Gold can be a very polarizing asset to discuss and to own for that matter. It always seems to be topical among at least one segment of investors, whether people are concerned about the demise of the current global currency system or the end of the world. I get a lot of questions about whether gold ownership makes sense or not. I don’t have a strong opinion on gold one way or the other. I believe in situationally investing in gold when certain criteria are met, but I don’t believe it makes sense to always own gold in an investment portfolio.

Gold has been an alluring object of value to people for thousands of years. In modern times, gold has gained popularity as a hedge against fiat currency debasement (devaluation of paper money). It has also been argued that gold serves as a hedge against inflation even though that hasn’t necessarily proven to be true. Gold is not without its detractors either. The “pet rock” meme has run rampant in recent years as gold isn’t productive and doesn’t produce any cash flows.

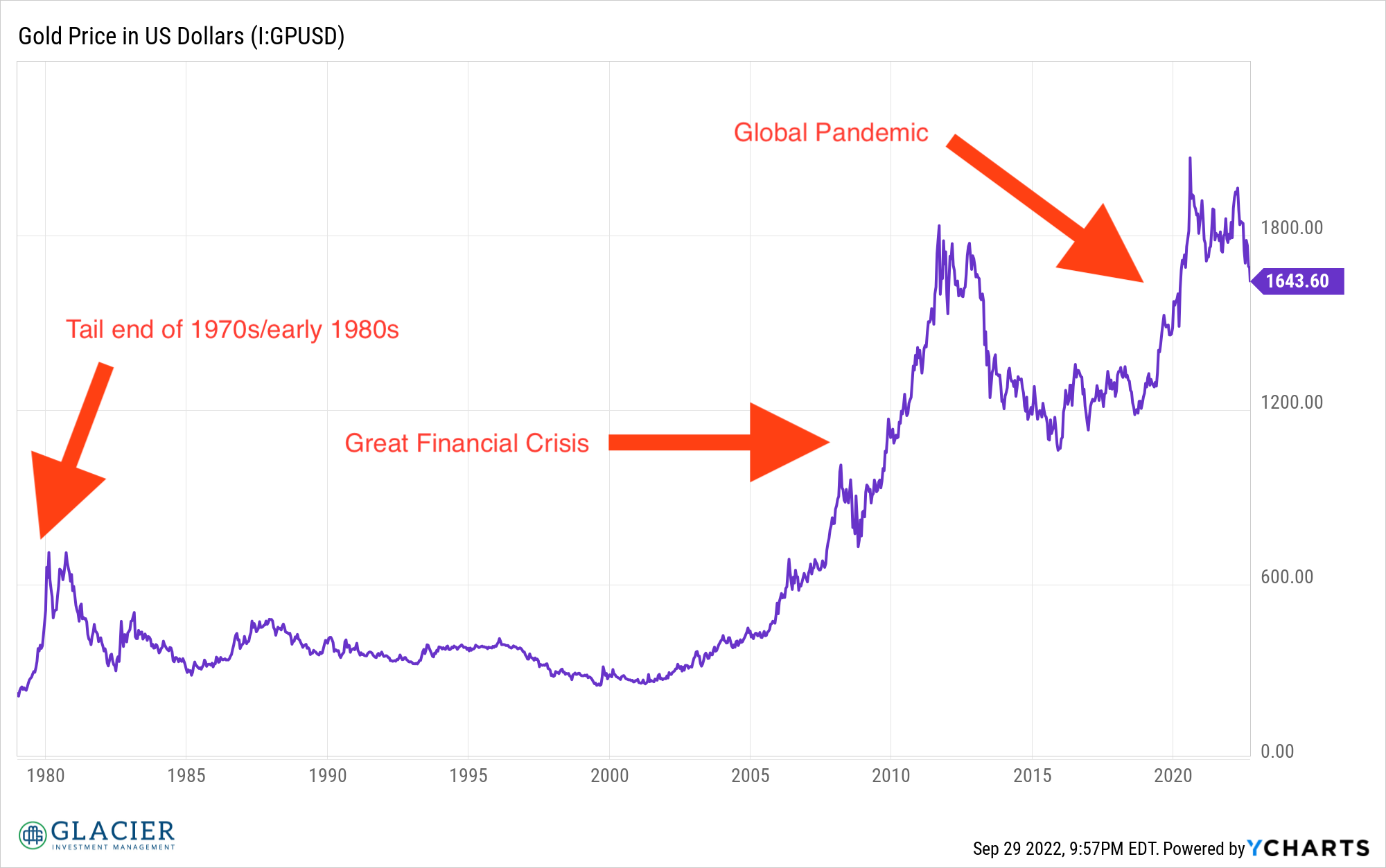

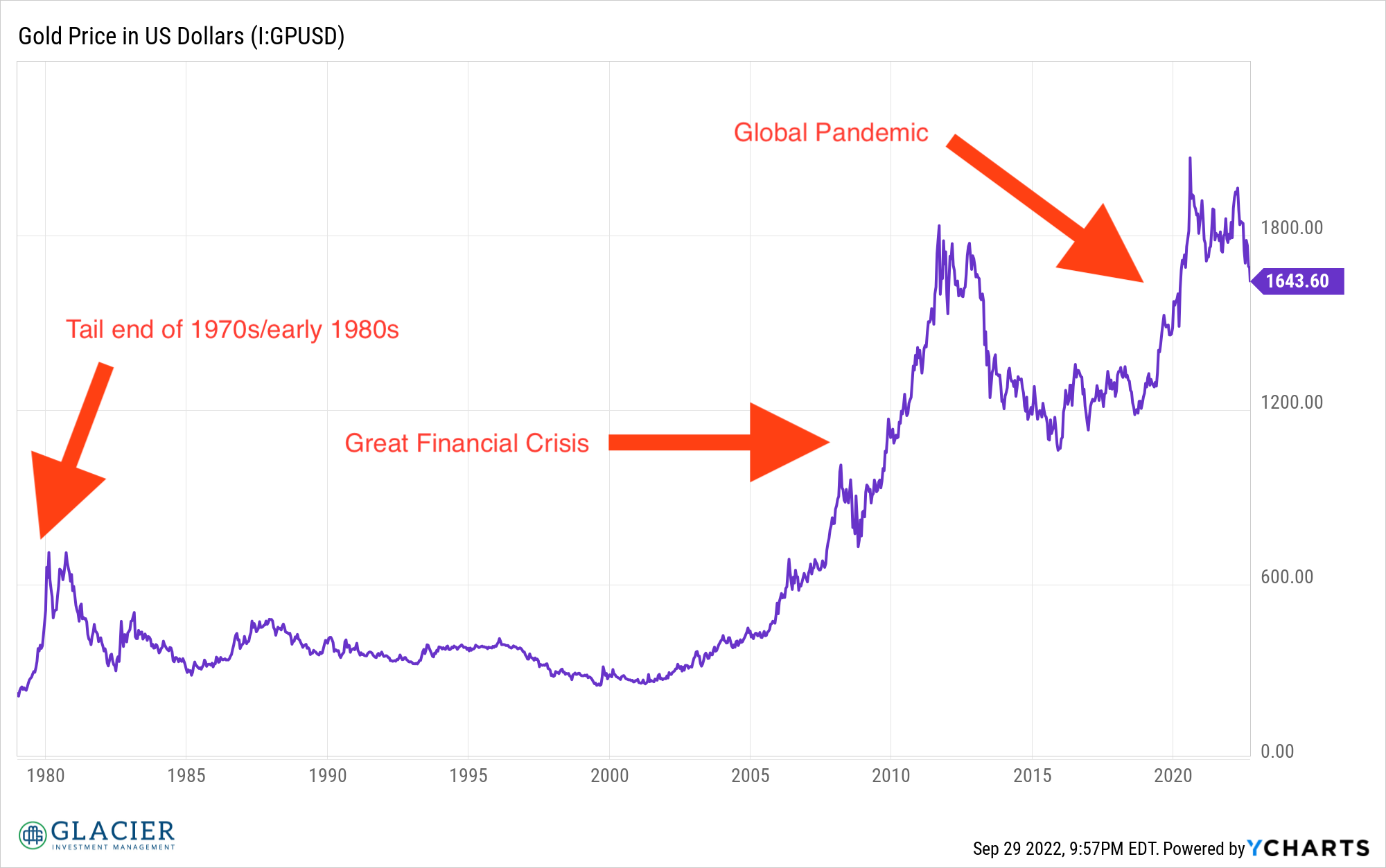

While gold can produce outsized returns, it can also lag for long periods of time. During the Great Financial Crisis, fiscal and monetary stimulus via Congressional bills, asset purchases, and other means were used to help stabilize the financial system. Investing in gold when the stimulus was announced in the fourth quarter 2008 through the end of 2012 led to outsized returns. The price of gold appreciated by 88% while the S&P 500 returned under 23%. Concerns about the viability of the global financial system surely contributed to the rise in gold prices.

