increases. Growth in starts was positive in the most recent reading but I believe that was driven primarily by multifamily. A lot of people I speak with are expecting a housing crash a la 2008. I’m not sure that’s in the cards this time around. We don’t have near the amount of financial engineering that existed leading up to Great Financial Crisis.

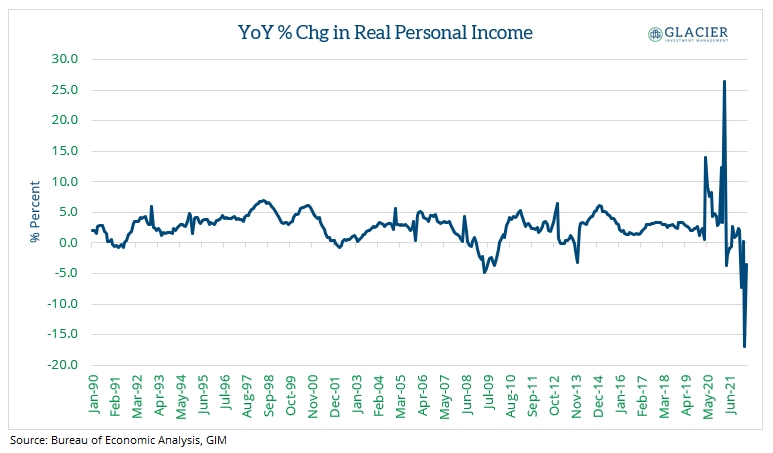

Real Personal Income

With elevated inflation, this metric continues to be weak. A negative print does not imply a recession or a even an economic slowdown. However, coupled with other variables in can paint a picture of slowing growth.

Employment Growth

We got the reading for May this morning and the job market is still on solid footing with another month of positive job and wage growth. While job growth is a lagging indicator, as long as people are working and earning money that’s usually a good thing for economies, especially those driven by the consumer.

Certain data points suggest there is a slowing in economic growth. Whether we’re at a recessionary breakpoint or not is up in the air, but it doesn’t feel like it. I know a lot of people are calling for a recession. We will end up in a recession again. It’s inevitable. However, the timing is uncertain. We are starting to see some of the markers that have signaled recessions historically, but we may still be several quarters away from an actual recession.

In the end, fretting over a recession (something we can’t control) isn’t the best use of our time and energy. Having a plan in place (which we do!) and following it should be our primary focus (something we can control).