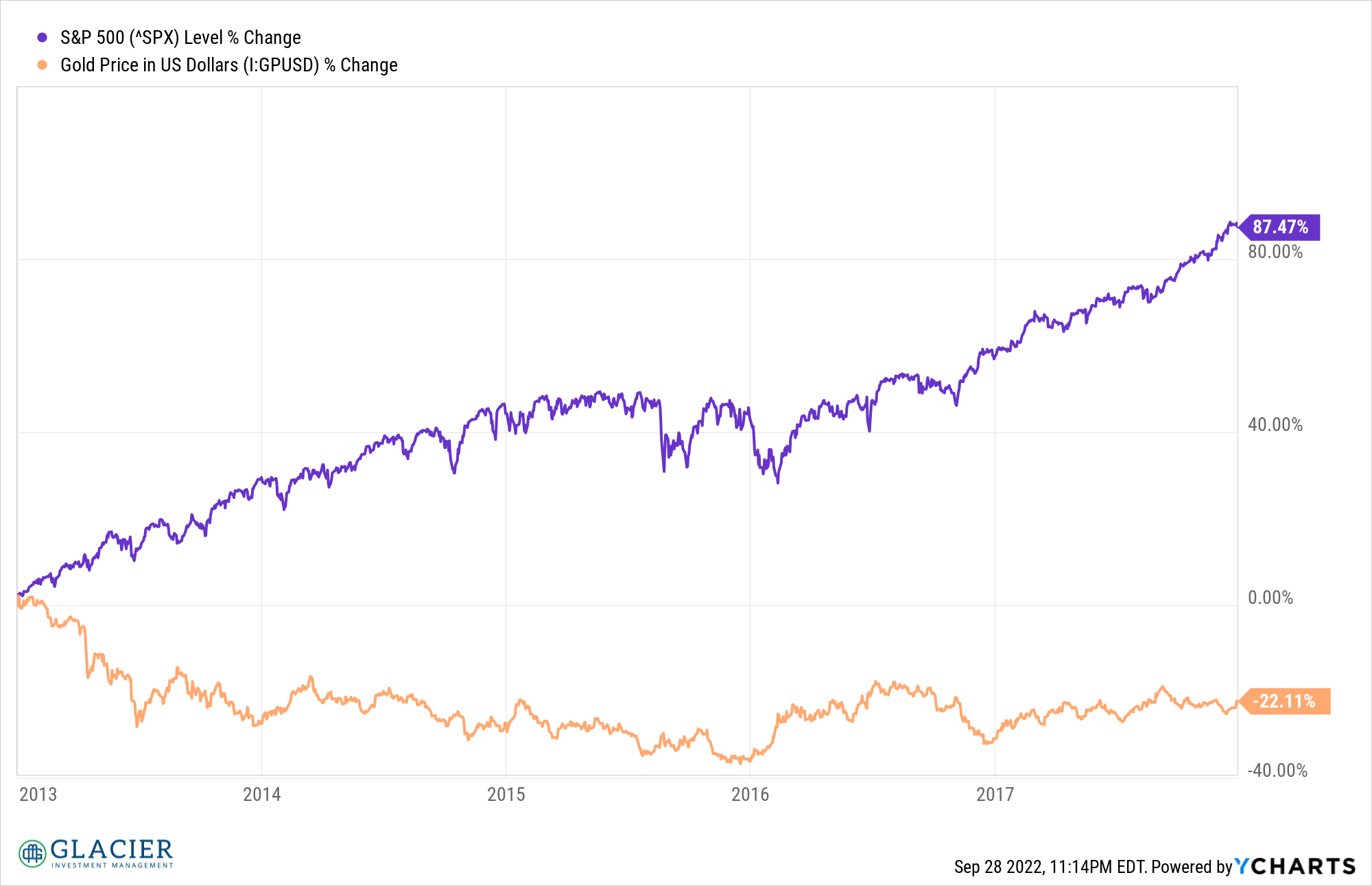

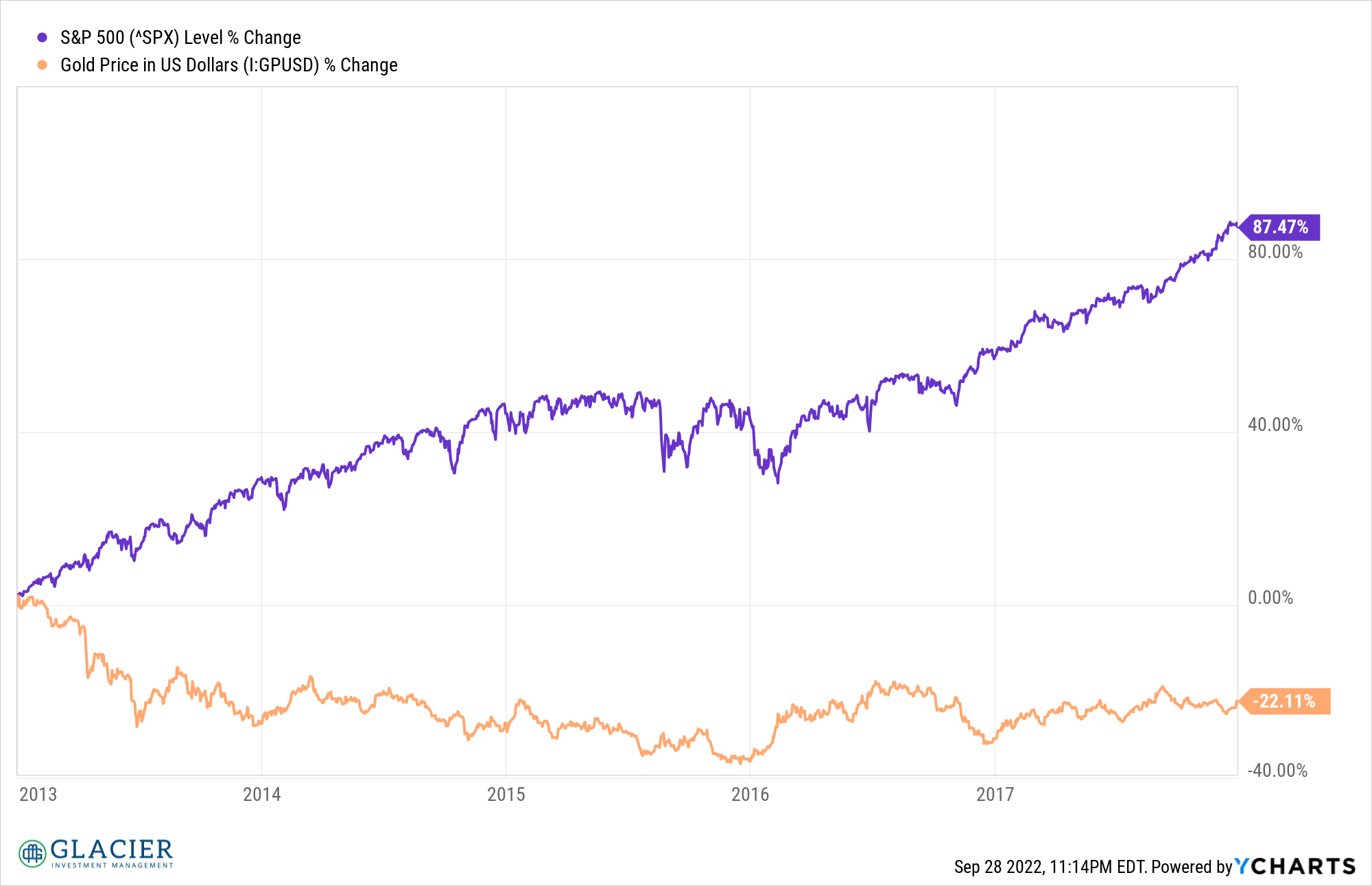

Of course, once the financial system stabilized gold lost its luster as they say and went on to greatly underperform over the next five years, shedding 22% while the S&P 500 returned 87%.

Historically, the price of gold has moved materially higher when the viability of paper currencies came into question. In particular, when USD went off the gold standard in the 1970s, after the monetary and fiscal responses to the Great Financial Crisis, and after the fiscal and monetary responses to the global pandemic. Notice the 20-year period from the early 1980s to the early 2000s where the price of gold didn’t really go anywhere. During periods of stability, the price of gold appears to be, well, fairly stable.

One of the challenges of investing in gold is timing. While the rationale for owning gold may intuitively make sense, the timeframe for that thesis to play out may be a lot longer than you anticipate, if it even happens the way you anticipate.

Additionally, whenever you’re investing in an asset there are always opportunity costs to holding that asset in place of another. Gold is great if you own it when it’s outperforming other assets, but it can also be a real drag on performance when it lags everything else.

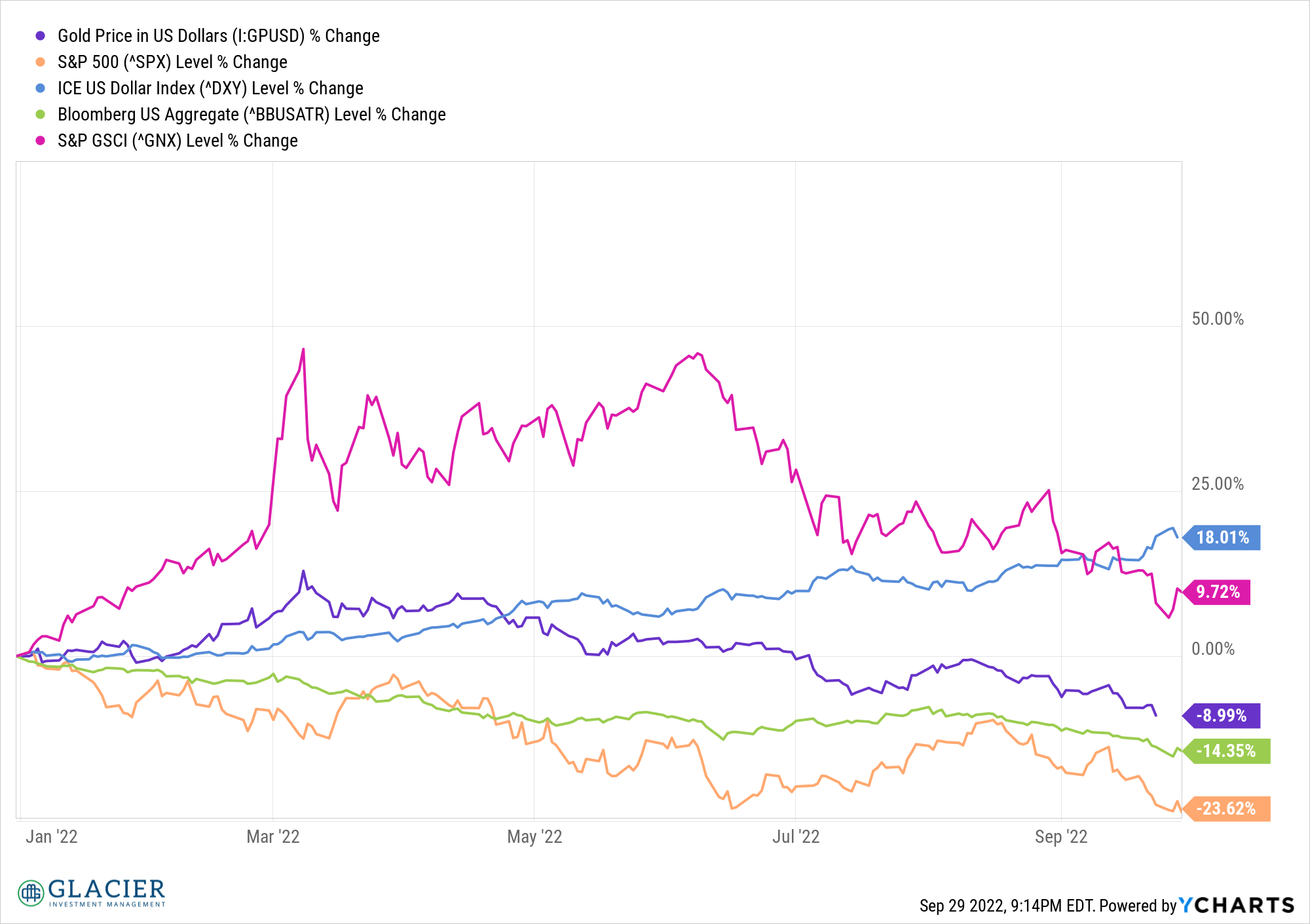

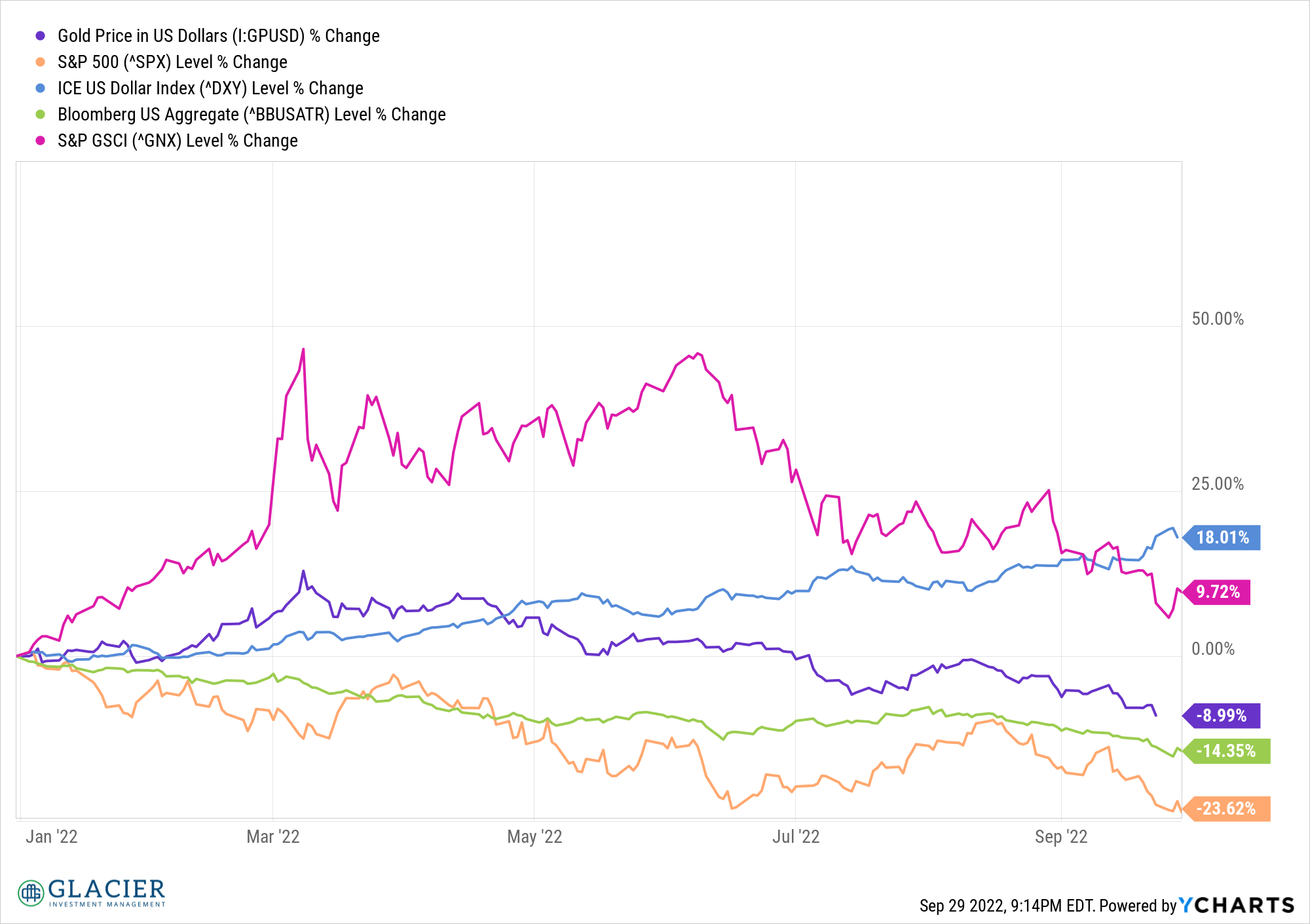

Look at this year as an example. Gold has outperformed stocks and bonds (Bloomberg US Aggregate) but has underperformed the US Dollar (USD) and a basket of commodities (S&P GSCI). It has paid to own gold this year in lieu of stocks and bonds but investing in USD and commodities would have yielded better returns.

What gives?

Gold is down about 9% year-to-date despite a war in eastern Europe, generationally high inflation, and plenty of other commotion. It feels like a lot of the factors necessary to push gold higher have lined up, but the expected outcome isn’t materializing. A couple of reasons why this may be happening are an incredibly strong USD and rising real interest rates (inflation-adjusted interest rates).

Historically, a strong USD has led to a weak gold price. Gold often trades like a currency since it is viewed as an alternative to fiat currencies. USD has been the strongest performing currency in 2022 while the Japanese Yen (JPY) and British Pound (GBP) have been among the weakest. Not surprisingly, the price of gold in JPY and GBP has been quite a bit stronger than the price of gold in USD.

Over the past several years, the price of gold has been inversely correlated with the level of real interest rates (inflation-adjusted). The more negative real interest rates, the higher the price of gold. As you know, interest rates have been rising in response to elevated inflation levels which has been pushing real rates higher and the price of gold down.

Looking Ahead

The outlook for gold is as uncertain as the outlook is for any other asset. A lot of the reasons for owning gold historically haven’t necessarily materialized into excess returns for the precious metal. I’m starting to think the drivers of the price of gold may be more nuanced than most of us realize. Additionally, it seems like it’s going to take a lot longer for the end game gold bulls are anticipating to play out. Regardless, the price of gold may never meet its most ardent supporters’ expectations. For these reasons, I believe situationally investing in gold when certain evidence-based criteria are met is the best approach to take rather than dogmatically holding onto the yellow metal indefinitely.